Pennsylvania Minutes of Annual Meeting of Stockholders of Corporation

Description

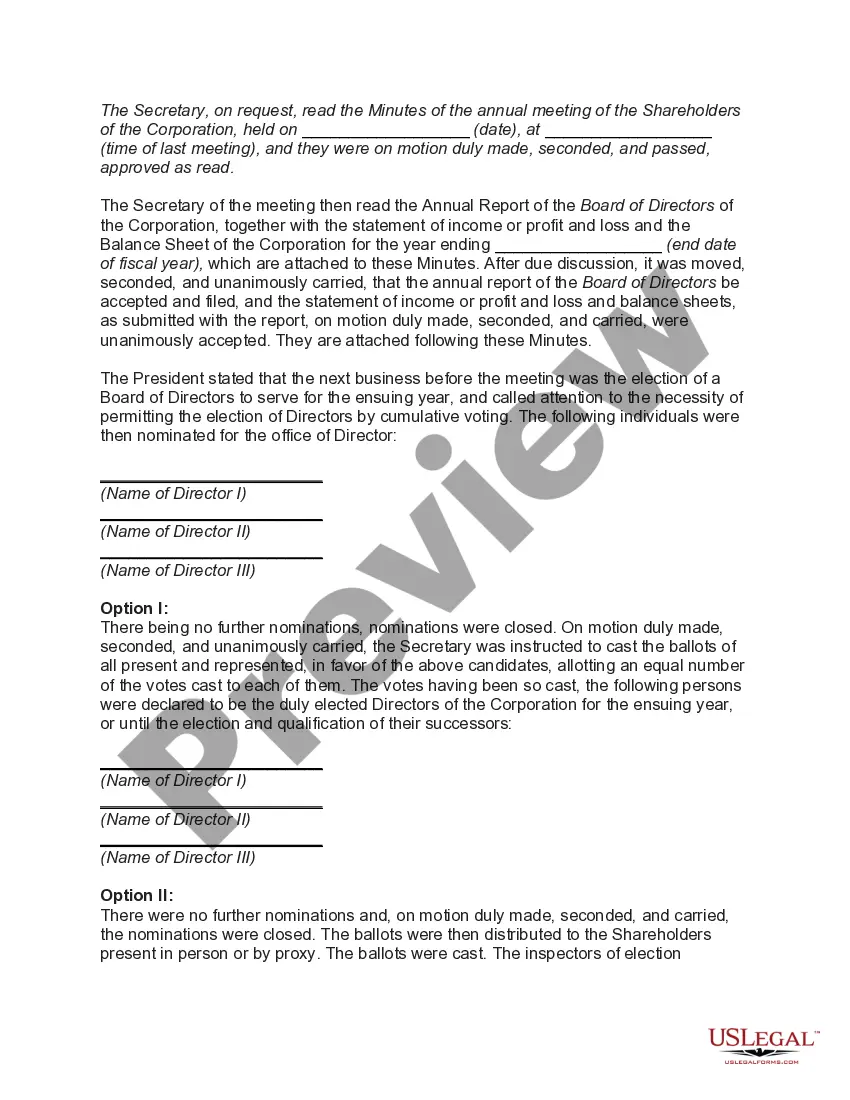

How to fill out Minutes Of Annual Meeting Of Stockholders Of Corporation?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can obtain or print.

By utilizing the website, you can access numerous forms for commercial and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Pennsylvania Minutes of Annual Meeting of Stockholders of Corporation in mere moments.

Read the form summary to confirm that you have chosen the right document.

If the form does not meet your requirements, use the Search section at the top of the page to find one that does.

- If you already have a monthly subscription, Log In to retrieve the Pennsylvania Minutes of Annual Meeting of Stockholders of Corporation from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region.

- Click on the Preview button to review the contents of the form.

Form popularity

FAQ

Board meeting minutes do not need to be made publicly available and in many cases they should not be, because they detail confidential or sensitive issues. However, past board meeting minutes should always be readily accessible to board members and shareholders as they will provide a formal record of the proceedings.

Shareholders are entitled to inspect the company's financial books and records, including, but not limited to, financial statements, shareholder lists, corporate stock ledgers, and meeting minutes.

Notes from shareholder's meetings should be recorded in the corporate minute book, a record of all notes from every past meeting. This should include notes about all appointments of officers, resolutions, and other actions taken by the shareholders.

Simple Rule 1: A member of a group has a right to examine the minutes of that group. Plain and simple, Robert's Rules says that the secretary of an organization has to (1) keep minutes and (2) make them available to members that ask for them.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

While it is not required, you can state your annual profit and loss statement in the annual minutes. Also, record any important changes to the business throughout the year. If your corporate bylaws and articles of incorporation provide for electing officers each year, then elect officers.

Internal documents, such as corporate bylaws, may require that certain information be contained in the minutes, so it is important to check for these rules and follow them closely. Officers, shareholders, and directors can demand a copy of the meeting minutes at any time.

Under Robert's Rules of Order, minutes that do not come up for review quarterly, may be approved by the board. Since annual meetings are annual not quarterly, the board can approve the minutes. "Minutes of one annual meeting should not be held for action until the next one a year later." (Robert's Rules, 11th ed., p.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Of course, shareholders have a legal right to attend annual meetings. It is, after all, the one time each year they have an opportunity to sit in the same room with representatives from the company.