Pennsylvania Amendments to Certificate of Incorporation refer to alterations or changes made to a company's official legal document that establishes its existence as a corporation in the state of Pennsylvania. These amendments are essential for modifying various provisions outlined in the original certificate of incorporation. The process of amending the certificate of incorporation ensures that a company remains compliant with the evolving legal requirements and reflects any updates in its structure or operations. Keywords: Pennsylvania, amendments, certificate of incorporation, changes, alterations, company, legal document, corporation, state, compliant, structure, operations. There are several types of Pennsylvania Amendments to Certificate of Incorporation, including: 1. Name Change Amendment: This amendment allows a company to modify its legal name as registered with the state of Pennsylvania. The amendment typically necessitates providing a new proposed name that follows the state's naming guidelines and avoids any conflicts with existing businesses. 2. Purpose Amendment: Companies may need to amend their certificate of incorporation to change or expand their stated purpose. This amendment allows them to add or remove specific business functions, products, or services they are authorized to engage in. 3. Registered Office or Agent Amendment: This type of amendment is required when a company needs to change its registered office address or the designated registered agent responsible for accepting legal documents on behalf of the corporation. The amendment ensures that the company's address and representative information remain accurate and up to date. 4. Capital Stock Amendment: A capital stock amendment is necessary when a company wants to modify the details related to its stock structure. This can include changing the number of authorized shares, par value, stock classes, or other related provisions. 5. Director or Officer Amendment: Companies may need to amend their certificate of incorporation when adding or removing directors or officers. This amendment allows them to update the names, positions, responsibilities, and other pertinent details of individuals holding key leadership roles within the corporation. 6. Miscellaneous Amendments: This category encompasses any other changes that do not fall under the aforementioned types. It may include amendments related to voting rights, shareholder provisions, dissolution procedures, or any other specific modifications required to align the certificate of incorporation with the company's evolving needs. Pennsylvania Amendments to Certificate of Incorporation are essential for maintaining legal compliance, reflecting changes in the company's structure and operations, and ensuring accurate representation of the corporation's details in the state records. Properly executed amendments protect the company's interests, enhance transparency, and provide clarity to stakeholders and potential investors.

Pennsylvania Amendments to certificate of incorporation

Description

How to fill out Pennsylvania Amendments To Certificate Of Incorporation?

Have you been inside a situation the place you need to have papers for both business or individual purposes almost every day time? There are plenty of lawful record themes accessible on the Internet, but getting versions you can trust isn`t straightforward. US Legal Forms delivers a large number of kind themes, much like the Pennsylvania Amendments to certificate of incorporation, that are created to satisfy federal and state specifications.

If you are already knowledgeable about US Legal Forms web site and have a free account, simply log in. Following that, you may down load the Pennsylvania Amendments to certificate of incorporation format.

If you do not offer an accounts and would like to start using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is to the correct town/state.

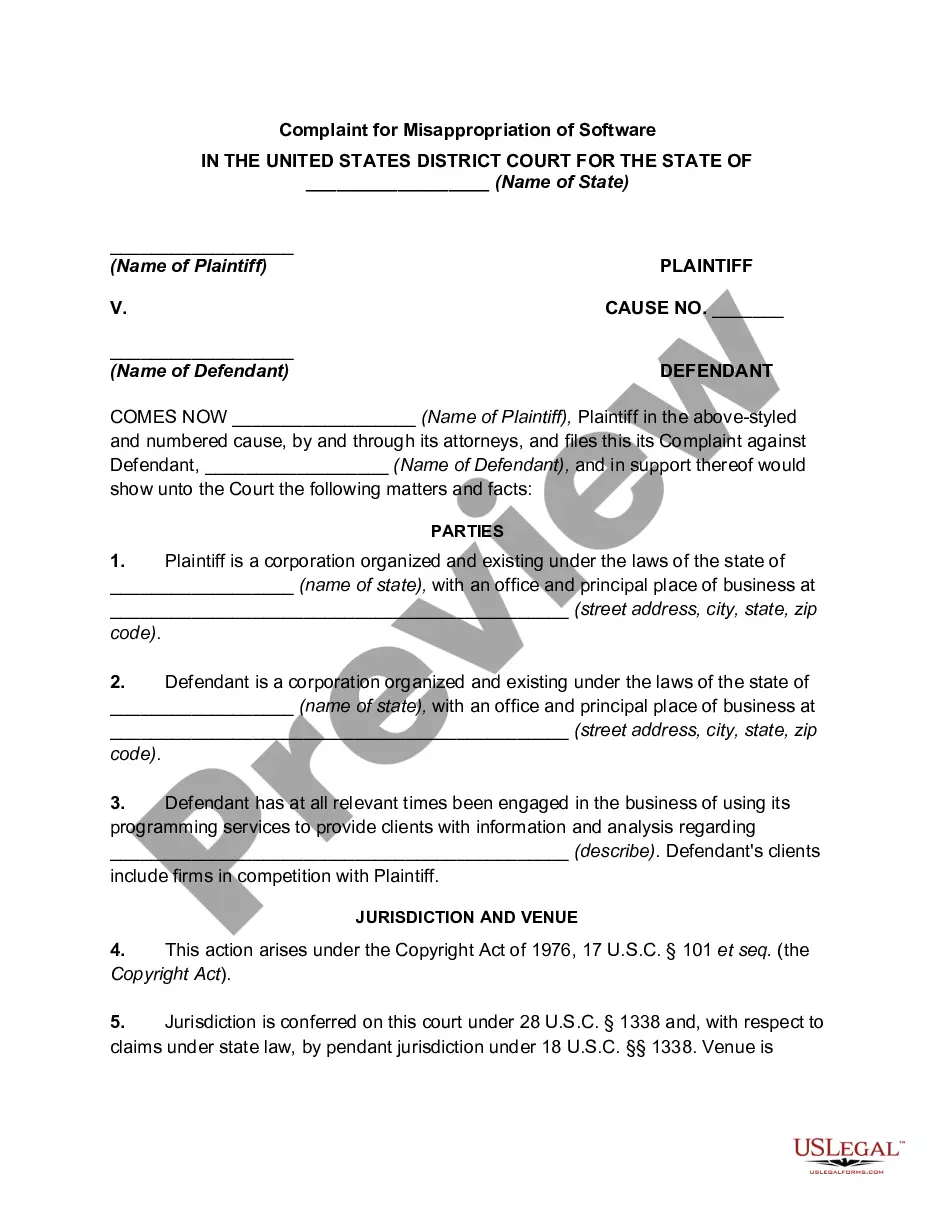

- Utilize the Preview key to review the form.

- See the description to actually have selected the appropriate kind.

- In the event the kind isn`t what you are searching for, use the Search field to discover the kind that meets your needs and specifications.

- If you find the correct kind, click Purchase now.

- Select the costs prepare you want, complete the specified information to make your account, and pay for the order utilizing your PayPal or Visa or Mastercard.

- Pick a handy paper structure and down load your duplicate.

Get all the record themes you may have bought in the My Forms menu. You may get a extra duplicate of Pennsylvania Amendments to certificate of incorporation anytime, if required. Just click the needed kind to down load or print the record format.

Use US Legal Forms, one of the most considerable selection of lawful kinds, to conserve time as well as prevent blunders. The support delivers expertly produced lawful record themes that can be used for an array of purposes. Create a free account on US Legal Forms and commence creating your life easier.