Pennsylvania Compensation Administration Checklist

Description

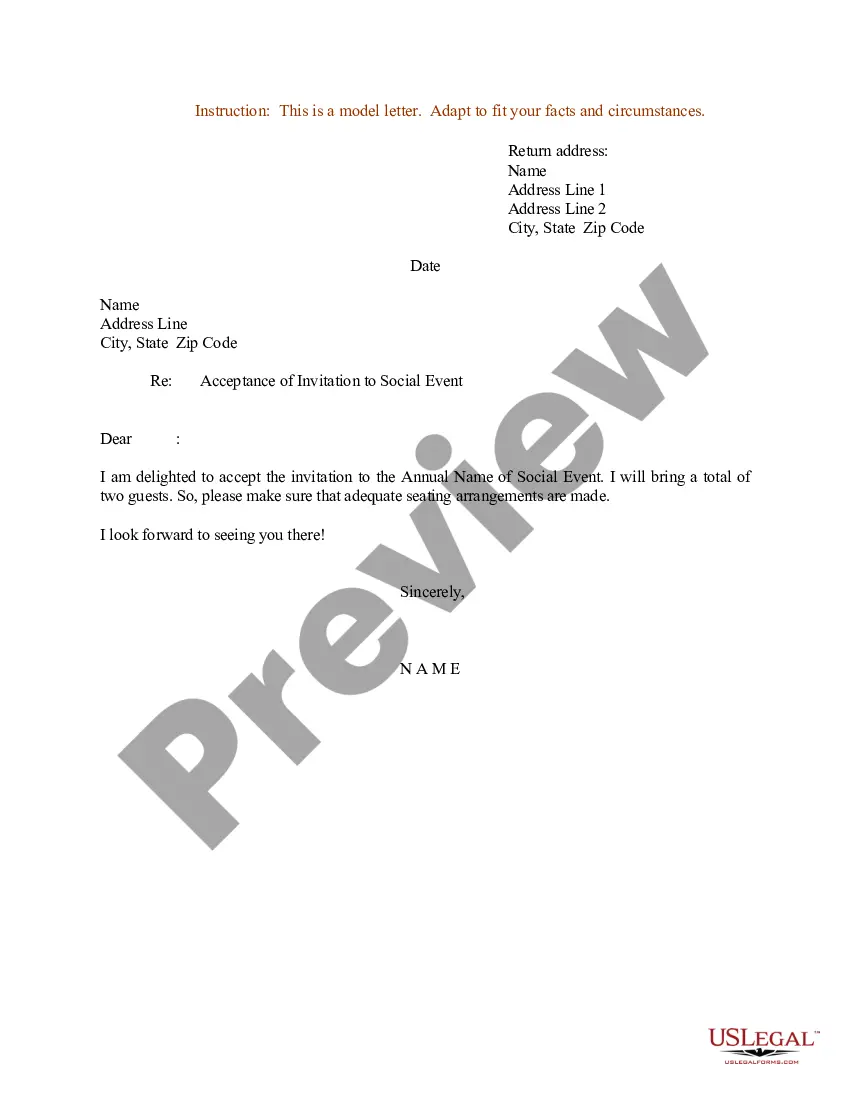

How to fill out Compensation Administration Checklist?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of forms such as the Pennsylvania Compensation Administration Checklist in just seconds.

If you have an account, Log In and download the Pennsylvania Compensation Administration Checklist from the US Legal Forms collection. The Download button will be available on each form you view. You gain access to all previously downloaded forms from the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Pennsylvania Compensation Administration Checklist.

Each template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Pennsylvania Compensation Administration Checklist with US Legal Forms, one of the most extensive collections of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal needs.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the content of the form. Check the form details to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, verify your choice by clicking on the Get now button. Then, select the pricing plan that suits you and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

Call our UC Service Center at 888.313. 7284 for your personal UC LiveChat Code.

The Mixed Earners Unemployment Compensation (MEUC) program is for UC, PEUC, and EB claimants with at least $5000 in net self-employment income. Eligible workers can apply for MEUC starting February 14. Payments will begin in several weeks. Learn more: uc.pa.gov/unemployment-b2026

Information about Separating Employer:Employer's name, address and phone number. Employer's PA UC account number (if known) First and last day worked with employer. Reason for leaving.

You must apply for the MEUC program and submit documentation which clearly shows $5,000 net income....Tax DocumentsBank receipts.Billing statements.Business records.Contracts.Invoices.Self-employment paycheck stubs.Tax returns.

You are eligible for PEUC if you: Are unemployed between March 29 through December 26, 2020; Have exhausted your regular state or federal benefits with week ending July 6, 2019 or later; Are currently not eligible for state or federal unemployment benefits; and.

You'll file online or using the Pennsylvania Teleclaims (888-255-4728) and you have all week (Sunday through Friday) to complete it. For your first, biweekly filing and claim, it can take up to four to six weeks to receive the approval determination. Continue to file during this time!

Claim ChangesVisit Ask EDD to request to backdate your claim if you think it has the wrong start date. Select Unemployment Insurance Benefits, then Claim Questions, then Backdate the Effective Date of my UI Claim Due to COVID-19. In your UI Online account, select Contact Us to request a change.

If you accidentally select the incorrect answer, the only way to fix it and move forward on your claim is to call the UC Service center at 888-313-7284 or uchelp@pa.gov.

You must apply to receive MEUC benefits. If you believe you may be eligible for MEUC benefits, but did not receive a message in your UI Online inbox, you can request an application by phone. Call the dedicated MEUC telephone line at 1-877-631-3247.