Pennsylvania Exempt Survey

Description

How to fill out Exempt Survey?

Finding the appropriate legal document format can be challenging.

Clearly, there are numerous templates accessible online, but how do you locate the legal template you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Pennsylvania Exempt Survey, which can be utilized for both business and personal purposes.

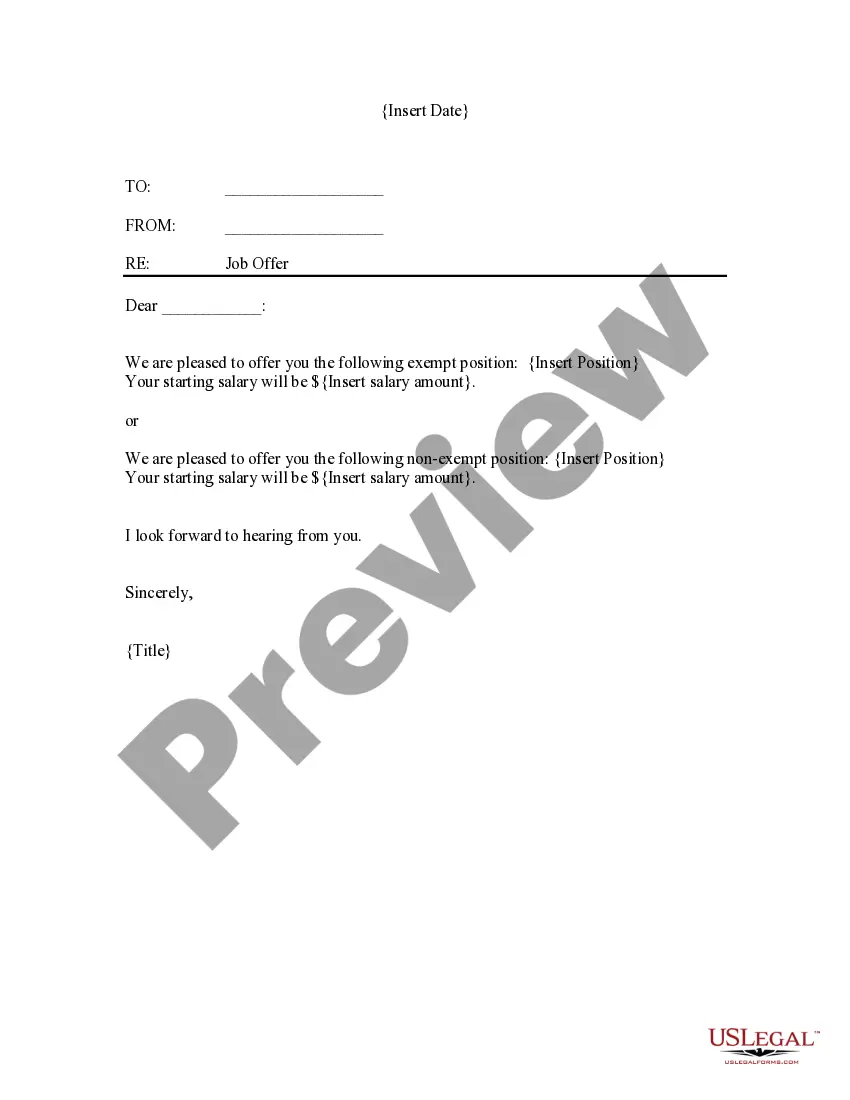

You can preview the form using the Preview button and review the form description to confirm it is suitable for you.

- All forms are reviewed by experts and adhere to federal and state requirements.

- If you are already registered, sign in to your account and click on the Download button to obtain the Pennsylvania Exempt Survey.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

To be exempt in Pennsylvania, employees must earn at least $684 per week in addition to passing specific duties tests. Beginning on October 3, 2021, to be exempt, employees must earn at least $780 per week.

The current minimum wage in Pennsylvania is $7.25 per hour, which is the current federal minimum wage. Special certificates can be obtained to pay learners or students as little as 85% of the minimum wage, or to pay certain disabled employees under the minimum wage.

To qualify for exemption, employees generally must be paid at not less than $684 per week on a salary basis.

The threshold specifics:October 3, 2020: $684 per week, $35,568 annually.October 3, 2021: $780 per week, $40,560 annually.October 3, 2022: $875 per week, $45,500 annually.Beginning in 2023, the salary threshold will adjust based on the average wages of exempt occupations in the state.

Pennsylvania Minimum Wage for 2021, 2022. Pennsylvania's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate.

$875 per week ($45,500 annually) effective Oct. 3, 2022.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

Pennsylvania Minimum Wage Increase. Under the proposal, minimum wage would increase to $12 on July 1, 2022, with annual increases of 50 cents until reaching $15 on July 1, 2028.

Federal Exemptions from Overtime: To be considered "exempt," these employees must generally satisfy three tests: Salary-level test. Effective January 1, 2020, employers must pay employees a salary of at least $684 per week. The FLSA's minimum salary requirement is set to remain the same in 2022.