Pennsylvania Contract with Independent Contractor to Work as a Consultant is a legally binding agreement between a business or individual seeking consulting services and an independent contractor in the state of Pennsylvania. This document outlines the terms and conditions under which the consultant will provide their expertise, guidance, and services to the client. The contract typically includes important provisions such as the scope of work, project timelines, compensation details, intellectual property rights, confidentiality clauses, and termination conditions. It is essential to have a well-drafted contract in place to protect the rights and obligations of both parties involved. Different types of Pennsylvania Contracts with Independent Contractors to Work as Consultants may exist depending on the nature of the consulting services being rendered. Some common types include: 1. Management Consulting Contract: This type of contract is often used for consultants providing strategic advice and guidance to a business or organization. It may involve assessing company operations, developing business plans, implementing strategies, and other management-related tasks. 2. Technical Consulting Contract: This contract is suitable for consultants with specialized technical knowledge. It may cover areas such as IT consulting, software development, engineering, or any other field requiring specialized technical skills and expertise. 3. Financial Consulting Contract: Financial consultants who offer advisory services in areas like accounting, tax planning, investment analysis, or risk assessment often enter into this type of contract. It defines the scope of financial advice to be provided and the obligations of both parties involved. 4. Marketing Consulting Contract: Businesses often engage marketing consultants to develop marketing strategies, conduct market research, manage advertising, or improve digital presence. This contract outlines the responsibilities, goals, and compensation terms specific to marketing consulting services. Regardless of the type of consulting services being rendered, the Pennsylvania Contract with Independent Contractor to Work as a Consultant should be tailored to the specific needs and requirements of both parties. It is advisable to consult with legal professionals to ensure compliance with Pennsylvania state laws and to adequately protect the interests of all parties involved.

Pennsylvania Contract with Independent Contractor to Work as a Consultant

Description

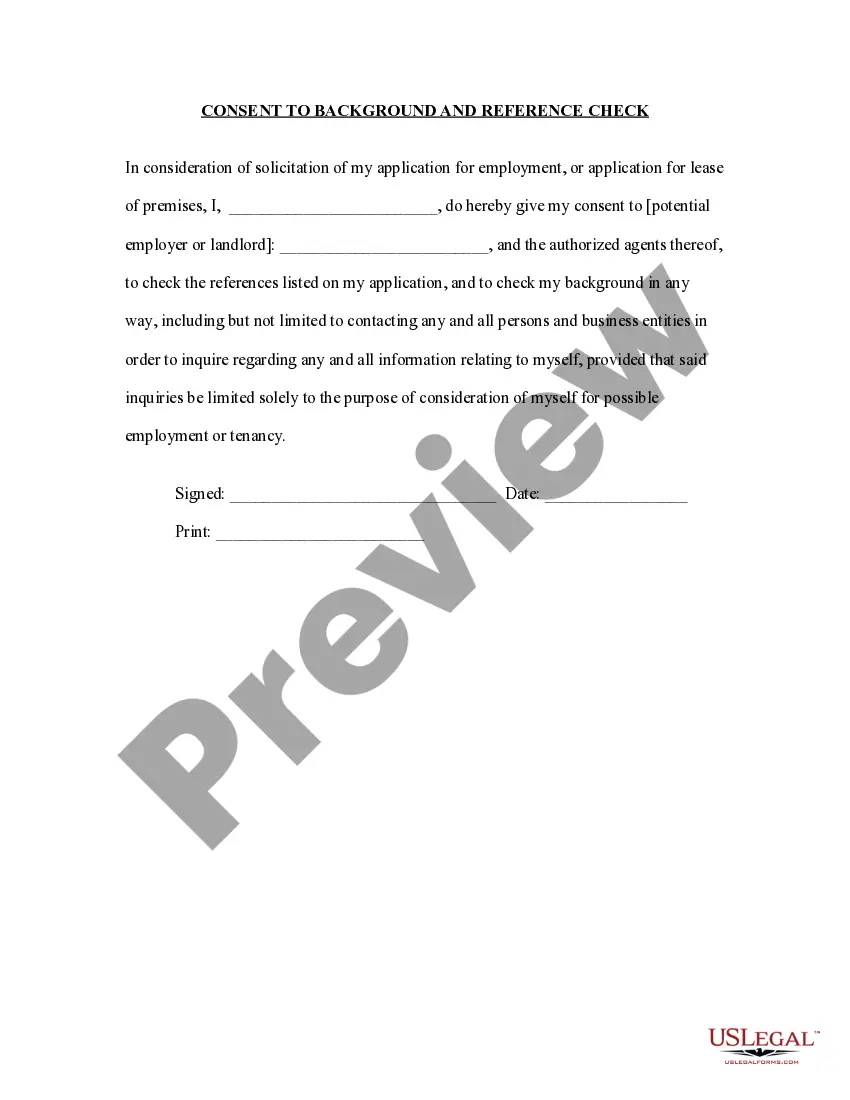

How to fill out Contract With Independent Contractor To Work As A Consultant?

If you have to comprehensive, acquire, or printing legal papers web templates, use US Legal Forms, the most important assortment of legal forms, that can be found on the web. Use the site`s basic and practical research to get the paperwork you want. Various web templates for enterprise and person functions are categorized by categories and says, or keywords. Use US Legal Forms to get the Pennsylvania Contract with Independent Contractor to Work as a Consultant within a few click throughs.

When you are presently a US Legal Forms buyer, log in in your accounts and then click the Obtain switch to find the Pennsylvania Contract with Independent Contractor to Work as a Consultant. You can even entry forms you earlier saved inside the My Forms tab of your respective accounts.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for the right metropolis/region.

- Step 2. Use the Review method to examine the form`s content material. Do not forget to see the information.

- Step 3. When you are not satisfied with all the form, take advantage of the Lookup field on top of the monitor to get other types in the legal form format.

- Step 4. Once you have discovered the shape you want, go through the Buy now switch. Pick the rates strategy you prefer and add your references to sign up for an accounts.

- Step 5. Approach the purchase. You can use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Pick the file format in the legal form and acquire it on your device.

- Step 7. Full, change and printing or indication the Pennsylvania Contract with Independent Contractor to Work as a Consultant.

Each and every legal papers format you purchase is yours forever. You have acces to each form you saved with your acccount. Go through the My Forms area and select a form to printing or acquire again.

Be competitive and acquire, and printing the Pennsylvania Contract with Independent Contractor to Work as a Consultant with US Legal Forms. There are many professional and express-particular forms you can use for your personal enterprise or person demands.

Form popularity

FAQ

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.