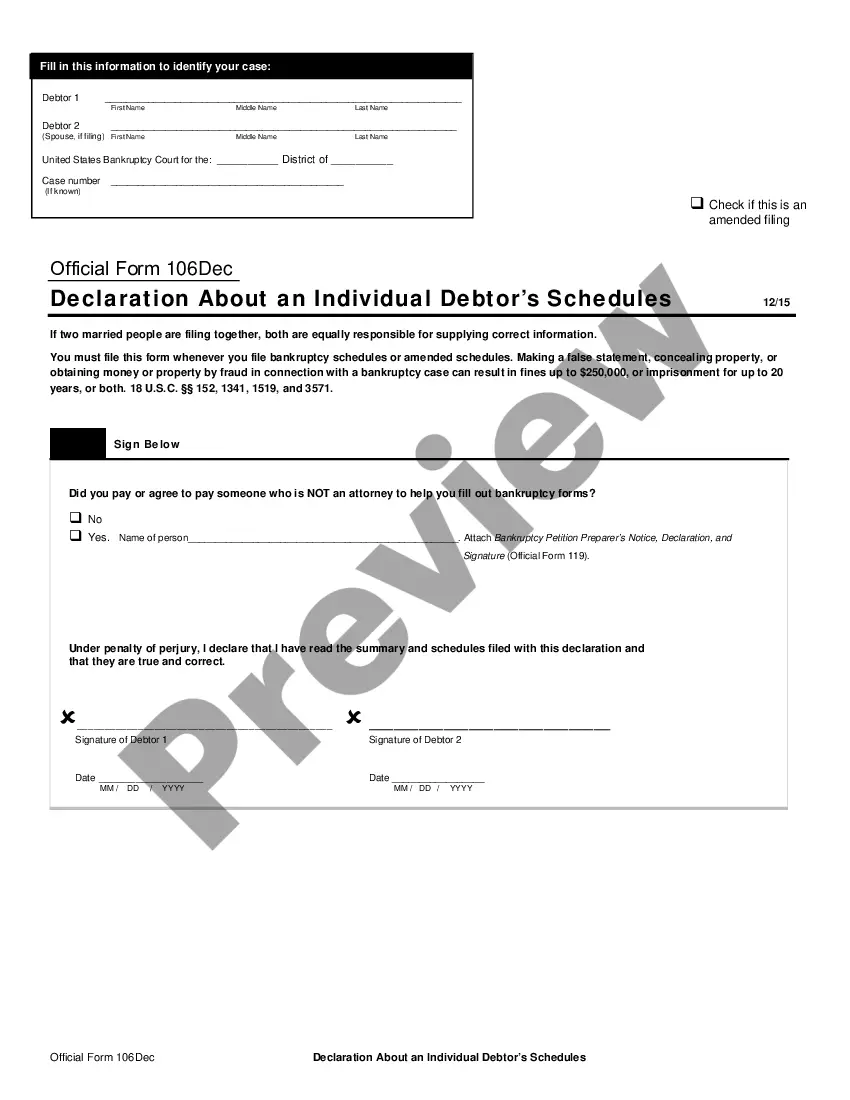

Pennsylvania Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005

Description

How to fill out Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005?

US Legal Forms - among the biggest libraries of legal forms in America - delivers an array of legal papers web templates you can download or print out. Making use of the website, you can find a huge number of forms for enterprise and specific uses, sorted by classes, claims, or key phrases.You can get the most up-to-date variations of forms like the Pennsylvania Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005 in seconds.

If you already possess a registration, log in and download Pennsylvania Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005 in the US Legal Forms local library. The Obtain option will appear on each and every form you look at. You gain access to all formerly saved forms from the My Forms tab of your respective profile.

In order to use US Legal Forms the very first time, listed here are easy guidelines to obtain began:

- Be sure you have picked the correct form to your area/region. Click on the Preview option to examine the form`s content material. See the form description to ensure that you have selected the correct form.

- If the form doesn`t fit your requirements, utilize the Lookup field at the top of the display screen to obtain the the one that does.

- If you are content with the shape, verify your option by clicking the Buy now option. Then, choose the prices program you favor and give your accreditations to register on an profile.

- Method the deal. Make use of your bank card or PayPal profile to finish the deal.

- Choose the structure and download the shape in your system.

- Make alterations. Fill up, modify and print out and sign the saved Pennsylvania Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005.

Every web template you added to your account does not have an expiration time and it is your own forever. So, if you want to download or print out one more version, just proceed to the My Forms portion and then click on the form you need.

Gain access to the Pennsylvania Declaration Concerning Debtors' Schedules - Form 6SIG - Post 2005 with US Legal Forms, the most substantial local library of legal papers web templates. Use a huge number of professional and state-specific web templates that satisfy your business or specific demands and requirements.

Form popularity

FAQ

Key Takeaways. Debtors are individuals or businesses that owe money, whether to banks or other individuals. Debtors are often called borrowers if the money owed is to a bank or financial institution, however, they are called issuers if the debt is in the form of securities.

The 3 Kinds of Debtors (and How to Work With Them) Those who've made a mistake and want to resolve it. Those who dispute the debt or want to avoid paying. Those who have a real problem in repaying the debt.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

A debtor is a person or an entity that owes money to another, which could be any individual or institution (including the government). In most cases, the debtor has to pay interest on debt along with the principal debt.