Pennsylvania Summons to Debtor in Involuntary Case - B 250E

Description

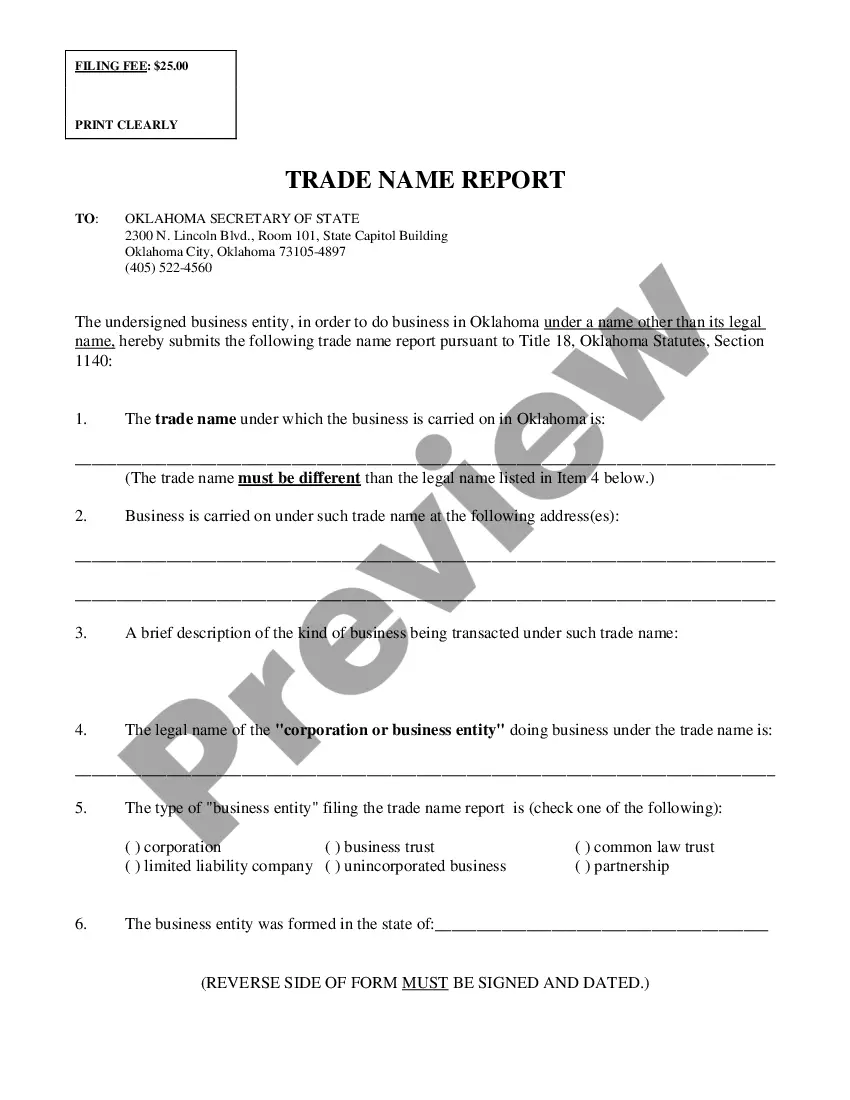

How to fill out Summons To Debtor In Involuntary Case - B 250E?

Have you been in the position that you require files for possibly enterprise or specific uses just about every day time? There are tons of authorized file templates available online, but locating ones you can depend on is not straightforward. US Legal Forms provides 1000s of develop templates, like the Pennsylvania Summons to Debtor in Involuntary Case - B 250E, which are composed to meet federal and state requirements.

Should you be previously informed about US Legal Forms web site and possess an account, basically log in. After that, it is possible to download the Pennsylvania Summons to Debtor in Involuntary Case - B 250E format.

Should you not come with an bank account and need to begin using US Legal Forms, follow these steps:

- Find the develop you need and make sure it is for that proper town/area.

- Use the Review button to check the shape.

- Browse the explanation to actually have selected the right develop.

- In case the develop is not what you`re searching for, make use of the Research field to obtain the develop that meets your needs and requirements.

- Whenever you find the proper develop, click on Get now.

- Select the rates program you desire, submit the necessary info to produce your account, and pay money for an order with your PayPal or Visa or Mastercard.

- Select a practical file structure and download your copy.

Get all of the file templates you possess bought in the My Forms food list. You can get a extra copy of Pennsylvania Summons to Debtor in Involuntary Case - B 250E at any time, if necessary. Just select the necessary develop to download or produce the file format.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to conserve efforts and stay away from mistakes. The assistance provides expertly created authorized file templates which you can use for a variety of uses. Generate an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

A petitioning creditor is qualified to file an involuntary petition if they hold a claim against the debtor that is not contingent as to liability or the subject of a bona fide dispute regarding the liability or its amount, ing to the Bankruptcy Code.

An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

A petition may be a voluntary petition, which is filed by the debtor, or it may be an involuntary petition, which is filed by creditors that meet certain requirements. 11 U.S.C. §§ 301, 303.

Bona fide dispute means a dispute of a specific amount of money actually billed by a Party. The dispute must be clearly explained by the disputing Party and supported by written documentation from the disputing Party, which clearly shows the basis for its dispute of the charges.

An order for relief will be entered if the debtor does not contest the involuntary petition or, if the debtor contests the involuntary petition, an order for relief will be entered if (1) the court determines that the debtor is not paying its undisputed debts as they come due, or (2) a custodian (other than a trustee, ...