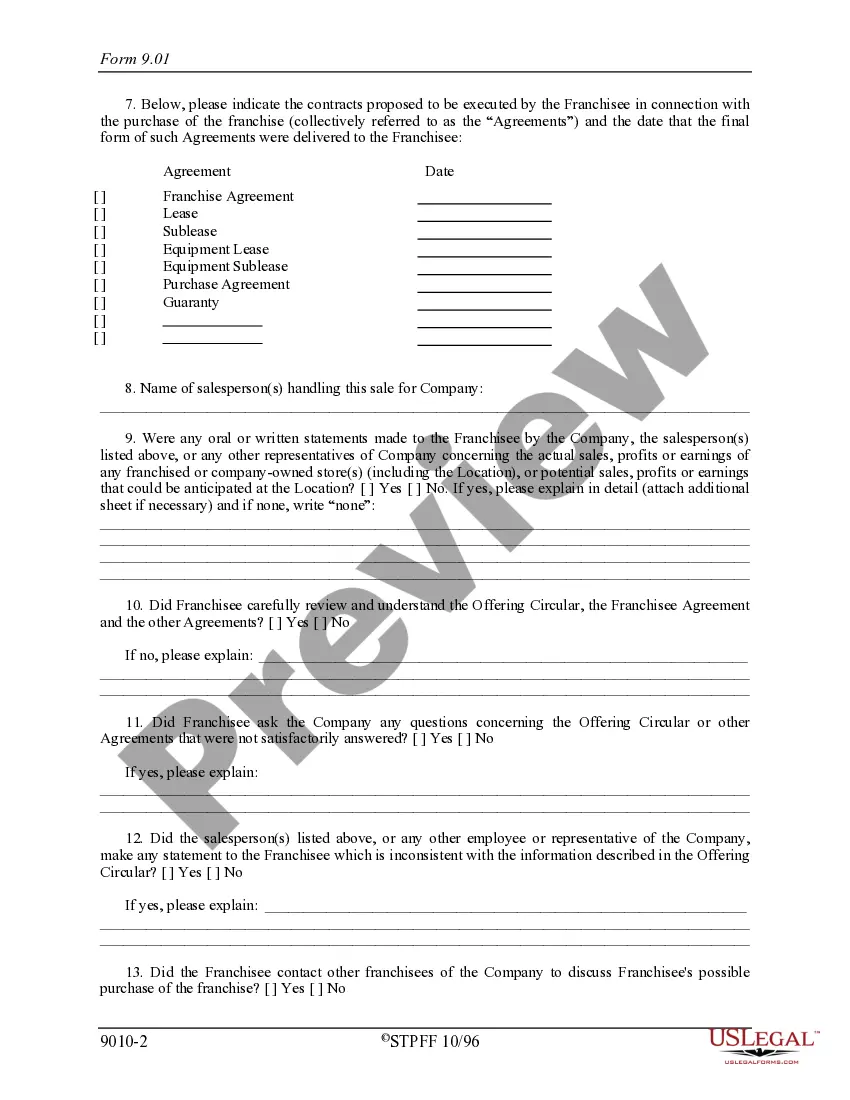

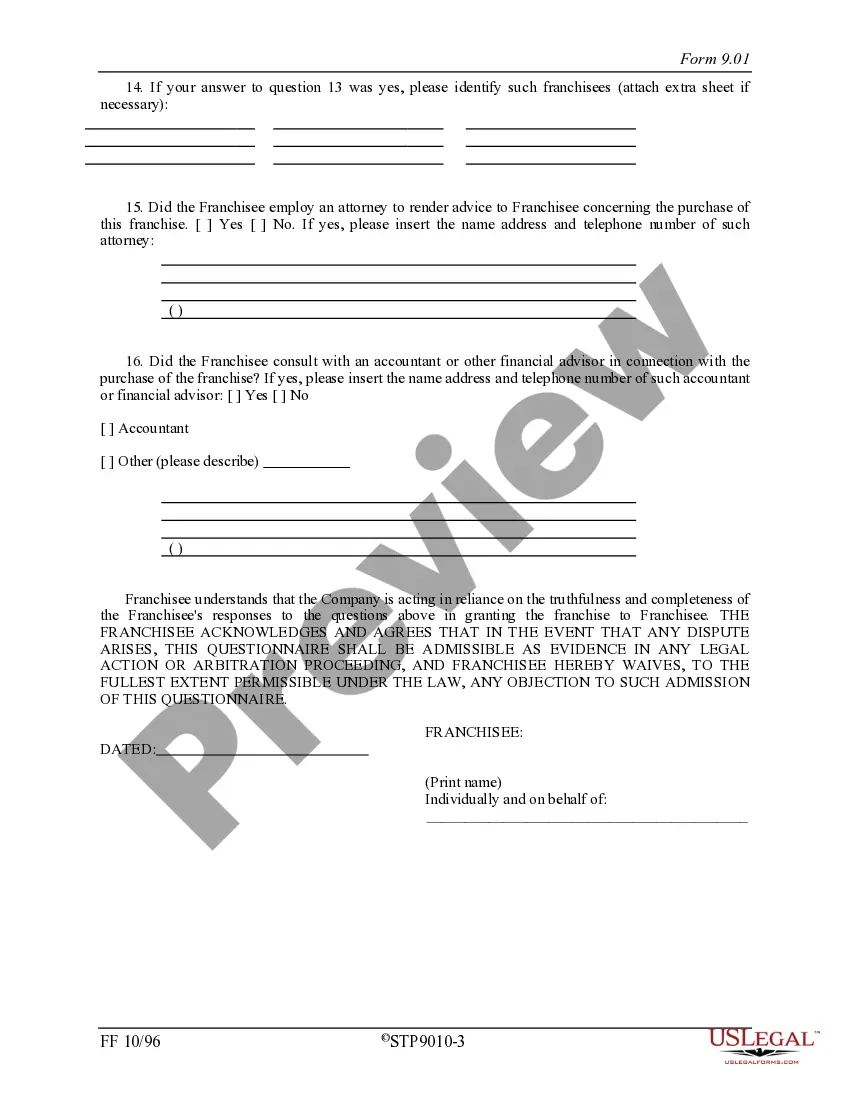

The Pennsylvania Franchisee Closing Questionnaire is a comprehensive document utilized in the state of Pennsylvania when a franchisee is closing down their business operations. This questionnaire serves as a tool to gather essential information and insights from the franchisee, ensuring that all legal, financial, and administrative matters are properly addressed during the closure process. By using the relevant keywords, here is a detailed description of the Pennsylvania Franchisee Closing Questionnaire: 1. Purpose: The Pennsylvania Franchisee Closing Questionnaire aims to collect important data and facilitate a smooth closure process for franchisees in Pennsylvania. This questionnaire is designed to help franchisees document their reasons for closure, provide necessary operational details, and ensure all requirements and obligations are met. 2. Franchisee Information: The questionnaire begins with sections dedicated to gathering specific information about the franchisee. This includes their business name, contact details, franchise agreement details, and the date on which the franchisee intends to close their business. 3. Reason for Closure: In this section, the questionnaire seeks to understand the reasons behind the franchisee's decision to close their business. This may include factors such as financial difficulties, market conditions, personal reasons, or strategic changes. 4. Compliance and Legal Obligations: The Pennsylvania Franchisee Closing Questionnaire emphasizes compliance with legal obligations. It includes sections where the franchisee is required to detail any pending legal actions, unresolved disputes, potential liabilities, or outstanding obligations related to the franchise agreement, employment contracts, leases, or any other agreements. 5. Inventory and Asset Details: To ensure a comprehensive closure, the questionnaire addresses the franchisee's inventory, equipment, and other assets. The franchisee will be asked to provide a detailed inventory list, including quantity, description, fair market value, and any liens or encumbrances on the assets. 6. Staff and Employment: Franchisees must outline their plans for staffing during the closure process. The questionnaire requests information on employee terminations or transfers, severance arrangements, and adherence to state regulations regarding employee rights and benefits. 7. Financial Matters: This section addresses financial aspects, including outstanding debts, loans, payment schedules, and arrangements with vendors or suppliers. The franchisee is required to disclose any pending financial obligations, outstanding taxes, or potential legal actions. 8. Intellectual Property and Trademarks: If the franchisee has utilized any intellectual property or trademarks during their operation, the questionnaire requests information regarding the transfer or cessation of these rights, ensuring compliance with brand guidelines and legal requirements. Different types/variations of the Pennsylvania Franchisee Closing Questionnaire may exist depending on specific industry sectors or franchise types, such as restaurants, retail stores, service-based franchises, or technology franchises. However, the overall purpose and relevant keywords outlined above apply universally to all variations.

Pennsylvania Franchisee Closing Questionnaire

Description

How to fill out Pennsylvania Franchisee Closing Questionnaire?

Choosing the best legal record template could be a battle. Naturally, there are tons of layouts available on the Internet, but how can you obtain the legal form you will need? Take advantage of the US Legal Forms website. The assistance offers 1000s of layouts, for example the Pennsylvania Franchisee Closing Questionnaire, which can be used for enterprise and private requires. Each of the types are checked by professionals and meet up with federal and state demands.

Should you be already listed, log in in your account and click on the Obtain switch to have the Pennsylvania Franchisee Closing Questionnaire. Make use of your account to look from the legal types you possess bought previously. Check out the My Forms tab of your respective account and have yet another backup from the record you will need.

Should you be a brand new customer of US Legal Forms, listed here are basic instructions for you to follow:

- Very first, ensure you have selected the right form for your personal city/region. You may check out the form while using Review switch and study the form information to guarantee this is basically the best for you.

- If the form is not going to meet up with your needs, make use of the Seach industry to find the proper form.

- When you are certain that the form is acceptable, select the Purchase now switch to have the form.

- Opt for the pricing plan you desire and type in the essential information and facts. Make your account and pay money for the transaction making use of your PayPal account or bank card.

- Opt for the data file format and down load the legal record template in your product.

- Complete, modify and produce and sign the received Pennsylvania Franchisee Closing Questionnaire.

US Legal Forms will be the greatest catalogue of legal types in which you can see various record layouts. Take advantage of the service to down load appropriately-manufactured paperwork that follow state demands.