Pennsylvania Private Trust Company

Description

How to fill out Private Trust Company?

If you wish to acquire, obtain, or print legal document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Take advantage of the site's straightforward and user-friendly search option to find the documents you need. Various templates for business and personal uses are categorized by types and states, or keywords.

Utilize US Legal Forms to locate the Pennsylvania Private Trust Company with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you have bought within your account. Click on the My documents section and select a form to print or download again.

Be proactive and obtain, and print the Pennsylvania Private Trust Company with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms subscriber, Log In to your account and click on the Download button to obtain the Pennsylvania Private Trust Company.

- You can also access documents you have previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for your specific city/state.

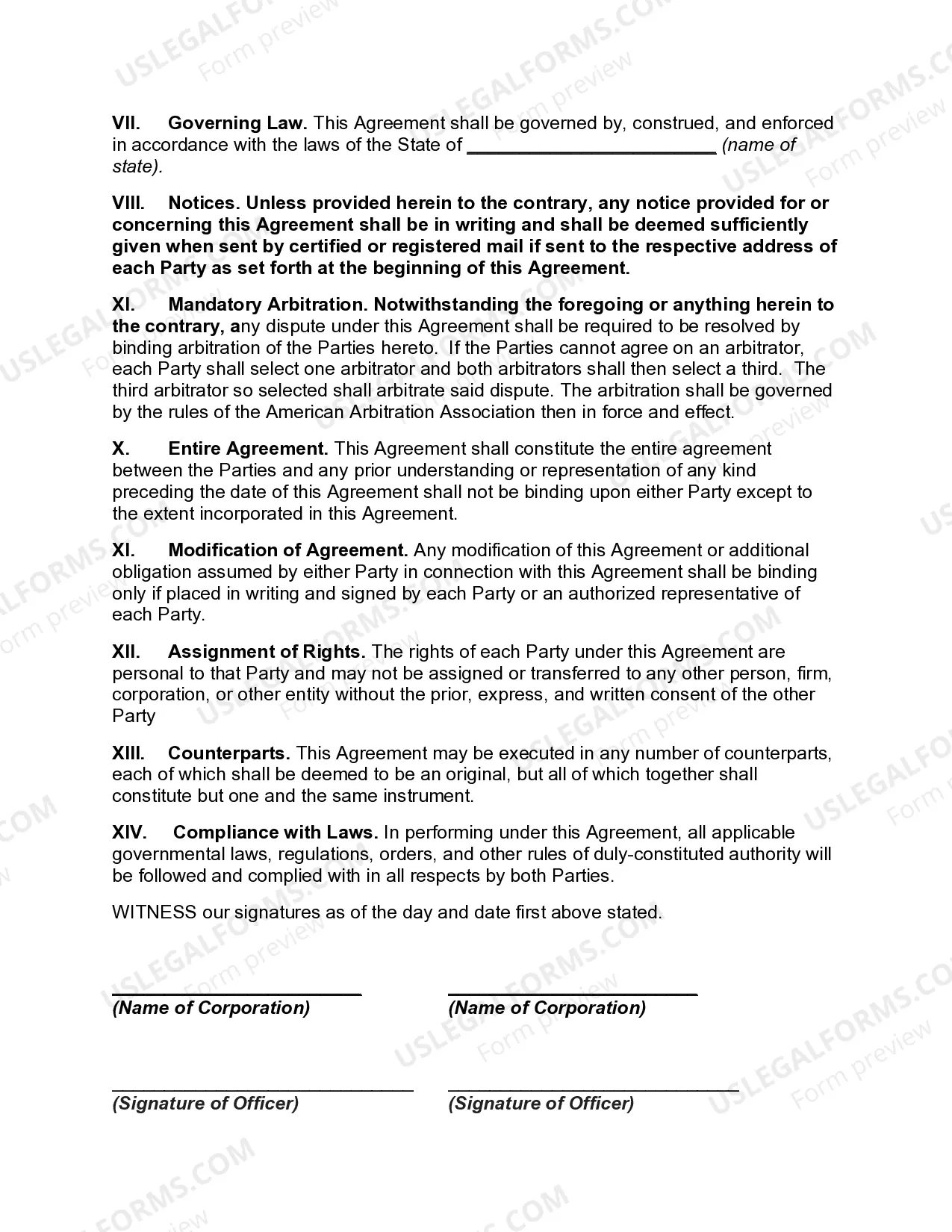

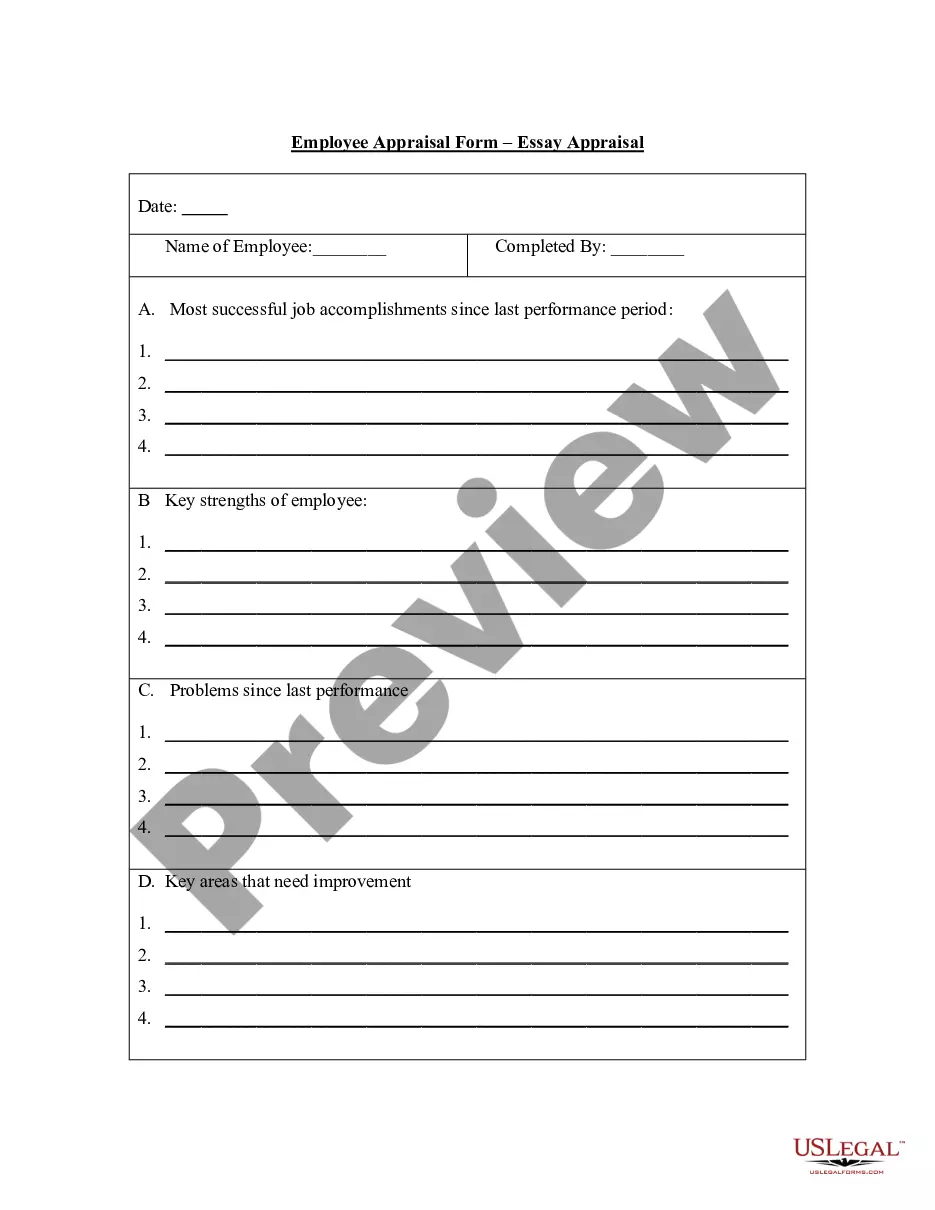

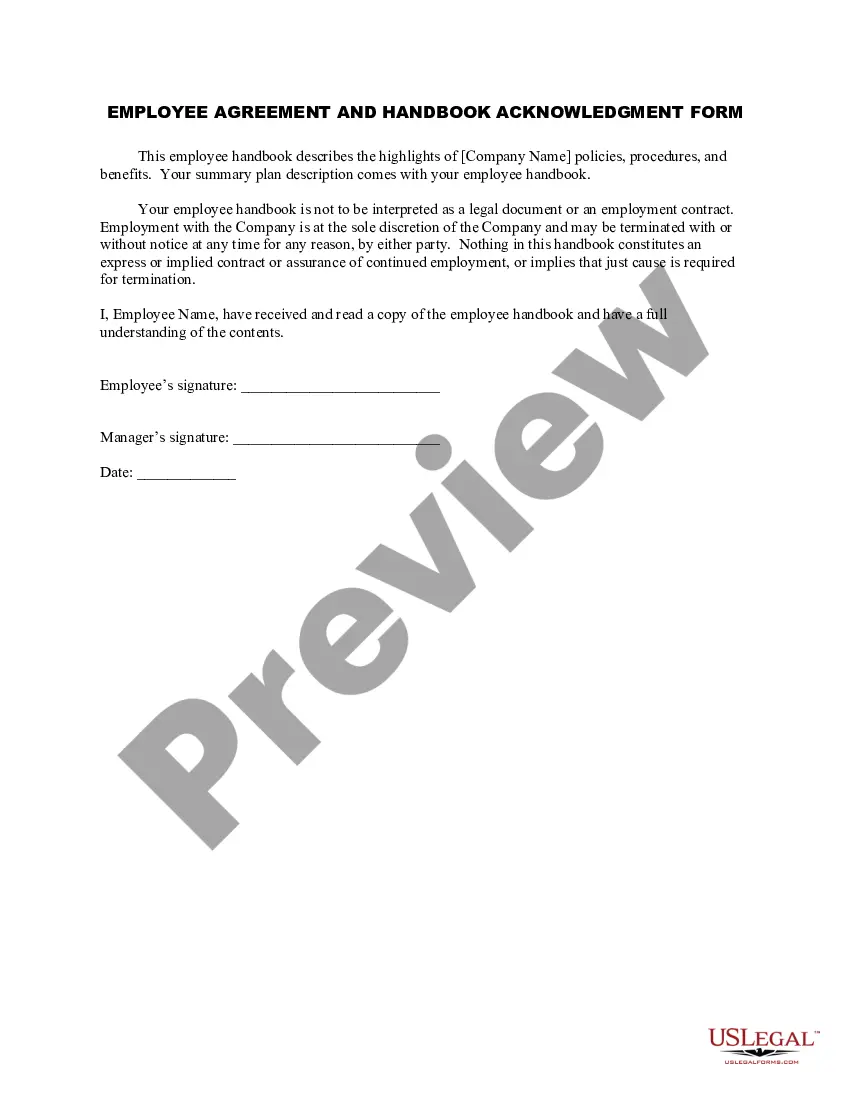

- Step 2. Utilize the Preview feature to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other types of the legal form template.

- Step 4. After finding the form you desire, click the Purchase now button. Select your preferred payment plan and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Private Trust Company.

Form popularity

FAQ

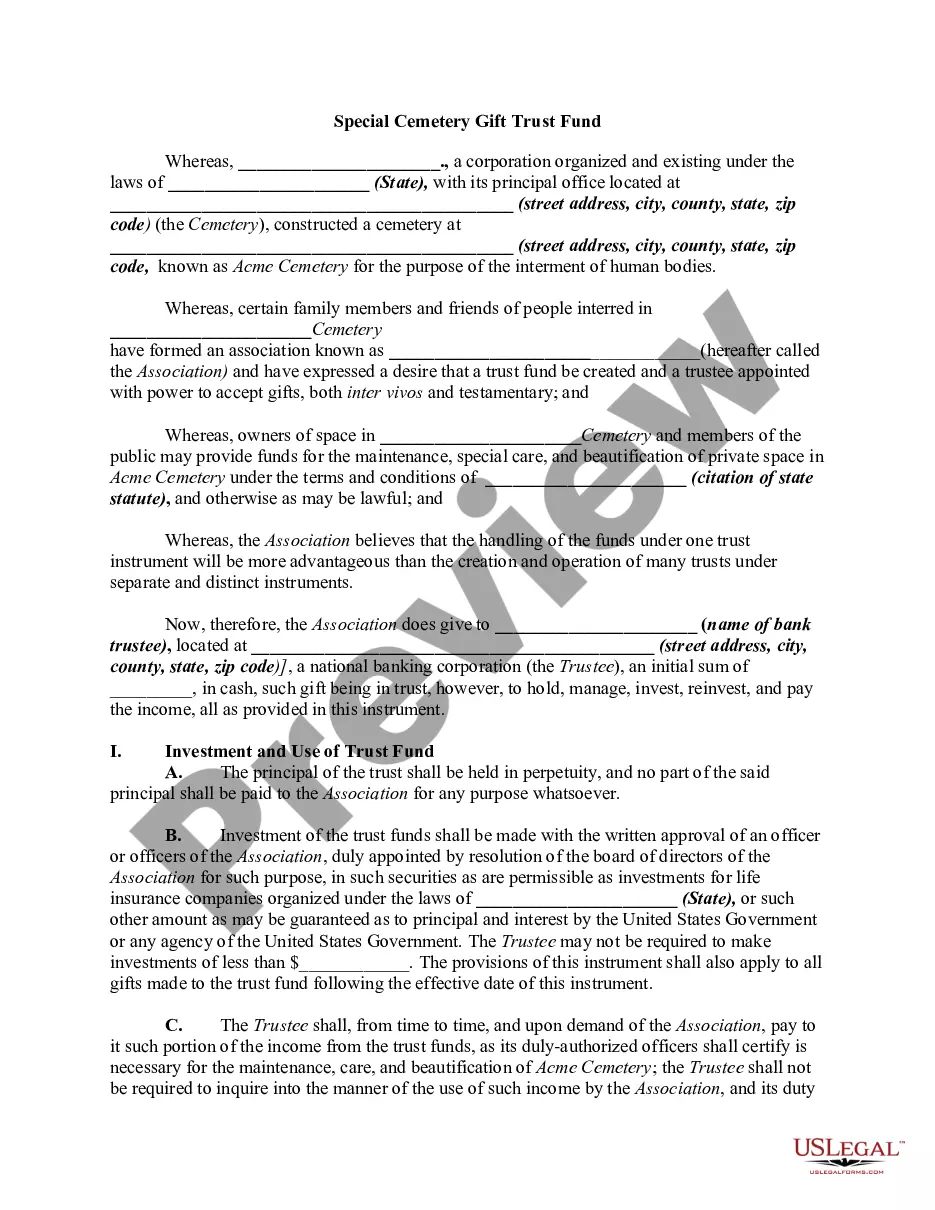

In terms of ownership structure, private trust companies may be held by the establishing family, another trust or a foundation. Private trust companies may be regulated or unregulated. A regulated private trust company offers trust services and is subject to state and/or federal laws.

A Private Trust Company (PTC) is often created to be the trustee of one or more (typically) family trusts, but is not run as a commercial trust company. PTCs are popular with ultra-high net worth families who want to retain significant control over trustee decision-making.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.

Plus, because trusts are private arrangements, they're a great way to plan the future ownership of any family business interests while keeping your financial affairs under wraps.

In legal terms, a Private Trust is a fiduciary relationship that grants a beneficiary the right to money or property. Private Trusts can survive the Grantor's death, and may also be created through direction in a Living Will. In the latter case, the Trust will be formed after the Grantor's death.

The California Department of Financial Institutions ("DFI") licenses trust companies in California.

Based on these considerations, some of the most common jurisdictions for private trust companies are Alaska, Delaware, Nevada, New Hampshire, South Dakota, Tennessee, and Wyoming.