Pennsylvania Statement of Financial Affairs - Form 7

Description

How to fill out Statement Of Financial Affairs - Form 7?

Have you been within a position that you will need documents for sometimes business or individual functions almost every time? There are plenty of legitimate record web templates available on the Internet, but discovering ones you can rely on isn`t effortless. US Legal Forms provides thousands of develop web templates, much like the Pennsylvania Statement of Financial Affairs - Form 7, which can be published to satisfy federal and state demands.

Should you be currently familiar with US Legal Forms website and also have a free account, basically log in. Following that, you may down load the Pennsylvania Statement of Financial Affairs - Form 7 template.

If you do not come with an account and need to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for that proper area/region.

- Use the Preview option to review the form.

- Look at the outline to ensure that you have chosen the correct develop.

- When the develop isn`t what you`re looking for, make use of the Look for industry to find the develop that meets your needs and demands.

- Whenever you get the proper develop, just click Acquire now.

- Choose the costs strategy you want, complete the desired info to produce your money, and purchase the transaction making use of your PayPal or credit card.

- Decide on a practical file structure and down load your copy.

Locate each of the record web templates you might have bought in the My Forms food selection. You can aquire a additional copy of Pennsylvania Statement of Financial Affairs - Form 7 any time, if needed. Just click the necessary develop to down load or print out the record template.

Use US Legal Forms, probably the most substantial collection of legitimate forms, to save efforts and prevent errors. The services provides skillfully made legitimate record web templates which you can use for a selection of functions. Generate a free account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Unsecured creditors. Where should a company undergoing reorganization report the gains and losses resulting from the reorganization? On the income statement, separate from other gains and losses.

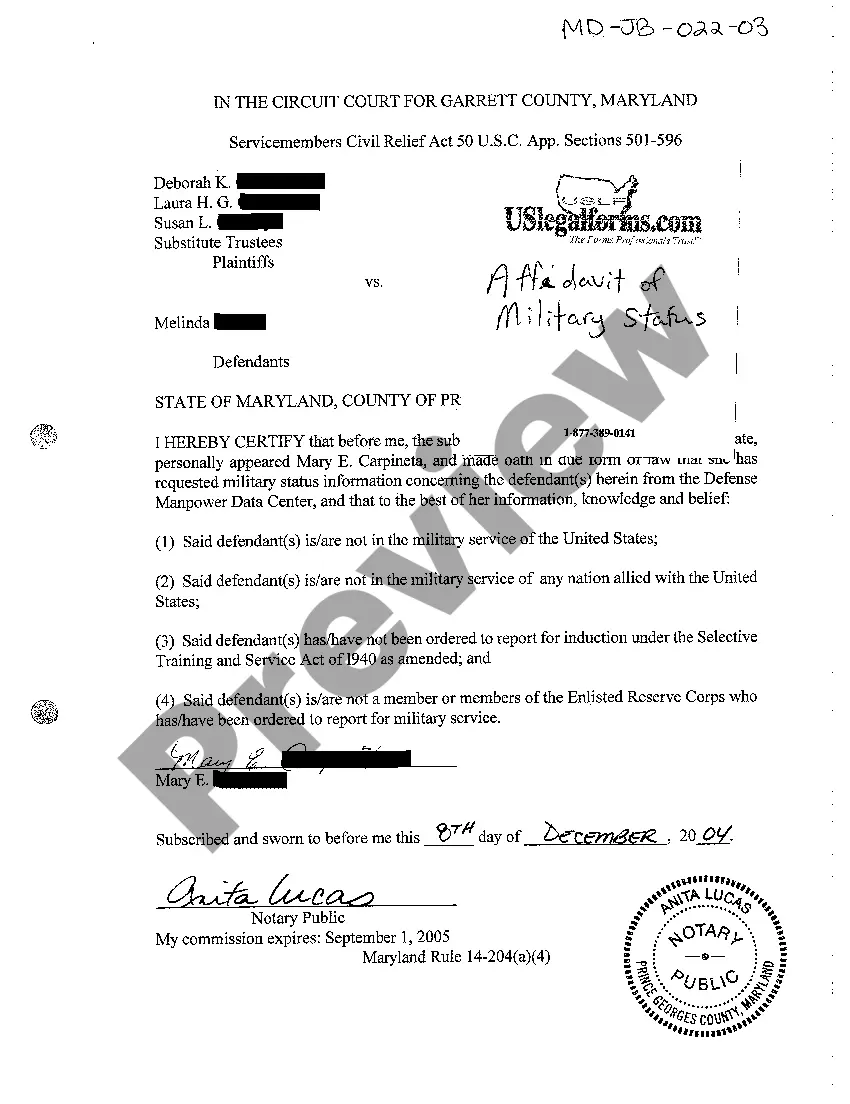

Statement of Financial Affairs (?SOFA?) The SOFA is a bankruptcy form that focuses on the financial situation that caused the debtor to become insolvent. The court, trustee, creditors and debtor's advisors will use the SOFA to look more closely at the debtor's business and financial situation.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

Statement of Financial Affairs (?SOFA?) The SOFA is a bankruptcy form that focuses on the financial situation that caused the debtor to become insolvent. The court, trustee, creditors and debtor's advisors will use the SOFA to look more closely at the debtor's business and financial situation.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

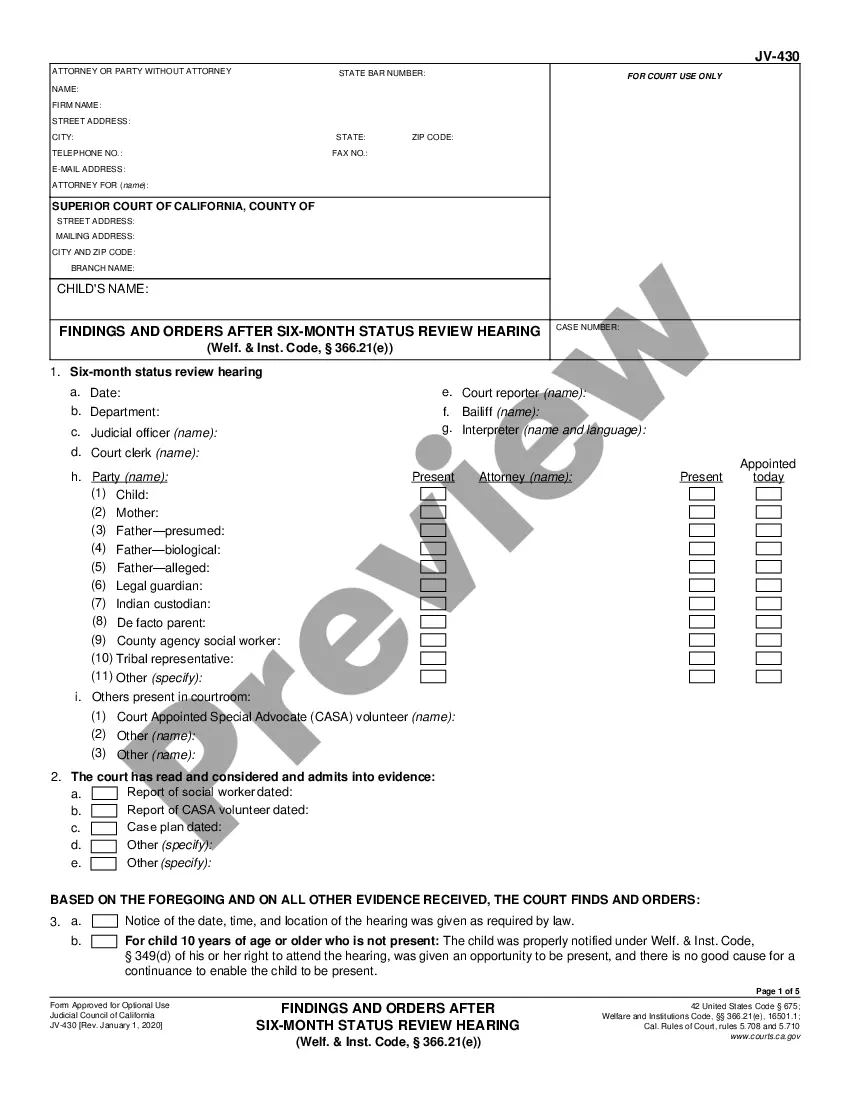

Form 7, the Statement of Financial Affairs, contains a series of questions which direct the debtor to answer by furnishing information. If the answer to a question is "None," or the question is not applicable, an affirmative statement to that effect is required.