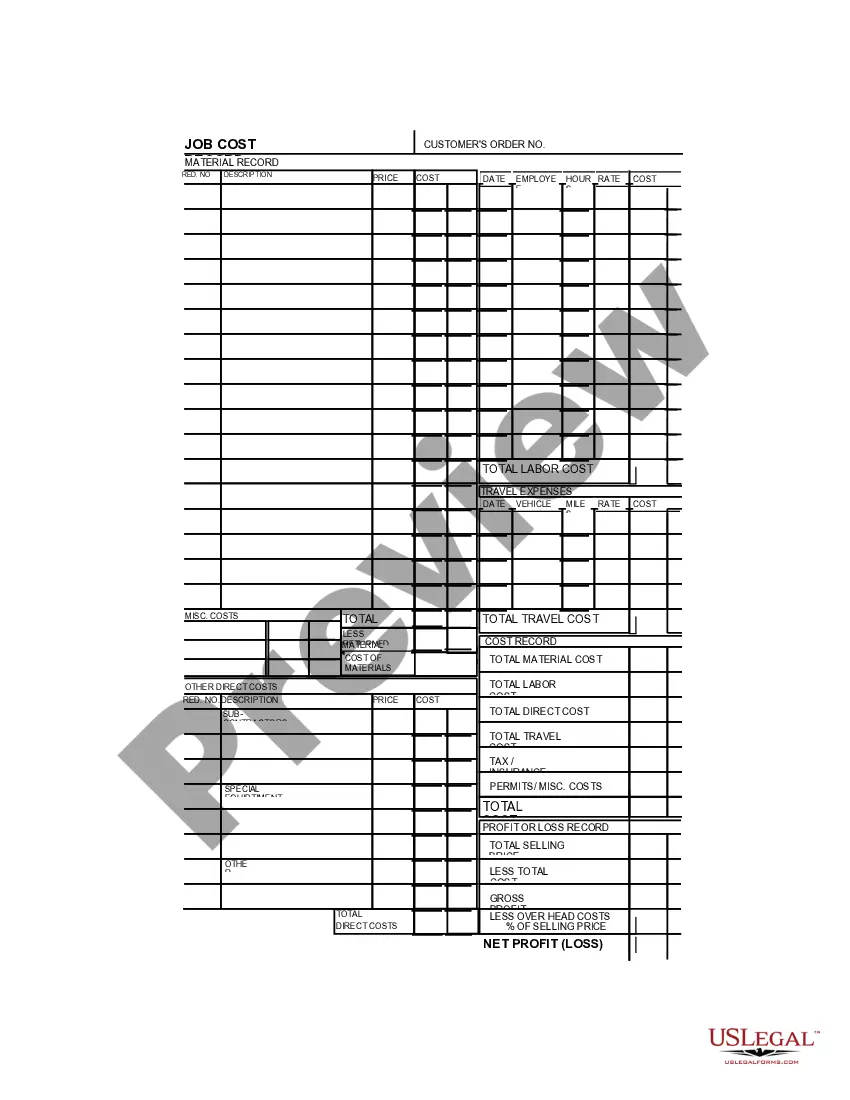

Pennsylvania Job Invoice - Long

Description

How to fill out Job Invoice - Long?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, including the Pennsylvania Job Invoice - Long, which are designed to satisfy federal and state regulations.

Once you locate the correct form, click Buy now.

Select the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or Visa or MasterCard.

- If you are already acquainted with the US Legal Forms website and have your account, just Log In.

- Then, you will be able to download the Pennsylvania Job Invoice - Long template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/area.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

A 0.06 percent (. 0006) tax on employee gross wages, or 60 cents on each $1,000 paid. Employee withholding contributions are submitted with each quarterly report. Employee withholding applies to the total wages paid in 2021.

The Pennsylvania Unemployment Compensation (UC) Law requires covered employers to make contributions into a pooled reserve known as the UC Fund. These contributions are used to pay benefits to jobless individuals who meet the claimant eligibility requirements of the UC Law.

What is the renewal requirement for background checks? They must be renewed every 60 months (five years). The fingerprint FBI check or the Disclosure Statement only needs to be completed one time since establishing PA residency.

If the employer does not reply to the Unemployment Compensation office within the time allowed, the Unemployment Compensation office will move forward with a determination and will base the eligibility for unemployment compensation benefits on the information before it, which is typically the information provided by

What are the contents of an invoice raised by a freelancer?Title.Name and logo.Contact details.Client's name and client's information.Invoice date.Invoice number.List of services with the rate charged (before tax)Tax rate and amount, if applicable.More items...?09-Nov-2021

New Employer Rate3.5 percent for new employers (Non-construction) 9.7 percent for new employers (Construction)

Most businesses pay both Federal Unemployment Tax Act (FUTA) taxes and State Unemployment Tax Act (SUTA) taxes, which primarily fund all unemployment programs.

To create an invoice for free, build your own invoice using Microsoft Word, Microsoft Excel or Google Docs. You can use a premade invoice template offered by the program you choose, or you can create your own invoice from scratch.

Steps to Create a Production Assistant InvoiceStep 1: Start with Your Full Name. Any invoice always starts with the sender.Step 2: Include Relevant Contact Details.Step 3: Registration Details.Step 4: Add Client Details.Step 5: Add Proper Description of Service Rendered.

After a claim for Pennsylvania unemployment compensation benefits is properly filed, the local service center will send out paperwork to the employer and may also include a telephone interview with the employer for the employer's response (i.e., how the separation occurred, etc.).