The Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a crucial document that outlines the decision-making process and the amount of annual disbursements to be distributed amongst the members of a Limited Liability Company (LLC) based in Pennsylvania. This resolution serves as a legal record of the LLC members' agreement on the allocation of profits and signals the financial expectations of the company for the upcoming year. Key elements included in a Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company may consist of: 1. Meeting Purpose: The resolution should clearly state that the purpose of the meeting is to determine and declare the amount of annual disbursements to be distributed to the LLC members. 2. Date and Location: The resolution must mention the date and location of the meeting. 3. Attendance: All LLC members should be listed in the resolution to indicate their presence at the meeting. 4. Opening Statement: The resolution may include an opening statement highlighting the importance of the annual disbursement determination and the significance of the meeting. 5. Financial Review: The resolution may require a comprehensive financial review, including an overview of the company's revenue, expenses, and profits for the preceding year. 6. Proposed Disbursement Amount: LLC members will propose and discuss the amount of annual disbursements to be distributed to each member. 7. Discussion and Voting: A detailed account of the discussion held amongst the LLC members, arguments presented, and the subsequent voting process should be documented in the resolution. The specified amount may either be agreed upon by consensus or decided by a majority vote, as deemed appropriate by the LLC's operating agreement. 8. Adoption of Resolution: Once the voting process is completed, the resolution should clearly state whether the proposed amount of the annual disbursements was adopted or rejected by the LLC members. 9. Signatures: Finally, all participating LLC members should date and sign the resolution to demonstrate their agreement and consent. Different types of Pennsylvania Resolutions of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company could vary based on the different LLC operating agreements or specific circumstances of the disbursement process. Some examples include: 1. Regular Annual Disbursement Resolution: This type of resolution is generally used for routine annual disbursements, where LLC members gather to determine the amount to be distributed based on the agreed-upon formula mentioned in the operating agreement. 2. Extraordinary Disbursement Resolution: In certain cases, such as a company experiencing an unexpected windfall or facing significant financial challenges, an extraordinary disbursement resolution might be required. This resolution would address unique circumstances that fall outside the regular annual disbursement process. 3. Disbursement Amendment Resolution: If the LLC operating agreement undergoes changes that affect the disbursement process, a disbursement amendment resolution may be necessary. This resolution allows LLC members to update the agreed-upon disbursement amount or modify the existing disbursement formula. It's important to consult legal professionals or review the specific requirements outlined in the LLC's operating agreement to ensure that the generated resolution adheres to the regulations and provisions set forth by the state of Pennsylvania and the LLC's governing documents.

Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Pennsylvania Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

If you want to comprehensive, download, or print authorized document templates, use US Legal Forms, the greatest assortment of authorized forms, that can be found online. Use the site`s basic and convenient search to obtain the paperwork you will need. Numerous templates for company and individual uses are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with a number of clicks.

If you are currently a US Legal Forms buyer, log in to your profile and click on the Down load key to have the Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. You can also accessibility forms you previously downloaded from the My Forms tab of your respective profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the form for your appropriate metropolis/region.

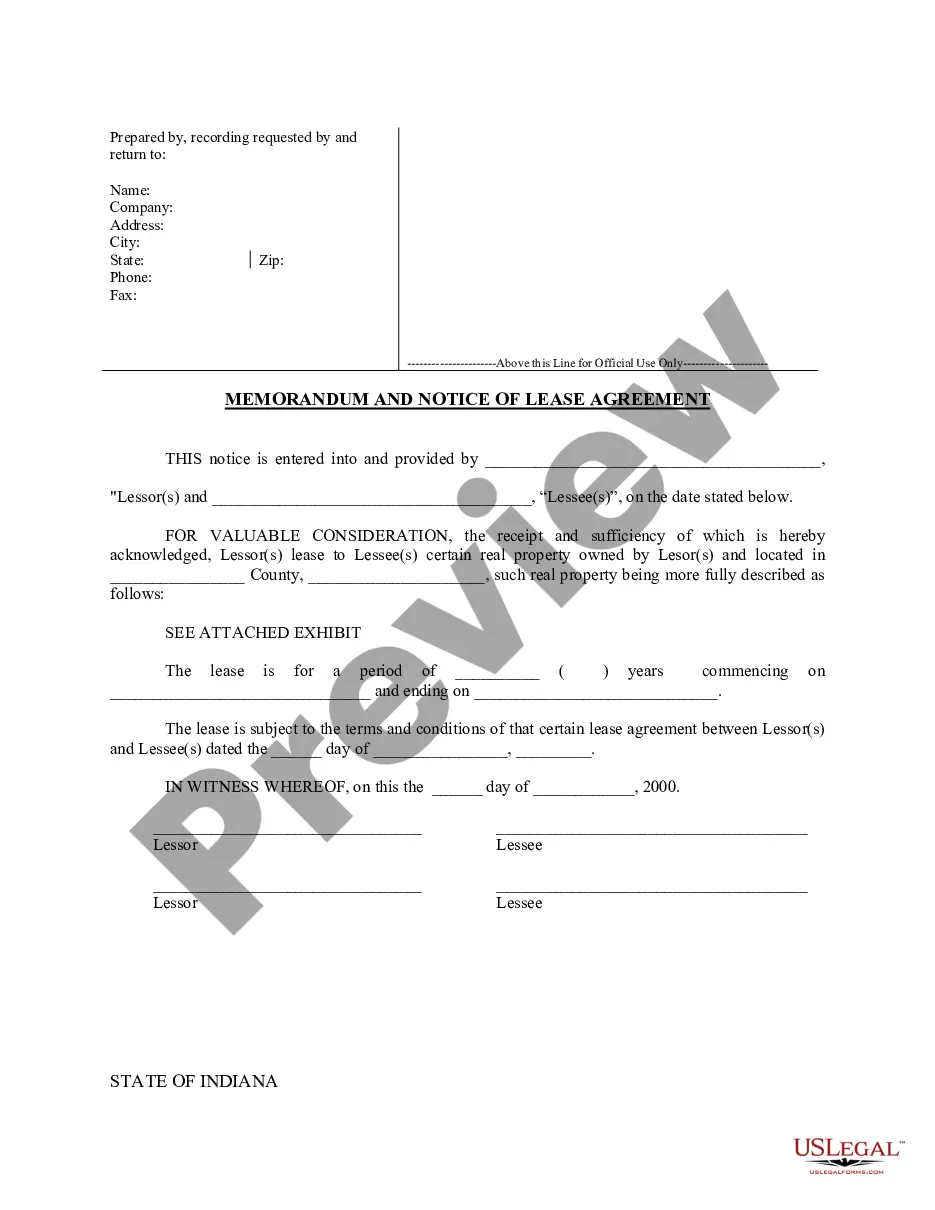

- Step 2. Make use of the Preview option to look over the form`s articles. Don`t neglect to see the description.

- Step 3. If you are not happy with all the type, take advantage of the Research area towards the top of the display screen to find other versions of your authorized type web template.

- Step 4. Once you have found the form you will need, click the Acquire now key. Pick the costs prepare you prefer and add your credentials to sign up to have an profile.

- Step 5. Method the purchase. You may use your charge card or PayPal profile to accomplish the purchase.

- Step 6. Choose the format of your authorized type and download it on your own product.

- Step 7. Total, edit and print or indication the Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Every authorized document web template you buy is the one you have forever. You have acces to each and every type you downloaded in your acccount. Select the My Forms segment and decide on a type to print or download once again.

Contend and download, and print the Pennsylvania Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with US Legal Forms. There are millions of skilled and express-particular forms you can use for your personal company or individual needs.