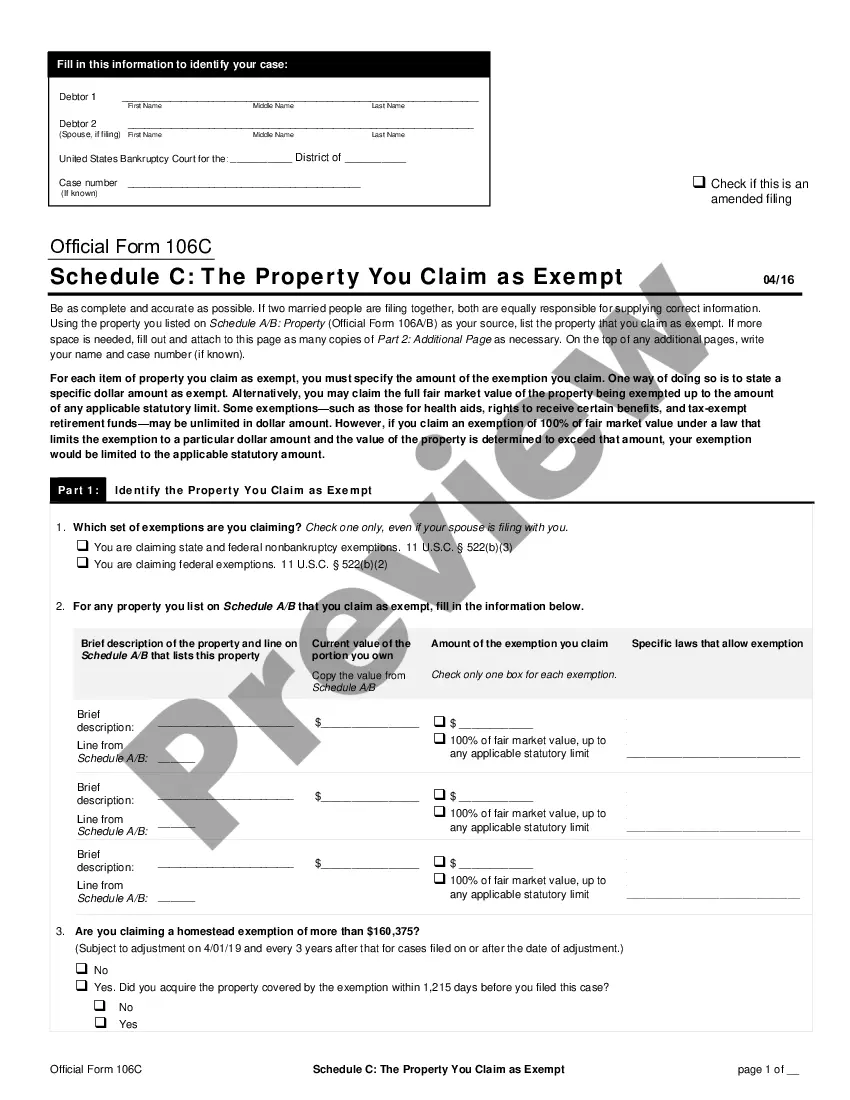

Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

If you wish to comprehensive, down load, or produce legitimate file templates, use US Legal Forms, the largest assortment of legitimate forms, that can be found online. Use the site`s easy and convenient lookup to get the documents you want. A variety of templates for company and person purposes are sorted by categories and says, or keywords. Use US Legal Forms to get the Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 within a couple of mouse clicks.

When you are currently a US Legal Forms client, log in for your account and click on the Download button to obtain the Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. You can even access forms you in the past acquired in the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for the appropriate metropolis/region.

- Step 2. Utilize the Review solution to check out the form`s information. Do not overlook to read the description.

- Step 3. When you are not happy using the form, utilize the Search industry towards the top of the screen to discover other variations of your legitimate form design.

- Step 4. Upon having identified the form you want, go through the Acquire now button. Pick the rates plan you favor and add your qualifications to register for the account.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Pick the structure of your legitimate form and down load it on the system.

- Step 7. Full, revise and produce or sign the Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every single legitimate file design you get is your own permanently. You may have acces to every form you acquired inside your acccount. Go through the My Forms segment and select a form to produce or down load once again.

Contend and down load, and produce the Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms. There are many expert and condition-distinct forms you may use for your company or person needs.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.