A Pennsylvania Revocable Letter of Credit is a financial instrument used in commercial transactions. It is issued by a bank or financial institution in Pennsylvania and serves as a guarantee of payment from the issuer to the beneficiary, usually a seller or supplier. The creditworthiness of the applicant, referred to as the account party, is a crucial factor in the issuance of this letter. The Pennsylvania Revocable Letter of Credit is a type of letter of credit that can be modified or revoked by the issuer without the consent of the beneficiary. This means that the issuer has the flexibility to cancel the letter of credit at any time as per their discretion. However, the beneficiary is entitled to notification of revocation or modification, providing them with some level of protection. The revocable nature of this letter of credit differentiates it from the irrevocable letter of credit, which cannot be modified or canceled without the agreement of all parties involved. Revocable letters of credit are therefore considered to have a lower level of security for the beneficiary compared to their irrevocable counterparts. There are several types of Pennsylvania Revocable Letter of Credit, each serving specific purposes. These types include: 1. Standby Letter of Credit: A standby letter of credit serves as a backup payment option in case the applicant fails to fulfill their obligations. It is commonly used in construction projects or as a guarantee for performance in contractual agreements. 2. Commercial Letter of Credit: The commercial letter of credit is widely used in international trade to ensure that payment will be made when the seller meets the specified conditions. It provides security to both the buyer and seller by ensuring the terms of the trade are met before payment is released. 3. Traveler's Letter of Credit: This type of letter of credit is designed for travelers, allowing them to obtain funds from a bank while abroad. It provides a convenient and secure payment option, particularly in locations where credit cards or other forms of payment might be impractical. 4. Revolving Letter of Credit: A revolving letter of credit is used in ongoing business relationships where multiple transactions occur over an extended period. It allows for the repeated use of funds without the need to reapply for a new letter of credit. In summary, the Pennsylvania Revocable Letter of Credit is a flexible financial instrument that provides a level of security in commercial transactions. However, its revocable nature means that beneficiaries should carefully consider the terms and conditions before relying solely on this form of payment guarantee.

Pennsylvania Revocable Letter of Credit

Description

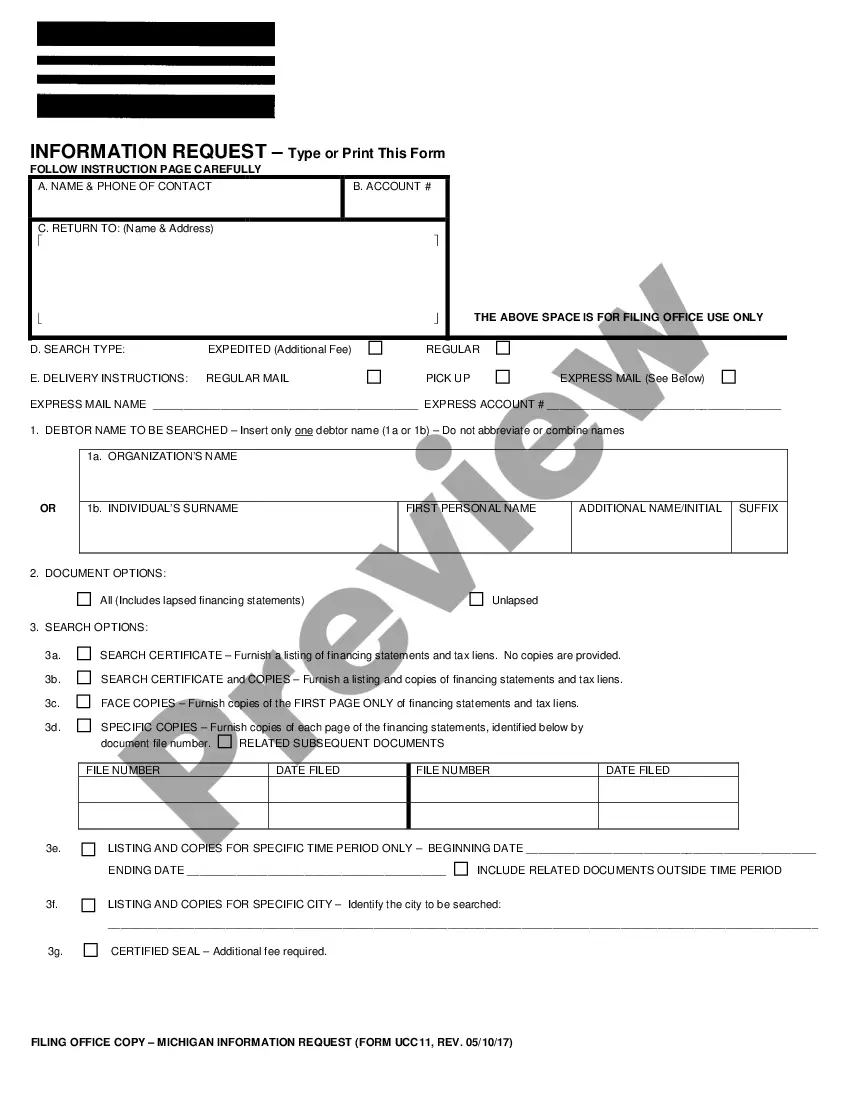

How to fill out Revocable Letter Of Credit?

Are you presently inside a position in which you need to have paperwork for possibly company or personal functions almost every working day? There are tons of legitimate document web templates available on the net, but locating kinds you can trust isn`t simple. US Legal Forms delivers 1000s of kind web templates, just like the Pennsylvania Revocable Letter of Credit, that are published to satisfy state and federal demands.

In case you are presently acquainted with US Legal Forms internet site and get a merchant account, merely log in. Following that, you are able to down load the Pennsylvania Revocable Letter of Credit template.

Should you not offer an profile and need to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for the right city/area.

- Use the Preview option to examine the shape.

- Browse the information to ensure that you have selected the proper kind.

- When the kind isn`t what you are seeking, make use of the Look for field to discover the kind that meets your needs and demands.

- Once you find the right kind, click on Buy now.

- Select the pricing program you want, fill out the specified information to produce your money, and pay money for the order using your PayPal or charge card.

- Select a handy paper formatting and down load your copy.

Locate every one of the document web templates you have bought in the My Forms food selection. You can aquire a further copy of Pennsylvania Revocable Letter of Credit any time, if necessary. Just select the essential kind to down load or print the document template.

Use US Legal Forms, the most considerable variety of legitimate varieties, to save some time and steer clear of faults. The service delivers appropriately made legitimate document web templates which can be used for a variety of functions. Create a merchant account on US Legal Forms and start generating your daily life easier.

Form popularity

FAQ

Some of the disadvantages are listed below: Can be revoked anytime. Both parties are at a disadvantage position, and financial loss is expected. Non-transferable instrument due to lack of authority/security related to issuing bank. An unapproved document adds to the security risk.

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

For example, under a revocable letter of credit, if the seller was unable to ship within the stipulated time period, he could simply amend the shipment date to whenever suits him. That may not suit the buyer, but he would be powerless.

The exporter and importer complete a sales agreement. Using the sales agreement's terms and conditions, the importer's bank drafts the letter of credit; this letter is sent to the exporter's bank. The exporter's bank reviews the letter of credit and sends it to the exporter after approval.

The process of a Letter of Credit is not as tedious as it seems: Issuing the Letter of Credit. A LOC is issued by the importers bank. ... Shipping of Goods. ... Submit the Documents to the Advising Bank. ... Payment Settlement and Goods Possession.

Once the goods have been shipped, the beneficiary will present the requested documents to the nominated bank. This bank will check the documents, and if they comply with the terms of the letter of credit, the issuing bank is bound to honor the terms of the letter of credit by paying the beneficiary.

Pursuant to the request of our customer, ___________________________________________________________ we, (Bank) ___________________________________________________ hereby establish and give to you an irrevocable Letter of Credit in your favour in the total amount of $ _____________ which may be drawn on by you at any ...