Pennsylvania Employment of Financial Analyst for Employer and Related Entities: A Comprehensive Overview In Pennsylvania, employment opportunities for financial analysts within various organizations and related entities abound. Financial analysts play a crucial role in assessing the financial health and viability of businesses, providing insightful recommendations, and supporting strategic decision-making processes. This description will provide a detailed overview of the nature of employment for financial analysts in Pennsylvania while incorporating relevant keywords to offer a comprehensive understanding. 1. Financial Analyst Job Description: Financial analysts employed by employers and related entities in Pennsylvania perform a diverse range of duties. They analyze financial data, such as market trends, economic indicators, and company financial statements, to assess the investment opportunities, risk levels, and overall financial performance. Their responsibilities often encompass collecting and interpreting complex financial information, preparing financial reports, forecasting trends, and developing financial models to guide decision-making processes. 2. Industry-Specific Financial Analysts: In Pennsylvania, financial analysts find employment across multiple industries, each with its specialized requirements. Some key sectors involving financial analyst positions include: a) Banking and Finance: Financial analysts in this field assess investment opportunities, analyze economic factors, manage risk, and provide recommendations for portfolio management, lending, and investment decisions. b) Insurance: Financial analysts in insurance companies focus on conducting risk analysis and assessing the financial stability of insurance policies or products. Their evaluations aid in determining premiums, claims management, and overall financial solvency. c) Investment Firms: Financial analysts in investment firms assess the potential risks and returns of investment opportunities, such as stocks, bonds, commodities, and real estate. Their analysis helps clients make informed investment decisions aligned with their financial goals. d) Corporate Financial Analysts: Many corporations in Pennsylvania employ financial analysts internally to analyze financial data, create financial models, and facilitate strategic planning. They offer crucial insights for budgeting, cost analysis, mergers and acquisitions, and overall financial performance evaluation. 3. Required Skills and Qualifications: Employers seeking financial analysts in Pennsylvania often look for candidates with the following skills and qualifications: a) Strong analytical abilities: Financial analysts must possess refined quantitative and qualitative analysis skills to interpret complex financial data accurately. b) Proficiency in financial software and tools: Utilizing tools such as Excel, financial modeling software, and data visualization tools is instrumental in performing financial analysis effectively. c) Knowledge of financial regulations and standards: Familiarity with relevant financial regulations, such as GAAP (Generally Accepted Accounting Principles) and SEC (Securities and Exchange Commission) guidelines, is essential. d) Excellent communication and presentation skills: Financial analysts must effectively communicate their findings and recommendations to stakeholders, both verbally and in written reports. e) Education and certifications: A Bachelor's or Master's degree in finance, business administration, economics, or a related field is often required. Professional certifications like the Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) can enhance job prospects. 4. Career Progression: Within Pennsylvania's financial industry, financial analysts often have opportunities for career advancement. Professionals can progress towards senior financial analyst roles, managerial positions, and even executive-level roles, such as Chief Financial Officer (CFO) or Director of Finance. Continuous professional development through further education and certification programs can help individuals achieve higher positions and secure attractive compensation packages. In conclusion, Pennsylvania employment opportunities for financial analysts in various industries and related entities are plenty. These professionals play a critical role in assessing financial data, providing recommendations for strategic decision-making, and contributing to the overall financial health and success of organizations. By possessing the necessary skills, qualifications, and industry knowledge, financial analysts can forge successful careers in Pennsylvania's vibrant financial landscape.

Pennsylvania Employment of Financial Analyst for Employer and Related Entities

Description

How to fill out Pennsylvania Employment Of Financial Analyst For Employer And Related Entities?

Have you been within a situation the place you need documents for possibly enterprise or individual purposes virtually every working day? There are a lot of lawful record web templates available online, but finding versions you can depend on isn`t effortless. US Legal Forms gives a large number of develop web templates, like the Pennsylvania Employment of Financial Analyst for Employer and Related Entities, which are created to meet state and federal needs.

Should you be presently acquainted with US Legal Forms internet site and possess an account, basically log in. Next, you are able to down load the Pennsylvania Employment of Financial Analyst for Employer and Related Entities template.

If you do not come with an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you will need and make sure it is to the correct metropolis/area.

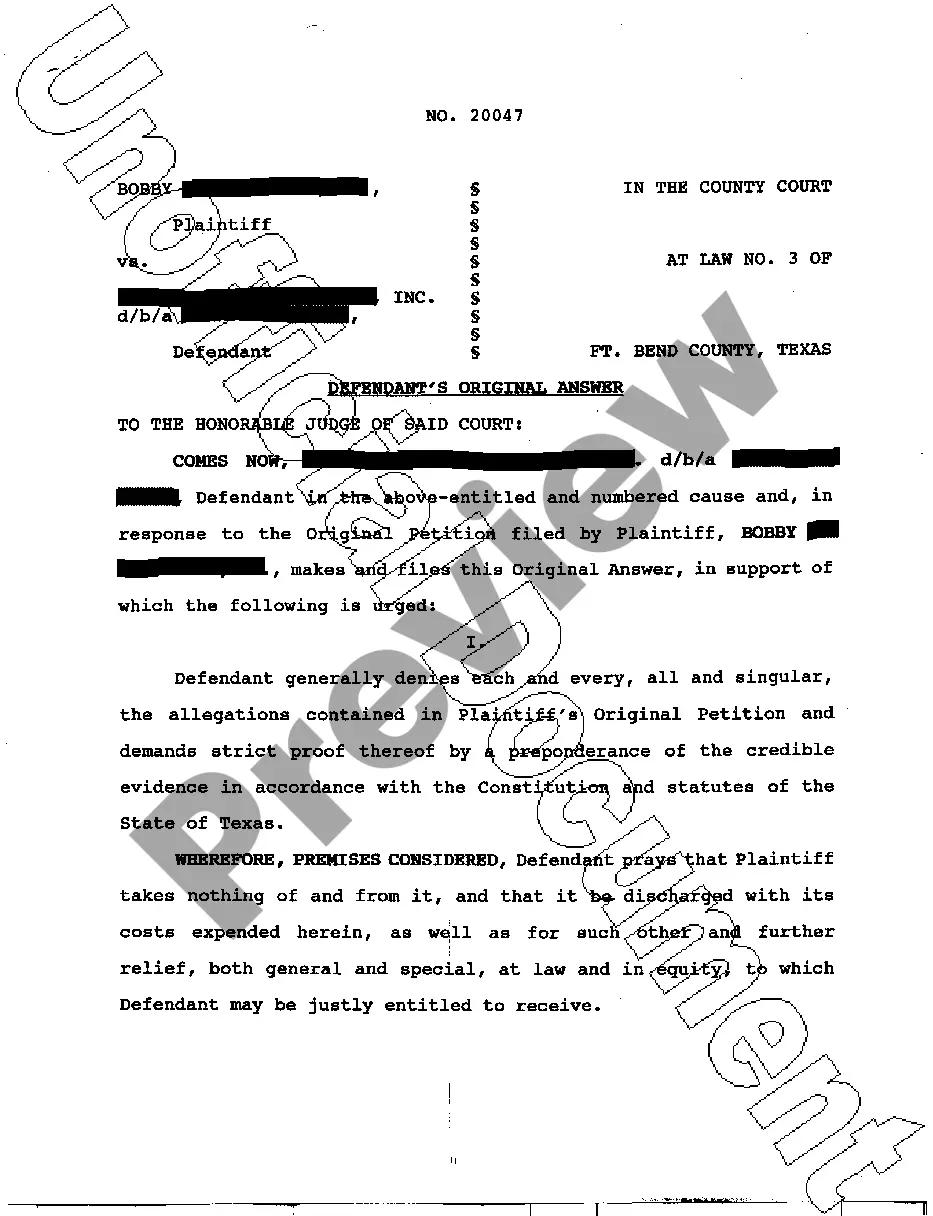

- Use the Review option to analyze the shape.

- Read the explanation to ensure that you have selected the correct develop.

- In the event the develop isn`t what you are searching for, take advantage of the Lookup area to find the develop that meets your requirements and needs.

- When you get the correct develop, simply click Get now.

- Choose the costs strategy you want, fill in the necessary information to produce your money, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Decide on a handy file structure and down load your copy.

Get all the record web templates you have bought in the My Forms food list. You can aquire a more copy of Pennsylvania Employment of Financial Analyst for Employer and Related Entities at any time, if possible. Just select the required develop to down load or print out the record template.

Use US Legal Forms, probably the most substantial selection of lawful kinds, in order to save efforts and avoid mistakes. The support gives professionally produced lawful record web templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin producing your way of life a little easier.