Pennsylvania Debit Shipping Authorization

Description

How to fill out Debit Shipping Authorization?

If you require thorough, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's straightforward and convenient search tool to find the documents you need.

A range of templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, edit and print or sign the Pennsylvania Debit Shipping Authorization.

- Utilize US Legal Forms to obtain the Pennsylvania Debit Shipping Authorization in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to obtain the Pennsylvania Debit Shipping Authorization.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

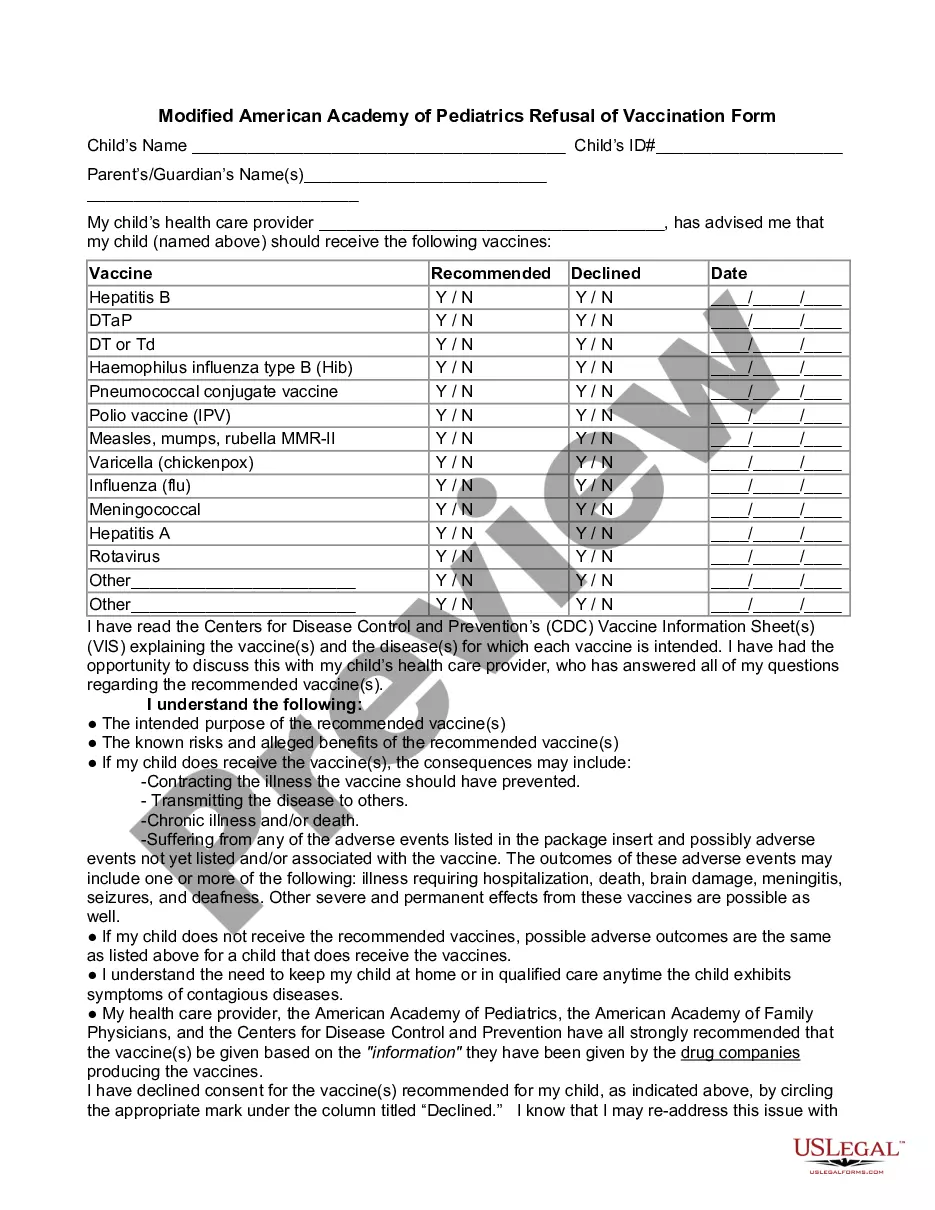

- Step 2. Utilize the Review option to examine the form's content. Make sure to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The fiduciary of a nonresident estate or trust uses the PA- 41 Fiduciary Income Tax Return to report: 2022 Pennsylvania-source income when there are no resident beneficiaries; 2022 Worldwide income when the estate or trust has Pennsylvania-source income and resident beneficiaries; or 2022 Any income tax liability of the estate

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Although Pennsylvania has not adopted economic nexus for personal income tax purposes, a partnership that has corporate partners may be required to file a PA-65 Corp.

We're working closely with your state to get the cards distributed as quickly as possible. Once we receive the card setup file from Pennsylvania Treasury Department, we mail your ReliaCard within approximately two business days. Please allow seven to ten days for the postal service to deliver the card to you.

A corporation is considered to have nexus in Pennsylvania for CNIT purposes when it has one or more employees conducting business activities on its behalf in Pennsylvania.

Effective July 1, 2019, sales into Pennsylvania that exceeded $100,000 in the previous 12-month period are considered to have economic nexus.

If it is your first time filing for UC benefits, a debit card will be mailed to you after you have been determined financially eligible for benefits. The card will be mailed within three business days.

Pennsylvania Tax NexusGenerally, a business has nexus in Pennsylvania when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

Taxpayers can utilize a new online filing system to file their 2020 Pennsylvania personal income tax returns for free. Visit mypath.pa.gov to access the new system, which also allows taxpayers to make payments, view notices, update account information and find the answers to frequently asked questions.