Pennsylvania Farm Lease or Rental — Crop Share is an agreement between a landowner (lessor) and a farmer (lessee) for the use of agricultural land in Pennsylvania. The farmer pays the landowner with a percentage of the crops or livestock produced on the leased land in exchange for the use of the property. In this type of lease or rental agreement, the farmer typically bears the costs of production, including seeds, fertilizers, machinery, and labor, while the landowner provides the land and may bear some shared costs such as property taxes or maintenance expenses. The crop share percentage can vary, but it is commonly around 50% for crops and may differ for livestock. There are different types of Pennsylvania Farm Lease or Rental — Crop Share agreements that can be customized based on the specific circumstances and preferences of both parties. Some common variations are: 1. Full Crop Share: In this arrangement, the landowner and farmer split the harvested crop equally, usually a 50-50 distribution. This type of lease encourages a partnership with shared risks and rewards. 2. Modified Crop Share: Here, the distribution percentage is adjusted based on certain factors such as the initial investment by the farmer, overall land productivity, or any additional services provided by the landowner. 3. Custom Crop Service Agreement: This agreement is suitable for landowners who do not wish to bear any production risks. Instead of receiving a percentage of the crop, the landowner hires the farmer as a custom operator who gets paid a fixed fee for cultivating and harvesting the crops. 4. Flex Lease: This type of lease allows for a more flexible share arrangement, where the landowner and farmer agree to share the risks and rewards based on certain factors such as market prices, yield, or input costs. The percentage of crop share can fluctuate annually, providing greater flexibility and adaptability. Pennsylvania Farm Lease or Rental — Crop Share agreements typically include terms regarding the duration of the lease, payment schedules, allocation of expenses, conservation practices, and any additional provisions or restrictions. In summary, Pennsylvania Farm Lease or Rental — Crop Share is a mutually beneficial arrangement where landowners and farmers can effectively collaborate to manage agricultural land while sharing risks and rewards. With various types of crop share agreements available, both parties can tailor the lease to suit their specific needs and goals.

Pennsylvania Farm Lease or Rental - Crop Share

Description

How to fill out Pennsylvania Farm Lease Or Rental - Crop Share?

US Legal Forms - one of many biggest libraries of legal kinds in the USA - delivers a wide range of legal file themes you may obtain or printing. Making use of the website, you can find a large number of kinds for enterprise and personal uses, sorted by categories, claims, or keywords and phrases.You can get the most up-to-date types of kinds such as the Pennsylvania Farm Lease or Rental - Crop Share within minutes.

If you currently have a registration, log in and obtain Pennsylvania Farm Lease or Rental - Crop Share from your US Legal Forms local library. The Down load button can look on each and every develop you view. You get access to all formerly saved kinds from the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, here are basic instructions to help you began:

- Make sure you have picked the proper develop for your personal area/area. Go through the Review button to analyze the form`s information. See the develop information to actually have selected the correct develop.

- In case the develop does not suit your needs, use the Look for field near the top of the monitor to discover the the one that does.

- If you are satisfied with the form, confirm your decision by visiting the Acquire now button. Then, pick the costs program you favor and provide your references to sign up on an accounts.

- Process the transaction. Use your charge card or PayPal accounts to accomplish the transaction.

- Choose the formatting and obtain the form on your own gadget.

- Make modifications. Fill out, revise and printing and sign the saved Pennsylvania Farm Lease or Rental - Crop Share.

Each template you included in your bank account lacks an expiry date and is also your own property eternally. So, if you want to obtain or printing one more version, just go to the My Forms area and then click about the develop you want.

Gain access to the Pennsylvania Farm Lease or Rental - Crop Share with US Legal Forms, the most substantial local library of legal file themes. Use a large number of professional and state-particular themes that meet your organization or personal demands and needs.

Form popularity

FAQ

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

The advantages of the first are that the tenant in many cases is free to manage the farm as he pleases, and as a long-time proposition he may pay less rent than under crop-sharing arrangements. The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be.

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

Farms in Pennsylvania The average price of farms for sale in Pennsylvania is $878,312.

Pennsylvania's average cash rental rate is $94 per acre, while New York state's average cash rental rate is $69 per acre.

In Pennsylvania, the average rent for farmland is $80.50 an acre, up a dollar from last year, and up $8 per acre from 2012.

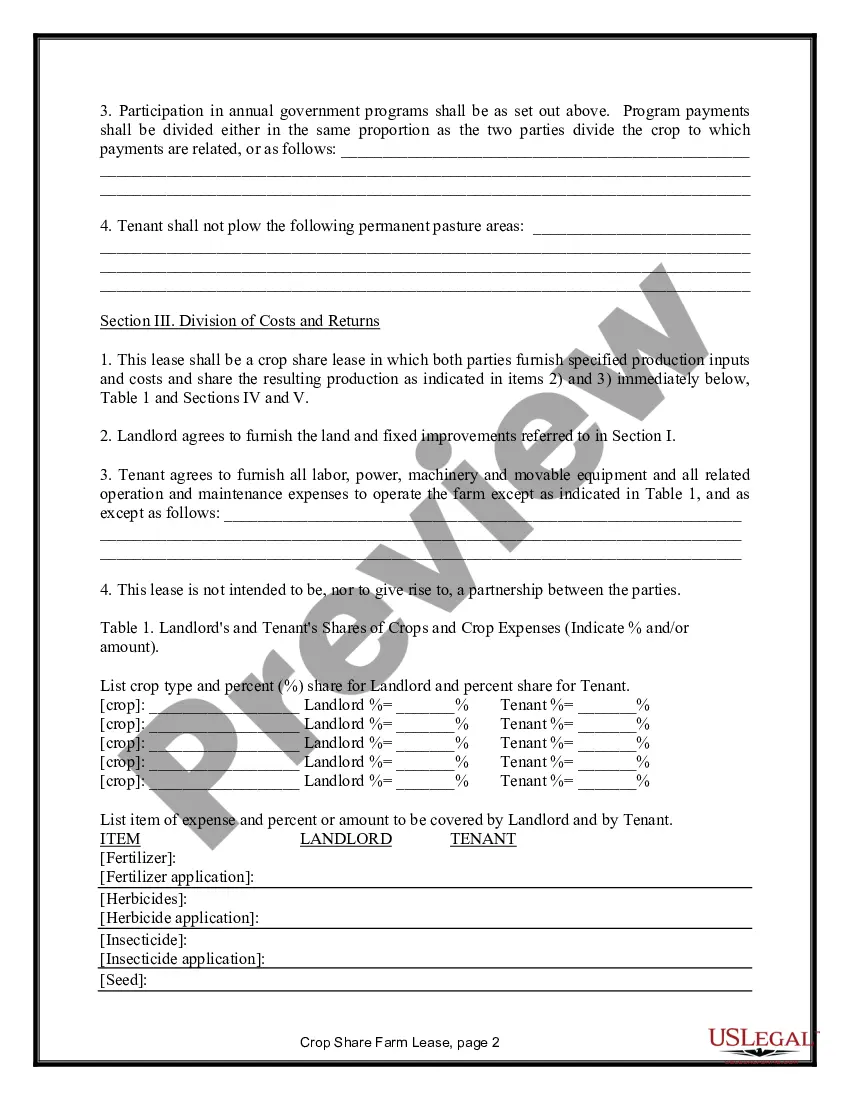

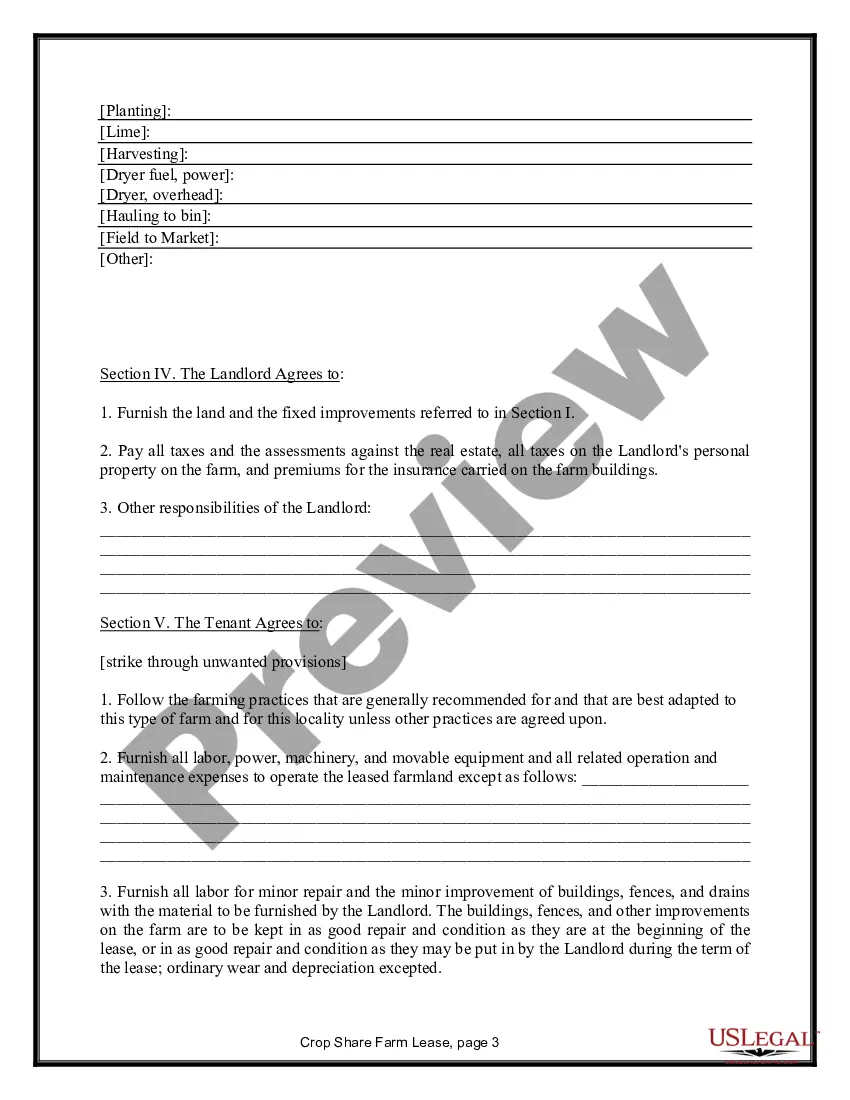

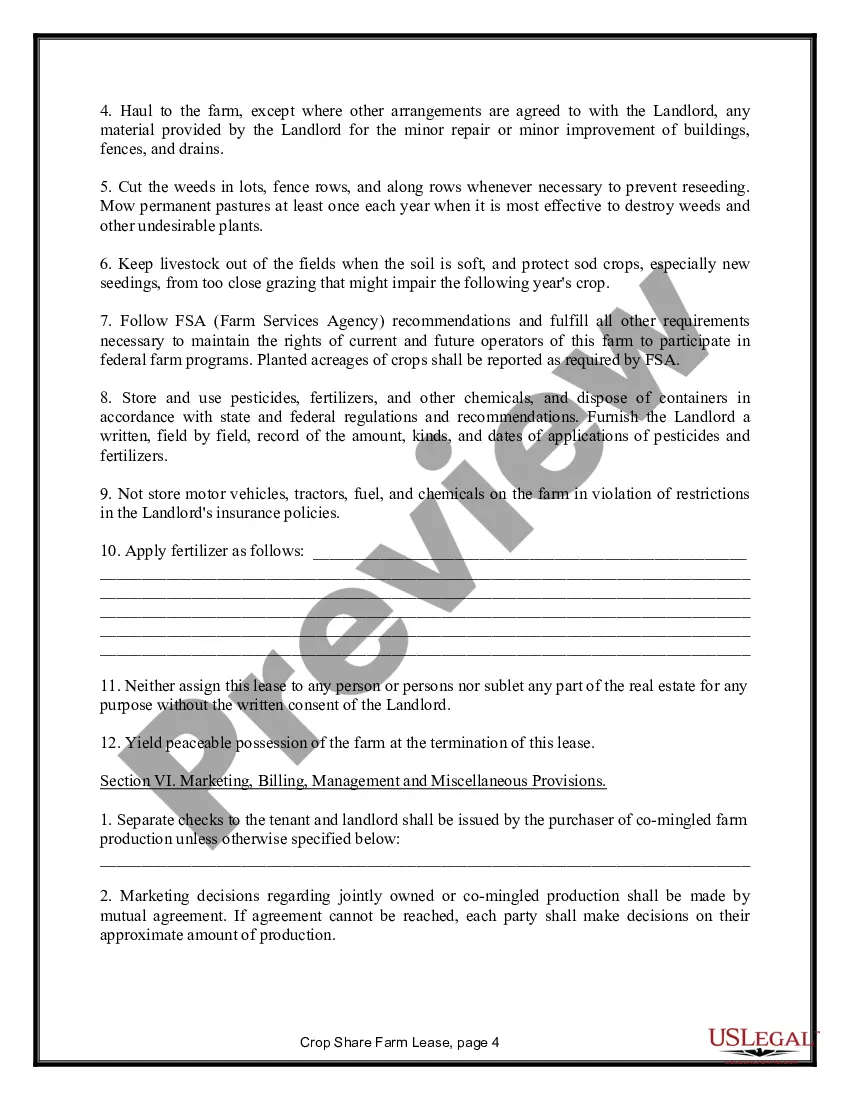

With a crop-share lease, the landlord receives a share of the crops produced in exchange for the use of the land by the tenant. The amount of the share typically depends on local custom. The landlord usually agrees to pay a portion of the input costs under a crop-share lease.