Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund

Description

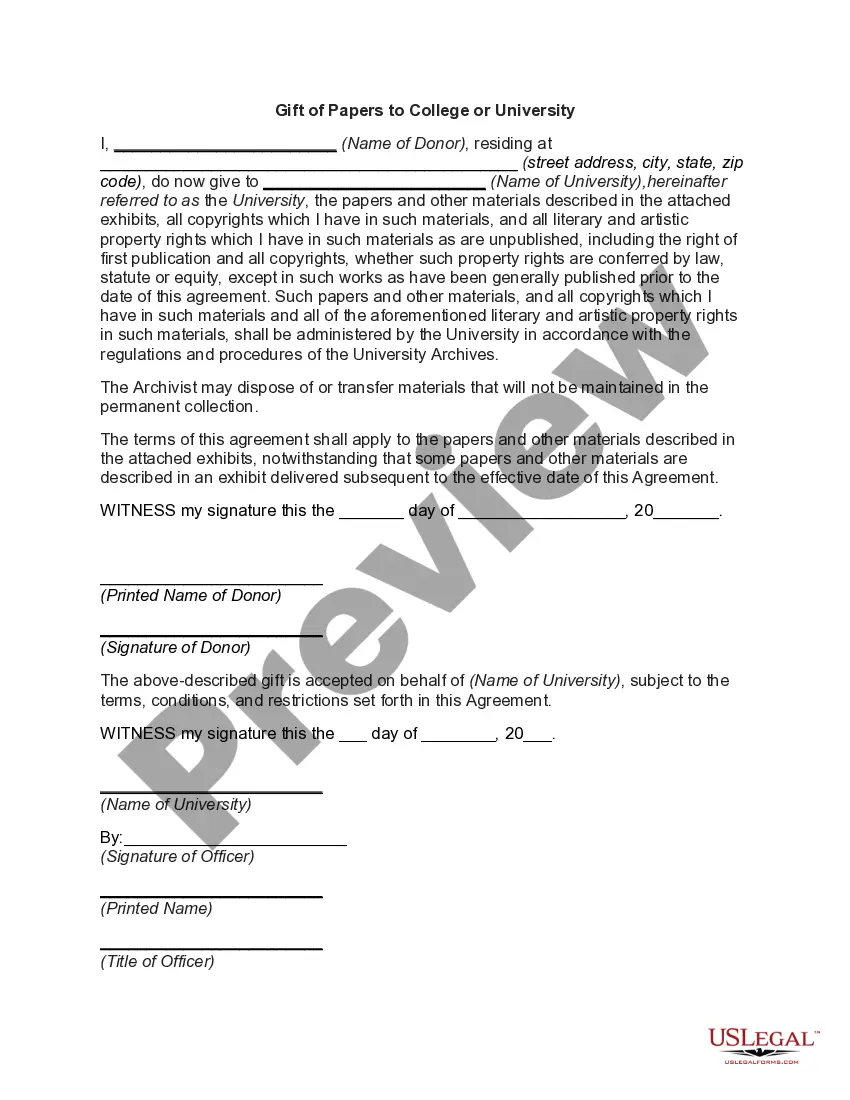

How to fill out Charitable Pledge Agreement - Gift To University To Establish Scholarship Fund?

US Legal Forms - one of the most prominent collections of legal templates in the US - provides a broad selection of legal document formats that you can download or print out.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can quickly find the most recent versions of forms like the Pennsylvania Charitable Pledge Agreement - Donation to University to Create Scholarship Fund.

Review the form description to confirm that you have selected the right one.

If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In and download the Pennsylvania Charitable Pledge Agreement - Donation to University to Create Scholarship Fund from the US Legal Forms library.

- The Download button will be visible on every document you view.

- You can access all of your previously saved forms from the My documents section of your account.

- If you’re using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to view the details of the form.

Form popularity

FAQ

Charitable pledges represent promises made by individuals to donate a specified amount to a charity, university, or non-profit organization. A Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund exemplifies how these pledges work. These commitments can typically be fulfilled over time, making them accessible for many donors. Charitable pledges help organizations plan and allocate resources for impactful programs, benefiting both the donor and the institution.

The gift recognition policy outlines how donors are acknowledged for their contributions. Institutions typically highlight gifts made through a Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund in various ways, such as donor walls, publications, or special events. This recognition boosts donor relations and encourages future contributions. Understanding the policy ensures that you recognize the impact of your generosity while receiving appropriate accolades.

The maximum amount of a gift can vary based on specific institutional policies and IRS guidelines. It is essential to consult the gifting policy associated with the Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund for detailed limitations. Generally, larger gifts may have different implications, including tax considerations. Always confirm with the university or a financial advisor to pinpoint allowable limits for your charitable contributions.

To establish a valid gift, three key elements must be present: intent, delivery, and acceptance. In the context of a Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, the donor must clearly express their intention to give, deliver the gift either physically or through documentation, and the recipient, typically the university, must accept the gift. Clarity on these aspects helps avoid misunderstandings and solidifies the donation process.

The IRS treats gifts as contributions that can potentially offer tax benefits. When you engage in a Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, it may qualify for a tax deduction under IRS regulations. However, certain limits apply, so it is crucial to understand these guidelines before giving. Always consult with a tax professional to maximize your charitable giving benefits in compliance with IRS policies.

Yes, gift pledges can be enforceable under certain conditions. A properly structured Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund can outline specific terms that clarify the donor's intentions. While enforcing a pledge may involve legal considerations, having a written agreement helps protect both the donor and the recipient. Thus, it's wise to consult legal resources to ensure compliance with applicable laws.

The purpose of the gift policy is to establish guidelines for making donations, such as the Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. This policy ensures transparency and accountability in the giving process. Additionally, it helps donors understand how their contributions will be used to support educational initiatives. By adhering to this policy, both the donor and the university can achieve clear alignment in their philanthropic goals.

Gift letters may serve as evidence of your intent to make a donation, but their legal binding nature can depend on various factors. For a Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, it is best to draft a formal agreement that outlines the terms of your gift to ensure clarity and understanding. Engaging with uslegalforms can provide you with templates that help clarify your intentions while making the process easier.

A gift can become an enforceable contract when it meets specific legal requirements, such as mutual consent and clarity on what is being offered. In the case of a Pennsylvania Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, ensuring your intent is well-documented can help establish the enforceability of your gift. Using a platform like uslegalforms can assist you in creating a solid legal basis for your charitable contributions.

The Pennsylvania State University (PSU) has a comprehensive gift policy that outlines how donors can contribute to different funds, including scholarships. This policy ensures that donations, such as those formalized through a Pennsylvania Charitable Pledge Agreement, are utilized effectively and in alignment with both donor intentions and institutional goals. Understanding this policy can enhance your own giving experience, helping your contributions make a lasting impact.