Pennsylvania Petty Cash Form is a financial document used by organizations in Pennsylvania to track and manage small, immediate cash expenses. This form proves essential in maintaining transparency and accountability within a company's financial operations. When employees need to make purchases, such as office supplies or minor equipment, which are too small to warrant formal procurement processes, they can utilize the Pennsylvania Petty Cash Form. The Pennsylvania Petty Cash Form typically includes several crucial details. Firstly, it requires the name and contact information of the person responsible for the petty cash fund. This person is usually an authorized employee or an assigned treasurer who will oversee the disbursement and reconciliation of the fund. Secondly, the form requests information about the purpose of the expenses or the nature of the purchase. Employees are required to provide a detailed description to ensure proper categorization and documentation. Furthermore, the form specifies the date and amount requested or spent, providing a record of when and how much cash is disbursed. This serves as an auditing mechanism to prevent misuse or discrepancies in petty cash handling. Additionally, employees are often required to provide receipts or supporting documentation for all expenses made using petty cash. This further strengthens the financial record and helps the organization maintain accurate and reliable accounting practices. Apart from the general Pennsylvania Petty Cash Form, there might be specific types suited for varying organizational needs or industries. For instance, a Pennsylvania Petty Cash Form tailored for educational institutions may include additional fields to record expenses related to school supplies or field trips. Similarly, a Pennsylvania Petty Cash Form used in healthcare facilities might have provisions for medical or patient-related expenditures. In summary, the Pennsylvania Petty Cash Form is a vital tool for monitoring and managing minor expenditures within organizations. It ensures transparency, accountability, and accuracy in financial transactions, benefiting both employees and employers. Depending on the nature of the organization, there might be specialized versions of this form designed to meet specific industry requirements.

Pennsylvania Petty Cash Form

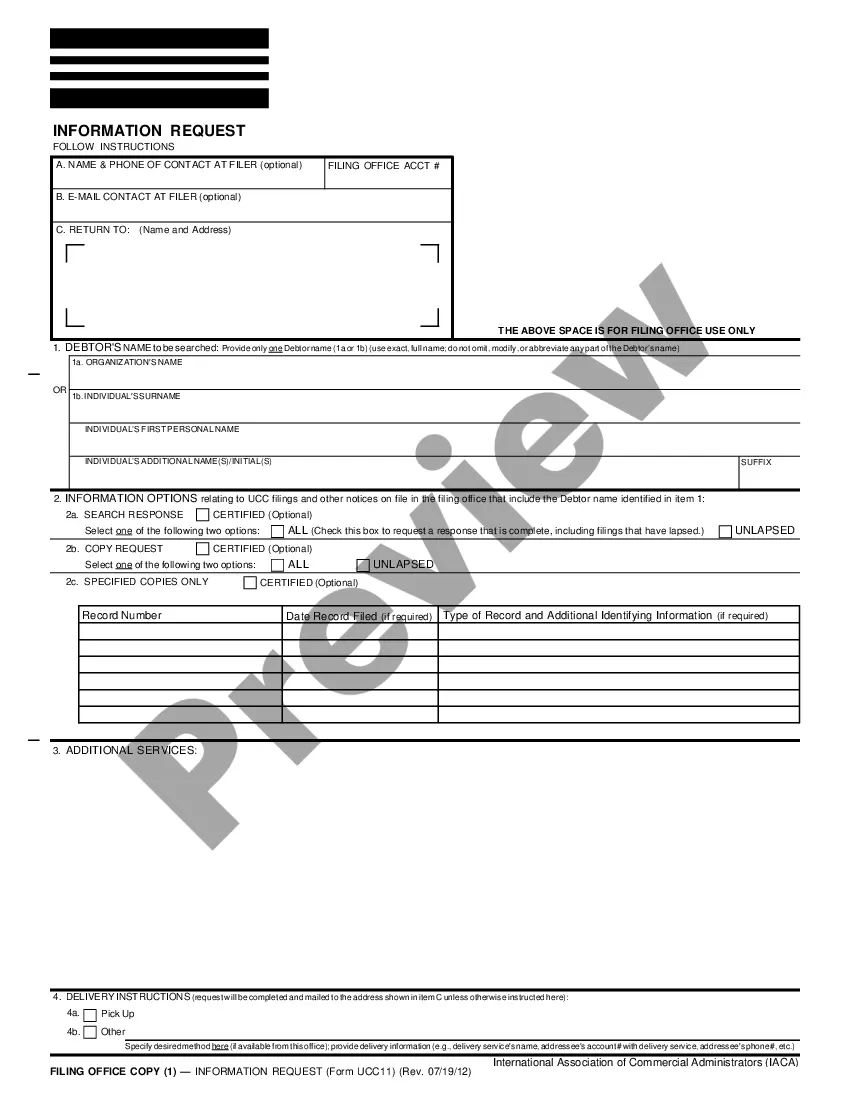

Description

How to fill out Pennsylvania Petty Cash Form?

If you wish to complete, down load, or printing authorized papers web templates, use US Legal Forms, the greatest collection of authorized forms, which can be found on-line. Use the site`s simple and easy handy research to obtain the files you need. Various web templates for organization and personal functions are sorted by groups and claims, or search phrases. Use US Legal Forms to obtain the Pennsylvania Petty Cash Form within a couple of mouse clicks.

Should you be currently a US Legal Forms consumer, log in in your account and click on the Obtain option to obtain the Pennsylvania Petty Cash Form. Also you can entry forms you in the past delivered electronically within the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Make sure you have selected the form to the right town/nation.

- Step 2. Use the Preview choice to look over the form`s information. Never neglect to read the outline.

- Step 3. Should you be not happy together with the develop, make use of the Look for field at the top of the display screen to locate other versions in the authorized develop format.

- Step 4. When you have found the form you need, select the Acquire now option. Choose the costs strategy you choose and add your references to sign up for the account.

- Step 5. Method the financial transaction. You can utilize your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the format in the authorized develop and down load it on your product.

- Step 7. Total, modify and printing or sign the Pennsylvania Petty Cash Form.

Each authorized papers format you purchase is yours for a long time. You possess acces to every single develop you delivered electronically inside your acccount. Click on the My Forms segment and pick a develop to printing or down load once more.

Contend and down load, and printing the Pennsylvania Petty Cash Form with US Legal Forms. There are millions of specialist and express-distinct forms you may use to your organization or personal requires.

Form popularity

FAQ

Petty Cash Forms The Accounts Payable Petty Cash form is used when a department has a petty cash fund and the petty cash fund needs to be replenished. Treasury Operations Petty Cash Form: Petty Cash Voucher - Cash Accounting.

The original Petty Cash Voucher is stapled to the original supporting documents (retail store sales slip, cash register tape, or other original receipt) and forwarded to Accounts Payable with the Petty Cash Replenishment Request (see Procedure 4-006, Preparation of Petty Cash Replenishment Request) at the time of petty

A credit card receipt can be used as evidence for a disbursement of funds from petty cash.

Helpful ToolsNo.Date Enter the date that the petty cash receipt is prepared.Pay To Enter the name of the payee who received the petty cash disbursement.$ (Dollar Amount) Enter the total amount of the payment.Description Enter a brief, but specific explanation of what the funds were used for.More items...

An employee using petty cash should provide a receipt for the purchase to the petty cash custodian. Give the receipt to your finance department or the person who handles your small business books. You typically evaluate your petty cash fund at the end of each month for more accurate balances.

Each time a payment is made from the petty cash fund, a pre-numbered voucher must be prepared as proof of payment. True. For internal control reasons, at least two people should be responsible for the petty cash fund, and the petty cash box should be kept in a locked desk drawer or safe.

The four steps to do petty cash accounting and recording are:Establish Petty Cash Policy & Procedures. The first thing you need to do is document your petty cash procedures and communicate them to all employees.Set Up a Petty Cash Log.Create Journal Entries to Record Petty Cash.Reconcile the Petty Cash Account.

Petty cash funds should be properly secured at all times. Access to the funds should be restricted to one person (e.g., the petty cash custodian or a specified cashier). Cash on hand and receipts for disbursements made should always equal the assigned amount of the petty cash fund.

Petty cash is a small amount of cash that is kept on the company premises to pay for minor cash needs. Examples of these payments are office supplies, cards, flowers, and so forth. Petty cash is stored in a petty cash drawer or box near where it is most needed.

The petty cash voucher shows the voucher number,amount, purpose of the expenditure, and account to debit. The person receiving the funds signs the voucher, and the person who controls the petty cash fund initials the voucher. used by most businesses to record transactions involving petty cash.