A Pennsylvania Certificate of Retention of Debtor in Possession — B 207 is a legal document issued by the bankruptcy court in Pennsylvania. It is designed to allow a debtor to retain possession of their property during bankruptcy proceedings. This certificate serves as a notice to creditors that the debtor is authorized to continue operating their business or managing their property while under bankruptcy protection. Keywords: Pennsylvania, Certificate of Retention, Debtor in Possession, B 207, bankruptcy court, legal document, property, bankruptcy proceedings, notice to creditors, authorized, business, bankruptcy protection. Different types or variations of the Pennsylvania Certificate of Retention of Debtor in Possession — B 207 may include: 1. General Retention Certificate: This type of certificate is issued to debtors who wish to retain possession of their assets, such as real estate, vehicles, or personal belongings, while the bankruptcy case is ongoing. 2. Business Operation Certificate: Debtors who own and operate a business can obtain this certificate to continue running their company during the bankruptcy process. It allows them to maintain control over business operations, manage finances, pay employees, and fulfill ongoing obligations. 3. Property Management Certificate: In cases where the debtor owns rental properties or other income-generating assets, a Property Management Certificate may be required. This certificate permits the debtor to continue managing and collecting rents, maintaining the properties, and meeting their financial obligations related to property ownership. 4. Professional Practice Certificate: Professionals, such as doctors or lawyers, who operate their practices as sole proprietors may need a Professional Practice Certificate. This certificate allows them to continue serving clients, conducting business activities, and receiving income from their practice. 5. Farm or Agricultural Operations Certificate: For debtors engaged in farming or agricultural activities, a specialized certificate may be required. This certificate enables them to continue operating their farm, managing livestock, crops, and other farm-related operations while under bankruptcy protection. It is important to consult with a bankruptcy attorney to determine the specific type of certificate required in a Pennsylvania bankruptcy case, as the exact documentation and requirements may vary.

Pennsylvania Statement of Your Financial Affairs (non-individuals)

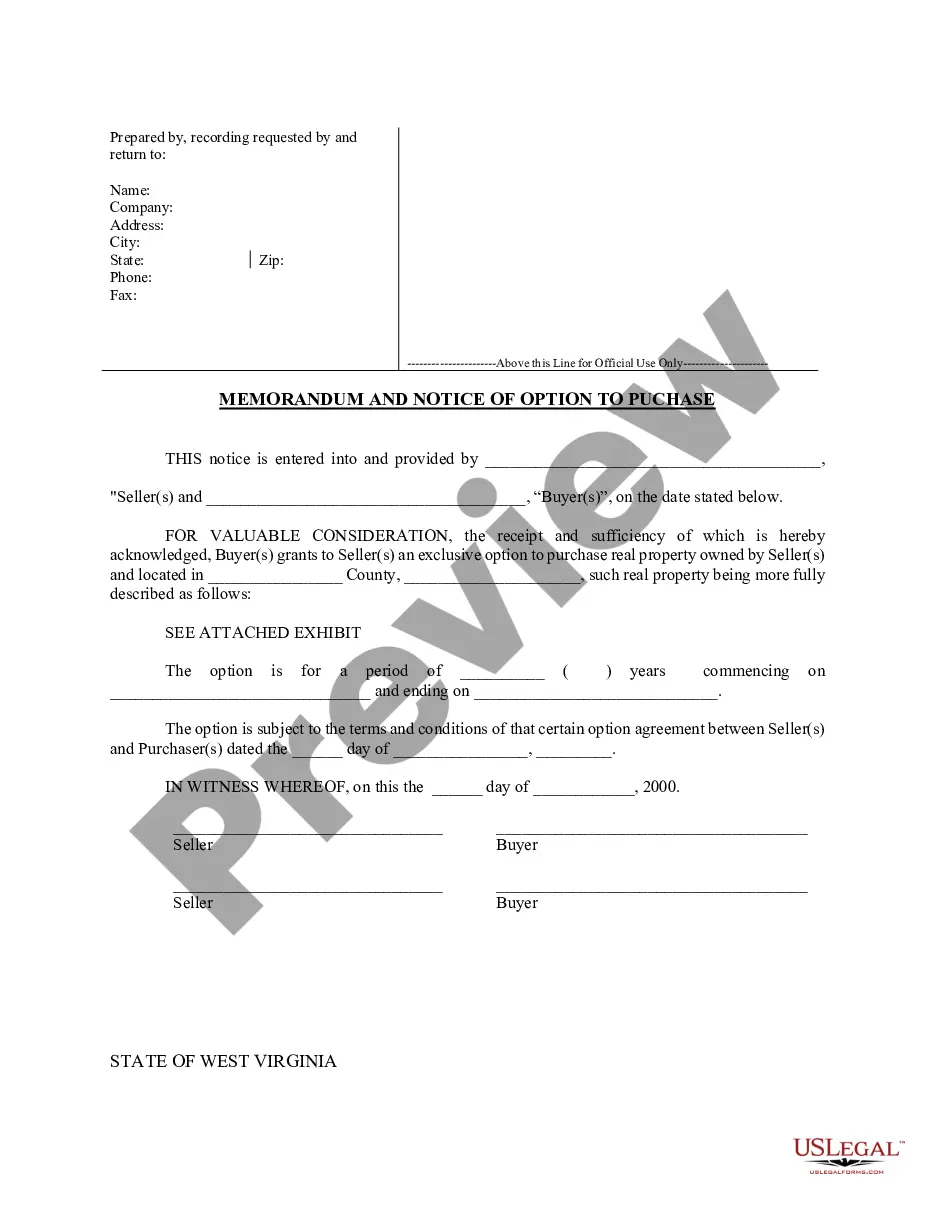

Description

How to fill out Pennsylvania Statement Of Your Financial Affairs (non-individuals)?

Are you currently within a situation that you will need documents for possibly enterprise or specific uses virtually every working day? There are plenty of legitimate file templates accessible on the Internet, but discovering kinds you can trust is not easy. US Legal Forms delivers a huge number of form templates, much like the Pennsylvania Certificate of Retention of Debtor in Possession - B 207, that happen to be written in order to meet federal and state demands.

If you are presently acquainted with US Legal Forms web site and have your account, basically log in. Following that, you may acquire the Pennsylvania Certificate of Retention of Debtor in Possession - B 207 web template.

Unless you provide an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Find the form you need and ensure it is to the correct city/area.

- Make use of the Preview switch to review the shape.

- See the outline to actually have chosen the correct form.

- If the form is not what you`re searching for, take advantage of the Research industry to find the form that suits you and demands.

- Whenever you discover the correct form, just click Get now.

- Choose the pricing plan you need, fill in the specified information to create your bank account, and purchase the order using your PayPal or bank card.

- Decide on a hassle-free file format and acquire your copy.

Get each of the file templates you possess purchased in the My Forms menu. You can get a extra copy of Pennsylvania Certificate of Retention of Debtor in Possession - B 207 whenever, if required. Just select the needed form to acquire or print the file web template.

Use US Legal Forms, probably the most comprehensive assortment of legitimate varieties, in order to save efforts and avoid blunders. The support delivers professionally produced legitimate file templates that you can use for a variety of uses. Generate your account on US Legal Forms and begin making your way of life a little easier.