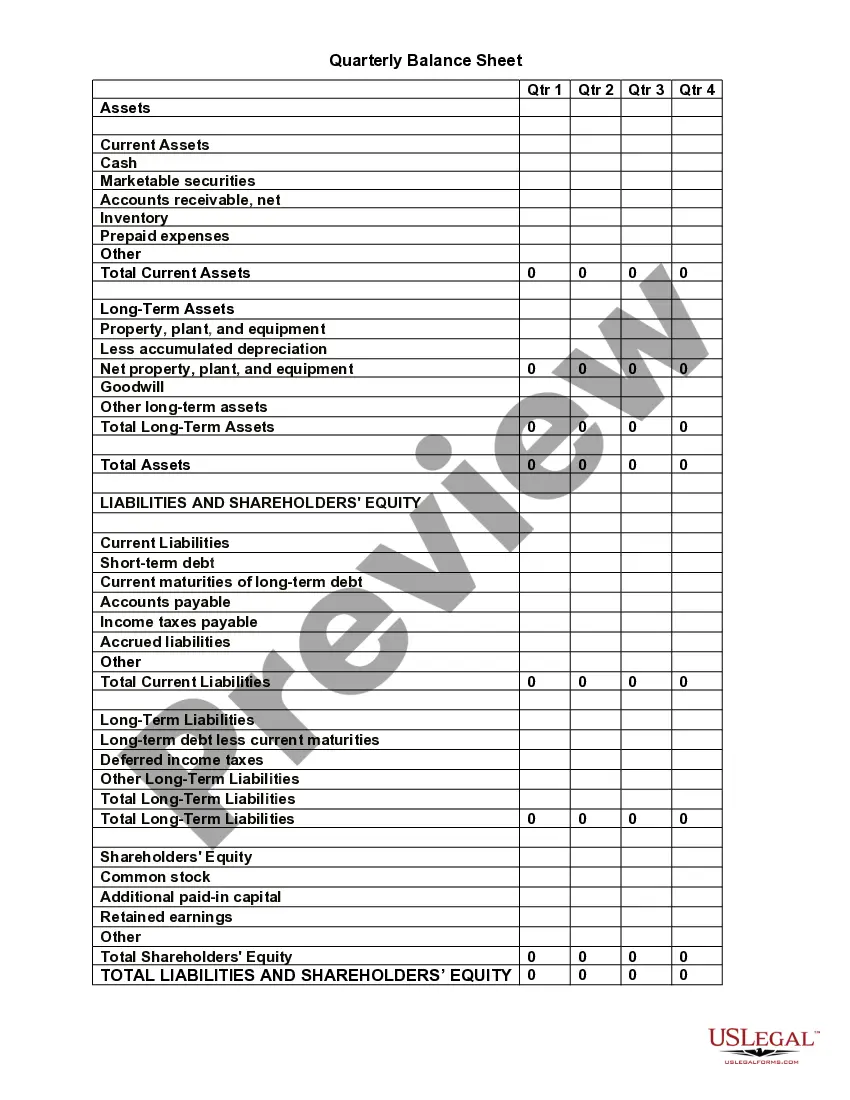

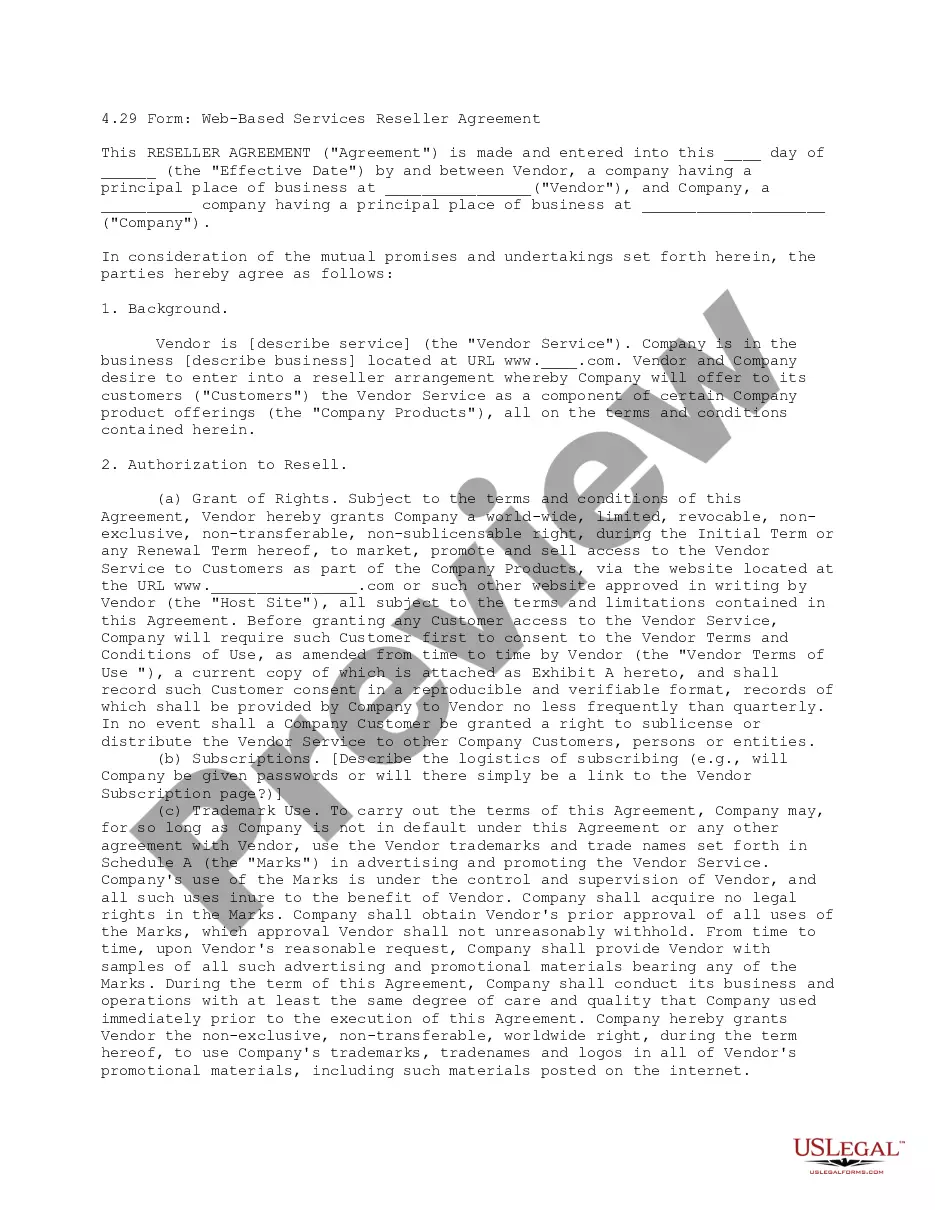

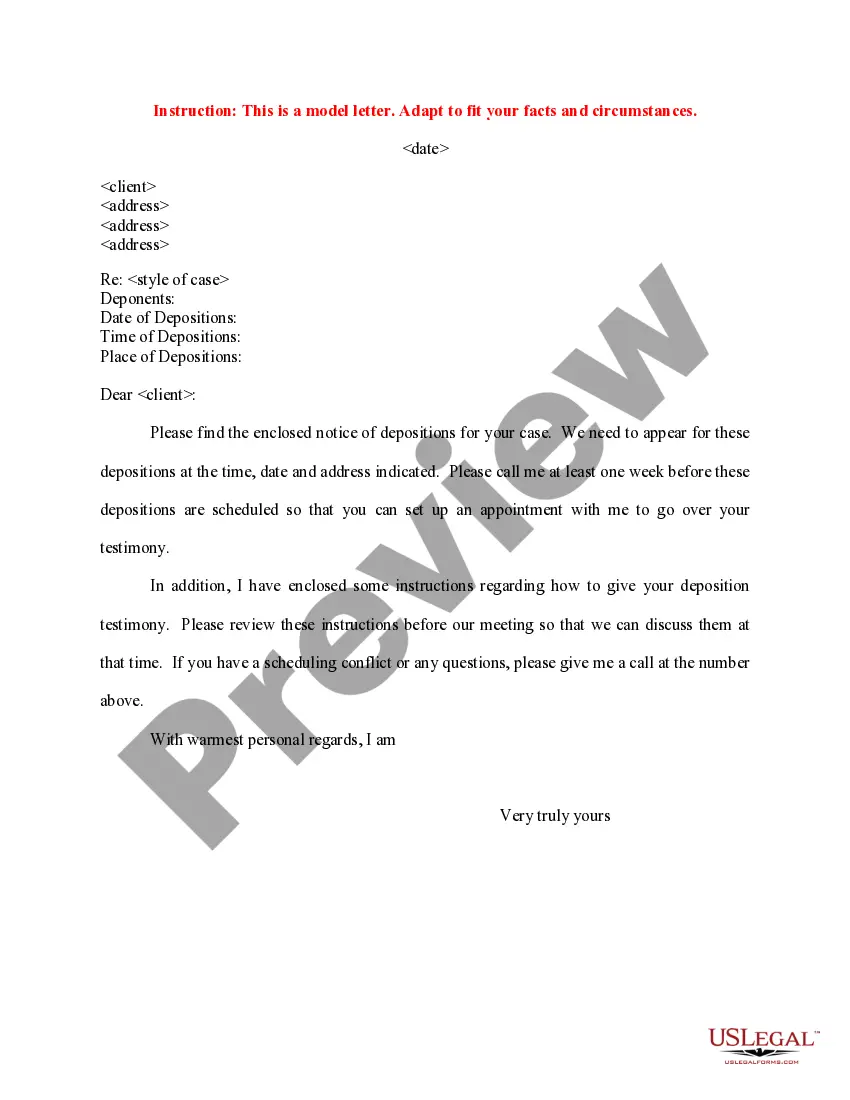

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Pennsylvania Yearly Expenses by Quarter

Description

How to fill out Yearly Expenses By Quarter?

If you desire to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and convenient search functionality to obtain the documents you require. A selection of templates for business and personal use is categorized by types, states, or keywords.

Use US Legal Forms to acquire the Pennsylvania Yearly Expenses by Quarter in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you acquired in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Pennsylvania Yearly Expenses by Quarter with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and select the Obtain option to retrieve the Pennsylvania Yearly Expenses by Quarter.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to check the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, select the Buy now option. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Pennsylvania Yearly Expenses by Quarter.

Form popularity

FAQ

The Pennsylvania Pound was first conceived by Francis Rawle, who can be rightly called The Father of the Pennsylvania Pound.

Balanced Budget:The Pennsylvania Constitution requires the Governor to submit a balanced budget and prohibits the Governor from approving appropriations in excess of actual and estimated revenues and surplus.

Among the states, Alaska had the highest per capita state and local spending in 2019 at $17,596, followed by New York ($15,667) and Wyoming ($15,107).

Between fiscal years 2015 and 2016, total government spending in Pennsylvania increased by approximately $4.5 billionfrom $73.5 billion in fiscal year 2015 to an estimated $78.0 billion in 2016.

Revenues come mainly from tax collections, licensing fees, federal aid, and returns on investments. Expenditures generally include spending on government salaries, infrastructure, education, public pensions, public assistance, corrections, Medicaid, and transportation.

According to NASBO, Pennsylvania's recent expenditure totals (general fund spending/total spending, including federal transfers) were: FY 2021: $38.8 billion/$103.8 billion. FY 2020: $36.3 billion/$96.0 billion. FY 2019: $36.3 billion/$89.6 billion.

Securing Pennsylvania's Fiscal Future All in, factoring in offline spending through federal CARES Act funds and American Rescue Plan funds, our year-over-year growth is just 2.6%. This budget will deposit over $2.52 billion into the Rainy Day Fund, growing the fund total to a historic $2.76 billion.

Even if my plan is followed exactly, Pennsylvania will still have a more than$3 billion surplus at the end of the year, above and beyond the $2.8 billion that will remain in the Rainy Day Fund. Gov. Wolf's plan for 2022-23 calls for major investments in our schools, our workforce, our economy, and more. Gov.

While Pennsylvania must pass a balanced budget, there is no constitutional requirement that a budget be in place by June 30. However, to ensure that funding for all state programs continues, the budget should be completed and signed by the Governor by midnight on June 30.