Title: Pennsylvania Letter Requesting Transfer of Property to Trust: A Comprehensive Guide Keywords: Pennsylvania, letter, requesting, transfer, property, trust, types Introduction: In Pennsylvania, a "Letter Requesting Transfer of Property to Trust" is a powerful legal instrument used to transfer ownership of real estate assets into a trust. This letter serves as a formal request to the concerned parties, highlighting the desired transfer and ensuring compliance with Pennsylvania's trust laws. Read on to explore the various types of Pennsylvania Letters Requesting Transfer of Property to Trust. 1. Pennsylvania Letter Requesting Transfer of Real Estate Property to Revocable Living Trust: This type of letter is commonly utilized when individuals wish to transfer their real estate property to a revocable living trust. A revocable living trust offers flexibility during the granter's lifetime and allows for seamless transfer to beneficiaries upon incapacity or death. 2. Pennsylvania Letter Requesting Transfer of Real Estate Property to Irrevocable Trust: An irrevocable trust offers distinct advantages, such as asset protection, tax benefits, and Medicaid planning. This letter outlines the transfer of property ownership from an individual to an irrevocable trust, containing the necessary details and legal language to facilitate the process. 3. Pennsylvania Letter Requesting Transfer of Business Property to Trust: Owners of commercial properties or businesses in Pennsylvania can utilize this type of letter to transfer the property or business assets into a trust. It ensures the smooth transition of ownership while protecting the interests and assets of all involved parties. 4. Pennsylvania Letter Requesting Transfer of Investment Property to Trust: Investment properties, such as rental properties or real estate portfolios, can be transferred to a trust using this specific letter. It specifies the transfer process, ensuring that the property's income and management are appropriately managed by the trust. 5. Pennsylvania Letter Requesting Transfer of Inherited Property to Trust: When inheriting property, individuals may choose to transfer it to a trust for better estate planning, management, and protection. This letter clearly outlines the intent and process of transferring the inherited property to the trust while complying with state laws and regulations. Conclusion: Pennsylvania Letters Requesting Transfer of Property to Trust offer invaluable legal protection, estate planning benefits, and efficient asset management. Whether you plan to transfer real estate, business property, investment property, or inherited property, utilizing the appropriate letter ensures a smooth transition and safeguards your interests. Always consult with a professional, such as an attorney or estate planner, to ensure compliance with Pennsylvania laws and to customize the letter to your specific needs.

Pennsylvania Letter Requesting Transfer of Property to Trust

Description

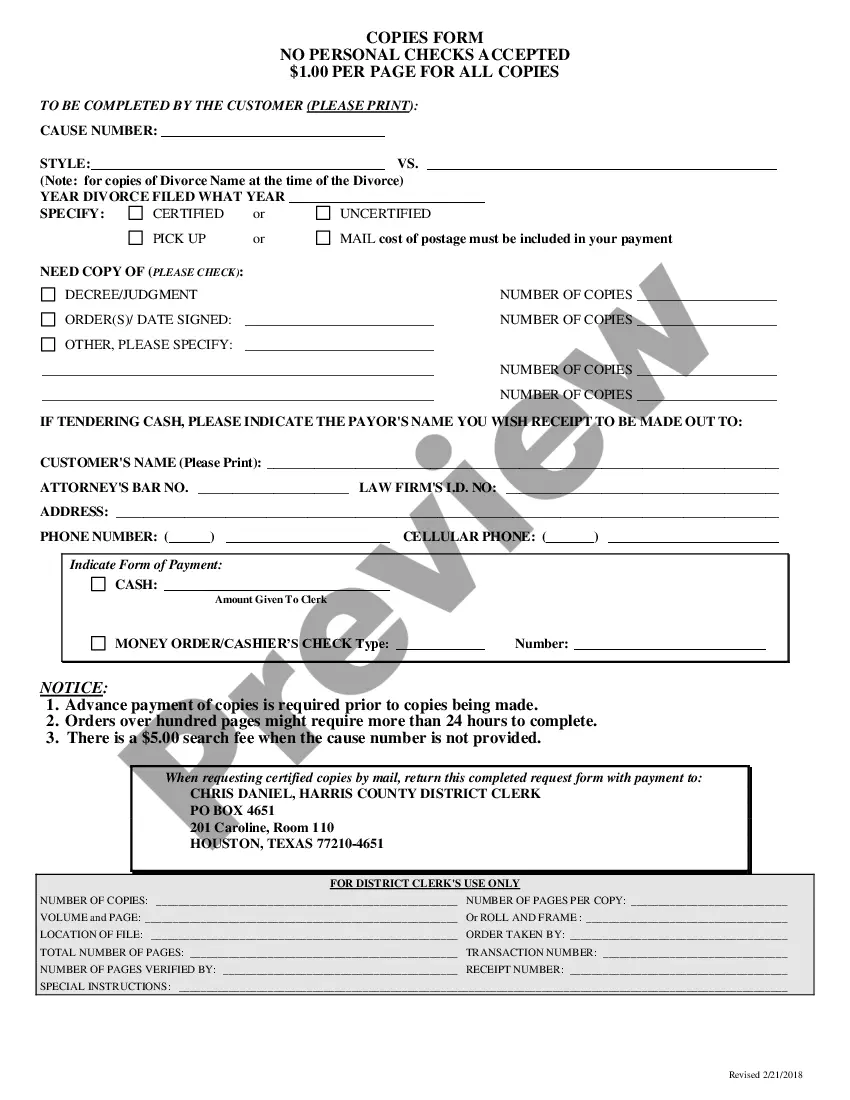

How to fill out Pennsylvania Letter Requesting Transfer Of Property To Trust?

Finding the right legal file web template could be a struggle. Naturally, there are plenty of templates available on the net, but how will you obtain the legal type you need? Take advantage of the US Legal Forms internet site. The support provides a huge number of templates, including the Pennsylvania Letter Requesting Transfer of Property to Trust, that can be used for organization and private requirements. All the forms are inspected by pros and fulfill state and federal requirements.

In case you are presently registered, log in to the accounts and then click the Acquire option to obtain the Pennsylvania Letter Requesting Transfer of Property to Trust. Make use of your accounts to look from the legal forms you may have purchased earlier. Visit the My Forms tab of your respective accounts and obtain an additional duplicate of your file you need.

In case you are a whole new end user of US Legal Forms, here are basic recommendations so that you can follow:

- Very first, ensure you have selected the right type for your city/area. It is possible to check out the form making use of the Review option and look at the form outline to make certain this is the best for you.

- When the type will not fulfill your needs, utilize the Seach area to obtain the correct type.

- When you are positive that the form would work, click on the Get now option to obtain the type.

- Choose the pricing strategy you need and enter in the required details. Design your accounts and pay for the transaction making use of your PayPal accounts or credit card.

- Choose the file formatting and acquire the legal file web template to the gadget.

- Comprehensive, revise and print out and indicator the acquired Pennsylvania Letter Requesting Transfer of Property to Trust.

US Legal Forms is definitely the greatest library of legal forms for which you will find a variety of file templates. Take advantage of the company to acquire appropriately-produced documents that follow state requirements.

Form popularity

FAQ

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

A grantor may place a mortgaged home in a living trust by signing a warranty or quitclaim deed from the current owners to the trust. In this case, the deed would name the living trust as grantee and would be and recorded just like any other property transfer.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

Moving your house or other assets into a trust (specifically an irrevocable trust) can decrease your taxable estate. For a wealthy estate that could otherwise be subject to a state or federal estate tax, putting assets into a trust can help avoid or minimize the estate taxes.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Gifting Property To Family Trust The first option you can choose when transferring the property title is to gift it to the trustee. The trustee and the trust will have to sign a gift deed, which establishes that the ownership of the property is being transferred without payment.

Potential DisadvantagesEven modest bank or investment accounts named in a valid trust must go through the probate process. Also, after you die, your estate may face more expense, as the trust must file tax returns and value assets, potentially negating the cost savings of avoiding probate.