The Pennsylvania Exchange Agreement and Brokerage Arrangement are widely used terms within the real estate industry in Pennsylvania. These terms refer to a legally binding agreement between parties involved in a real estate transaction, typically involving the exchange of property or the provision of brokerage services. Both concepts play a crucial role in facilitating smooth property transactions and protecting the interests of all parties involved. Pennsylvania Exchange Agreement: The Pennsylvania Exchange Agreement, also known as a 1031 exchange, is a transaction in which an investor sells a property and reinvests the proceeds into a similar property, deferring the capital gains tax that would otherwise be triggered by the sale. This agreement is based on Section 1031 of the Internal Revenue Code, which allows the exchange of "like-kind" properties. By utilizing a Pennsylvania Exchange Agreement, investors can effectively defer their tax liabilities and continue to grow their real estate portfolio. There are several types of Pennsylvania Exchange Agreements, including: 1. Simultaneous Exchange: This is the most straightforward type of 1031 exchange, where the sale of the relinquished property and acquisition of the replacement property occur simultaneously. 2. Delayed Exchange: In this type, the sale of the relinquished property occurs first, and the replacement property is identified and acquired within a specified timeline, typically 45 days to identify and 180 days to close. 3. Reverse Exchange: This type of exchange allows an investor to acquire a replacement property before selling their relinquished property. It requires the use of an exchange accommodation titleholder to hold the property until the relinquished property is sold. Pennsylvania Brokerage Arrangement: A Pennsylvania Brokerage Arrangement involves the relationship between a real estate broker and their client. This arrangement outlines the terms and conditions under which the broker will provide their services, assisting the client in buying, selling, or leasing real estate. The brokerage arrangement details the responsibilities, obligations, and compensation structure for the broker's services, ensuring clarity and protection for both parties. There are different types of Pennsylvania Brokerage Arrangements, including: 1. Exclusive Right-to-Sell Listing: In this arrangement, the seller grants the broker the exclusive right to represent and sell the property. Regardless of who brings the buyer, the broker is entitled to a commission. 2. Exclusive Agency Listing: The seller grants exclusive representation rights to the broker, but allows themselves the right to sell the property without paying a commission, as long as they find the buyer themselves. 3. Open Listing: This non-exclusive arrangement allows the seller to engage multiple brokers simultaneously, with the commission payable only to the broker who successfully brings the buyer. In conclusion, the Pennsylvania Exchange Agreement and Brokerage Arrangement are essential components of real estate transactions in the state. The various types of Exchange Agreements allow investors to defer capital gains taxes and continue accumulating real estate assets. On the other hand, the different types of Brokerage Arrangements define the relationship between brokers and clients, protecting the interests of both parties throughout the buying, selling, or leasing process.

Pennsylvania Exchange Agreement, Brokerage Arrangement

Description

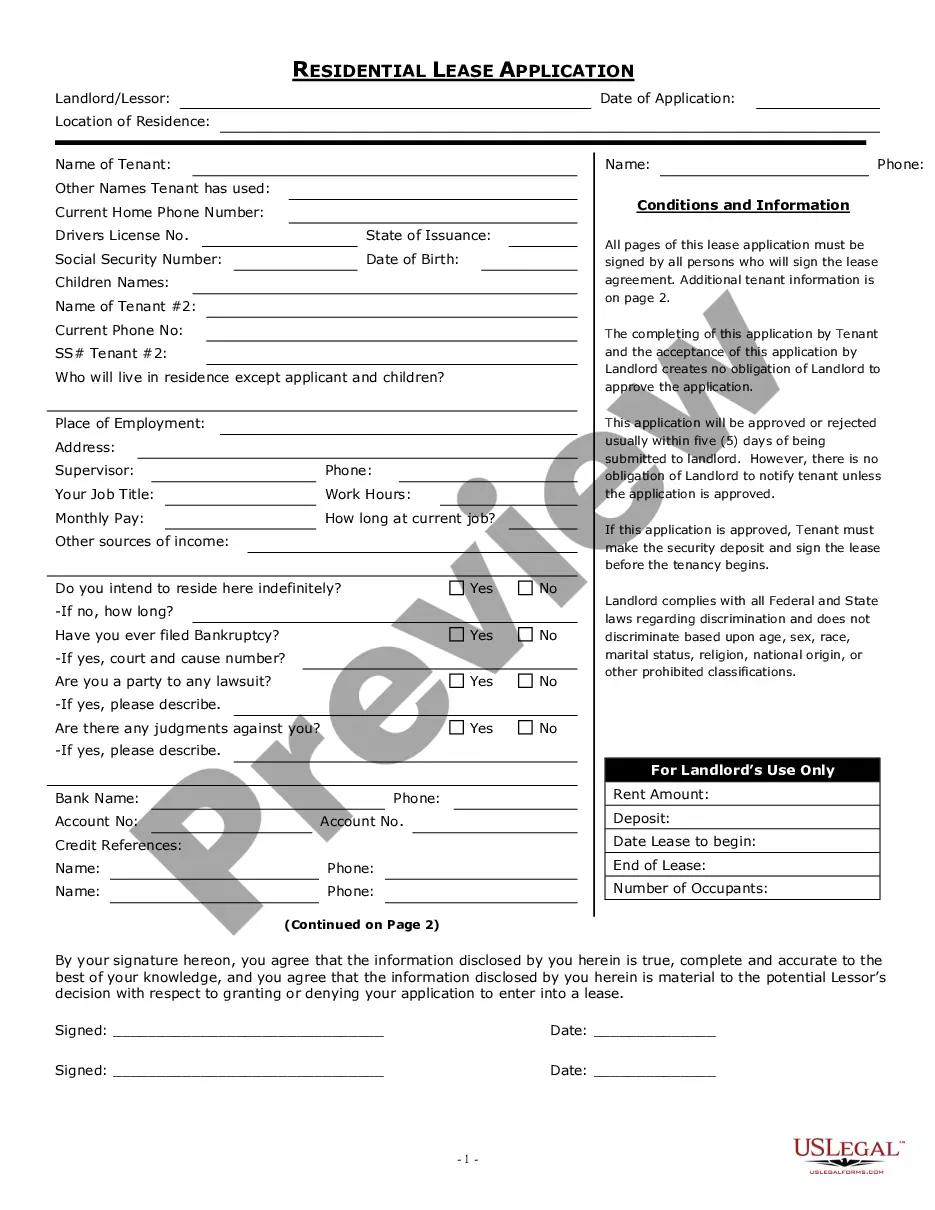

How to fill out Pennsylvania Exchange Agreement, Brokerage Arrangement?

Are you presently in a situation where you require files for both business or person reasons nearly every time? There are tons of legitimate papers themes available on the Internet, but locating versions you can trust isn`t effortless. US Legal Forms offers a huge number of form themes, like the Pennsylvania Exchange Agreement, Brokerage Arrangement, that happen to be composed to fulfill state and federal needs.

In case you are already acquainted with US Legal Forms website and also have a merchant account, simply log in. Afterward, you can download the Pennsylvania Exchange Agreement, Brokerage Arrangement design.

If you do not offer an accounts and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for the proper city/area.

- Make use of the Preview switch to review the shape.

- Read the outline to ensure that you have selected the right form.

- In the event the form isn`t what you`re trying to find, use the Lookup industry to find the form that meets your requirements and needs.

- If you obtain the proper form, just click Buy now.

- Select the rates strategy you would like, fill out the required information and facts to generate your account, and purchase the order using your PayPal or bank card.

- Decide on a hassle-free paper formatting and download your duplicate.

Locate each of the papers themes you possess purchased in the My Forms food list. You can get a extra duplicate of Pennsylvania Exchange Agreement, Brokerage Arrangement anytime, if necessary. Just select the required form to download or print out the papers design.

Use US Legal Forms, one of the most extensive selection of legitimate kinds, to conserve time and stay away from mistakes. The service offers skillfully created legitimate papers themes that you can use for a range of reasons. Generate a merchant account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

This agreement outlines the broker's/agent's duties and obligations to the buyer. It defines agency relationships, the broker's scope of duty, and buyer obligations. It doesn't provide for compensation. The buyer can hire more than one broker/agent to locate a suitable property.

Buyer gives Broker the exclusive right to locate and/or assist in the purchase, exchange or option to purchase property (purchase) at a price and with terms acceptable to Buyer. 2. Buyer agrees to compensate Transaction Broker.

This type of agreement is also known as the 'Buyer Representation Agreement'. It outlines the broker's duties and obligations to the property buyer. The agreement includes the understanding that the buyer wishes to utilise the help of the broker to search for and buy a property ing to their specifications.

A listing agreement authorizes the broker to represent the seller and their property to third parties. The listing agreement is an employment contract rather than a real estate contract: The broker is hired to represent the seller, but no property is transferred between the two.

You'll want to include details like: the broker's name; who's requesting the broker's services; whether the broker will be finding goods or services; whether the broker will be making introductions, or be involved in the details of the transaction; whether the broker has the licenses and certifications required by the ...

"Brokerage relationship" means the contractual relationship between a client and a real estate licensee who has been engaged by such client for the purpose of procuring a seller, buyer, option, tenant, or landlord ready, able, and willing to sell, buy, option, exchange or rent real estate on behalf of a client.

Brokerage Relationship A relationship created by a written brokerage agreement. between a client and a broker where the client. authorizes the broker to provide real estate brokerage. services in a residential real estate transaction.