Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits In Pennsylvania, the employment of executives comes with various compensation packages that include a combination of salary, cash equivalents to stock dividends, and comprehensive retirement benefits. This enticing remuneration structure aims to attract top-tier executives who can contribute significantly to the success and growth of organizations. Let's delve into the key components of the Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits. 1. Salary: Executives employed in Pennsylvania are offered competitive salaries, commensurate with their level of expertise, experience, and industry standards. These salaries serve as a baseline for the overall compensation package, ensuring executives are financially rewarded for their leadership and strategic decision-making. 2. Cash Equivalent to Stock Dividends: Pennsylvania-based organizations often provide executives with additional compensation known as cash equivalents to stock dividends. This component adds an extra layer of incentive by reflecting the organization's stock performance. Executives are essentially granted a cash equivalent amount in line with the dividends they would be entitled to if they held company stock. This reward system aligns the executive's interests with the shareholders' and encourages long-term commitment to the company's growth and financial success. 3. Retirement Benefits: The Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits also encompasses comprehensive retirement plans. These retirement benefits are designed to ensure executives have a financially stable future even after their active employment ends. Organizations in Pennsylvania may offer various retirement plans such as 401(k)s, pension plans, or other investment vehicles. These plans often include employer-matching contributions and vesting schedules to incentivize executives to remain with the company for extended periods. Types of Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits: 1. Executive Level 1: This type includes executives occupying the highest positions within the organization and making critical strategic decisions. They receive the most generous compensation packages, including higher salaries, substantial cash equivalents to stock dividends, and comprehensive retirement benefits. 2. Executive Level 2: These executives hold senior positions within the organization and are responsible for overseeing specific departments or business divisions. While their compensation packages are slightly lower than those at Level 1, they still enjoy competitive salaries, significant cash equivalents to stock dividends, and retirement benefits tailored to their roles. 3. Executive Level 3: This category comprises mid-level executives who play a crucial role in implementing strategies and managing day-to-day operations. They receive competitive salaries, reasonable cash equivalents to stock dividends, and retirement benefits designed to provide them with financial security in their post-employment years. In conclusion, the Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits offers attractive compensation packages to executives, combining competitive salaries, cash equivalents tied to stock dividends, and comprehensive retirement benefits. These arrangements aim to reward executives for their valuable contributions, align their interests with shareholders, encourage long-term commitment, and provide financial security in retirement. By tailoring these packages to various levels of executive positions, organizations in Pennsylvania can attract and retain top talent, facilitating their continued success.

Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

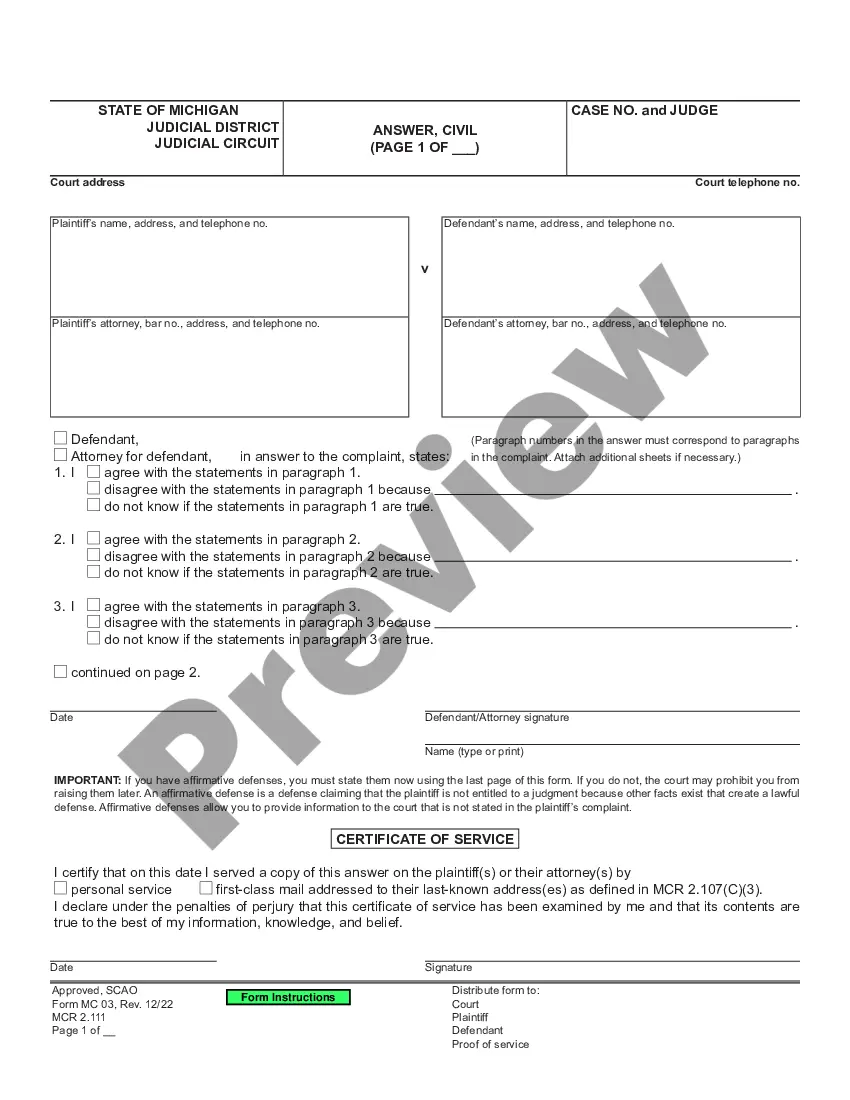

How to fill out Pennsylvania Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

US Legal Forms - one of many most significant libraries of legitimate varieties in the USA - delivers an array of legitimate file layouts you may obtain or printing. While using website, you may get 1000s of varieties for company and specific purposes, sorted by types, says, or keywords.You can find the newest variations of varieties like the Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits within minutes.

If you currently have a membership, log in and obtain Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits from the US Legal Forms library. The Obtain option can look on every single develop you look at. You have accessibility to all earlier saved varieties from the My Forms tab of your own bank account.

In order to use US Legal Forms initially, listed here are basic directions to get you started out:

- Be sure you have chosen the right develop for your town/state. Click the Preview option to analyze the form`s content material. See the develop information to ensure that you have selected the appropriate develop.

- In the event the develop doesn`t suit your needs, make use of the Lookup field towards the top of the display to discover the one that does.

- When you are happy with the form, affirm your option by clicking on the Acquire now option. Then, opt for the rates program you favor and give your references to sign up on an bank account.

- Procedure the financial transaction. Make use of credit card or PayPal bank account to accomplish the financial transaction.

- Select the formatting and obtain the form on your device.

- Make adjustments. Complete, edit and printing and indication the saved Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits.

Each design you included in your money lacks an expiration time which is yours for a long time. So, if you would like obtain or printing another duplicate, just go to the My Forms area and click on in the develop you want.

Gain access to the Pennsylvania Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits with US Legal Forms, probably the most comprehensive library of legitimate file layouts. Use 1000s of professional and condition-distinct layouts that meet up with your business or specific needs and needs.

Form popularity

FAQ

Investments in Stocks and BondsAny gain or loss on the sale, exchange or disposition of stocks or bonds is reportable for Pennsylvania personal income tax purposes.

For retirement accounts, stock dividends are not taxed. In a non-retirement account, qualified dividends are taxed at long-term capital gains rates depending on your tax bracket (federal rates are 0%, 15%, or 20%), while non-qualified dividends are taxed at ordinary income rates just like regular income.

Dividends are reported to you on Form 1099-DIV and the eFile tax app will include this income on Form 1040. If the ordinary dividends you received total more than $1,500, or if you received dividends that belong to someone else because you are a nominee, then Schedule B will be included - eFileIT.

Box 14 - The following items, and their respective amounts, will be shown in this box: FEHB Premium Conversion This reflects the amount of FEHB Premiums (this amount is not included in Boxes 1, 3, and 5, unless you opted out), HSA (Health Savings Account) Shows any employer contributions to an HSA.

Pennsylvania fully exempts all income from Social Security, as well as payments from retirement accounts, like 401(k)s and IRAs. It also exempts pension income for seniors age 60 or older. While its property tax rates are higher than average, the average total sales tax rate is among the 20 lowest in the country.

Stock DividendsA stock dividend is not taxable for Pennsylvania personal income tax purposes. A stock dividend is a pro rata distribution by a corporation to its stockholders in the form of stock if the distribution is not treated as income for federal income tax purposes.

Enter in box 14 the total employment income before deductions. Include the following: Salary and wages (including pay in lieu of termination notice). Bonuses.

Box 14: Your employer may report additional tax information here. If any amounts are reported in Box 14, they should include a brief description of what they're for. For example, union dues, employer-paid tuition assistance or after-tax contributions to a retirement plan may be reported here.

Box 14 Employment income. Enter in box 14 the total employment income before deductions. Include the following: Salary and wages (including pay in lieu of termination notice).