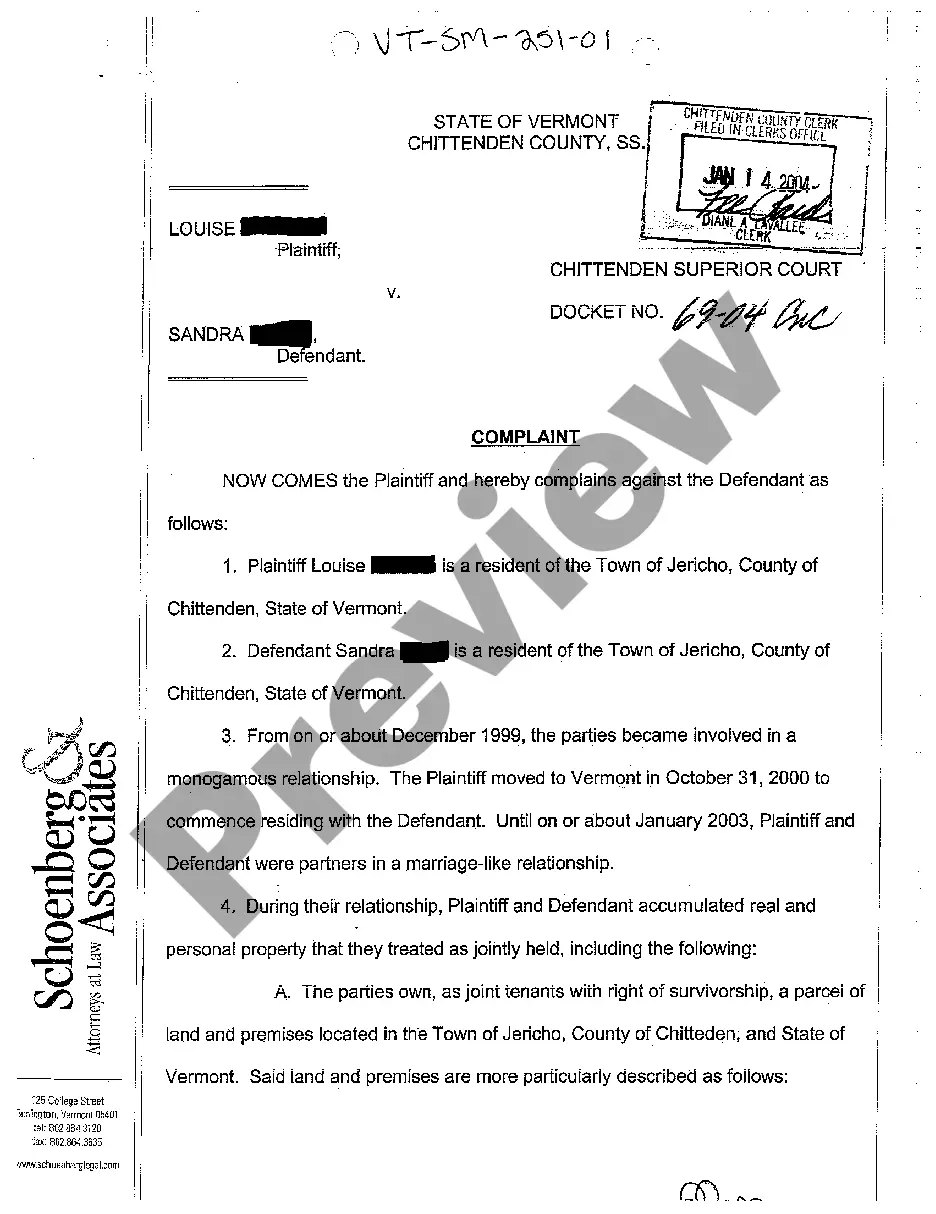

Pennsylvania Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form

Description

How to fill out Order Discharging Debtor Before Completion Of Chapter 12 Plan - Updated 2005 Act Form?

Discovering the right lawful record web template could be a have difficulties. Naturally, there are tons of layouts available online, but how can you obtain the lawful type you want? Use the US Legal Forms web site. The services offers thousands of layouts, for example the Pennsylvania Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form, which can be used for enterprise and private requirements. Each of the forms are examined by professionals and meet federal and state needs.

Should you be previously signed up, log in for your account and click on the Acquire switch to find the Pennsylvania Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form. Use your account to appear through the lawful forms you have ordered formerly. Go to the My Forms tab of your account and obtain one more backup of the record you want.

Should you be a brand new user of US Legal Forms, allow me to share simple instructions for you to adhere to:

- Initial, make sure you have chosen the appropriate type for the area/state. You may check out the shape while using Preview switch and browse the shape information to ensure it is the right one for you.

- In case the type does not meet your requirements, make use of the Seach discipline to get the appropriate type.

- When you are sure that the shape is suitable, click on the Get now switch to find the type.

- Select the prices plan you would like and enter the essential information. Design your account and pay for an order using your PayPal account or Visa or Mastercard.

- Choose the submit structure and obtain the lawful record web template for your device.

- Complete, edit and produce and sign the received Pennsylvania Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form.

US Legal Forms will be the greatest collection of lawful forms that you can see various record layouts. Use the company to obtain professionally-created papers that adhere to state needs.

Form popularity

FAQ

Except as otherwise provided in subdivision (d), a complaint to determine the dischargeability of a debt under §523(c) shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a).

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

II. Section 523(a)(2)(A) of the Bankruptcy Code provides an exception from the discharge of any debt for money, property or services, to the extent such debt was obtained by false pretenses, a false representation, or actual fraud. 11 U.S.C.

Deadline for objecting to discharge is September 8, 2023. Deadline for filing claims was . Chapter 11 Status Conference is continued to October 18, 2023 at am.

Creditors are also warned that they will be held in contempt of the court if they attempt to collect on the discharged debts.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

A trustee's or creditor's objection to the debtor being released from personal liability for certain dischargeable debts. Common reasons include allegations that the debt to be discharged was incurred by false pretenses or that debt arose because of the debtor's fraud while acting as a fiduciary.