Title: Understanding Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation Keywords: Pennsylvania Sample Stock Purchase Agreement, Purchase of Common Stock, Wholly-Owned Subsidiary, Separate Corporation, Types Introduction: Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation is a legally binding document that outlines the terms and conditions related to the acquisition of common stock of a wholly-owned subsidiary. This agreement is specifically designed for Pennsylvania-based corporations and provides clarity and protection for both the buyer and the seller. In this article, we will delve into the details of this agreement, exploring its purpose, key components, and the potential types that exist. Purpose of the Agreement: The main objective of the Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation is to establish a framework for a transaction in which a separate corporation acquires the common stock of a wholly-owned subsidiary. This agreement ensures that all parties involved are on the same page concerning the terms of the purchase, financial obligations, and any conditions that need to be fulfilled. Key Components of the Agreement: 1. Parties Involved: The agreement identifies the buyer (separate corporation) and the seller (wholly-owned subsidiary), stating their legal names and addresses. 2. Purchase Price and Payment Terms: The agreement outlines the total purchase price for the common stock and the agreed-upon payment terms, such as lump sum or installments, along with the due date(s) for the payments. 3. Representations and Warranties: Both the buyer and the seller provide assurances regarding their authority, ownership, and ability to enter into the transaction, as well as any legal or financial obligations connected to the subsidiary. 4. Closing Conditions: This section specifies the conditions that must be met for the transaction to be considered complete, including regulatory approvals, necessary consents, and the delivery of required documents. 5. Indemnification: The agreement usually includes provisions for indemnification, allocating responsibility for any potential losses, damages, or liabilities arising from the transaction. Types of Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation: While there may not be variations in the Pennsylvania Sample Stock Purchase Agreement specifically for the purchase of common stock of wholly-owned subsidiaries, the agreement can be customized to suit specific circumstances and needs. Thus, the various types can stem from modifications made to the key components mentioned above, adapting the agreement to the unique requirements of the parties involved. Conclusion: The Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation serves as a crucial legal document for entities engaged in acquiring common stock of wholly-owned subsidiaries. By clearly defining the terms and conditions of the purchase, this agreement ensures a smooth transaction process and provides protection for both the buyer and the seller. It is advised to consult with legal professionals well-versed in Pennsylvania corporate law while drafting or reviewing such agreements.

Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation

Description

How to fill out Pennsylvania Sample Stock Purchase Agreement For Purchase Of Common Stock Of Wholly-Owned Subsidiary By Separate Corporation?

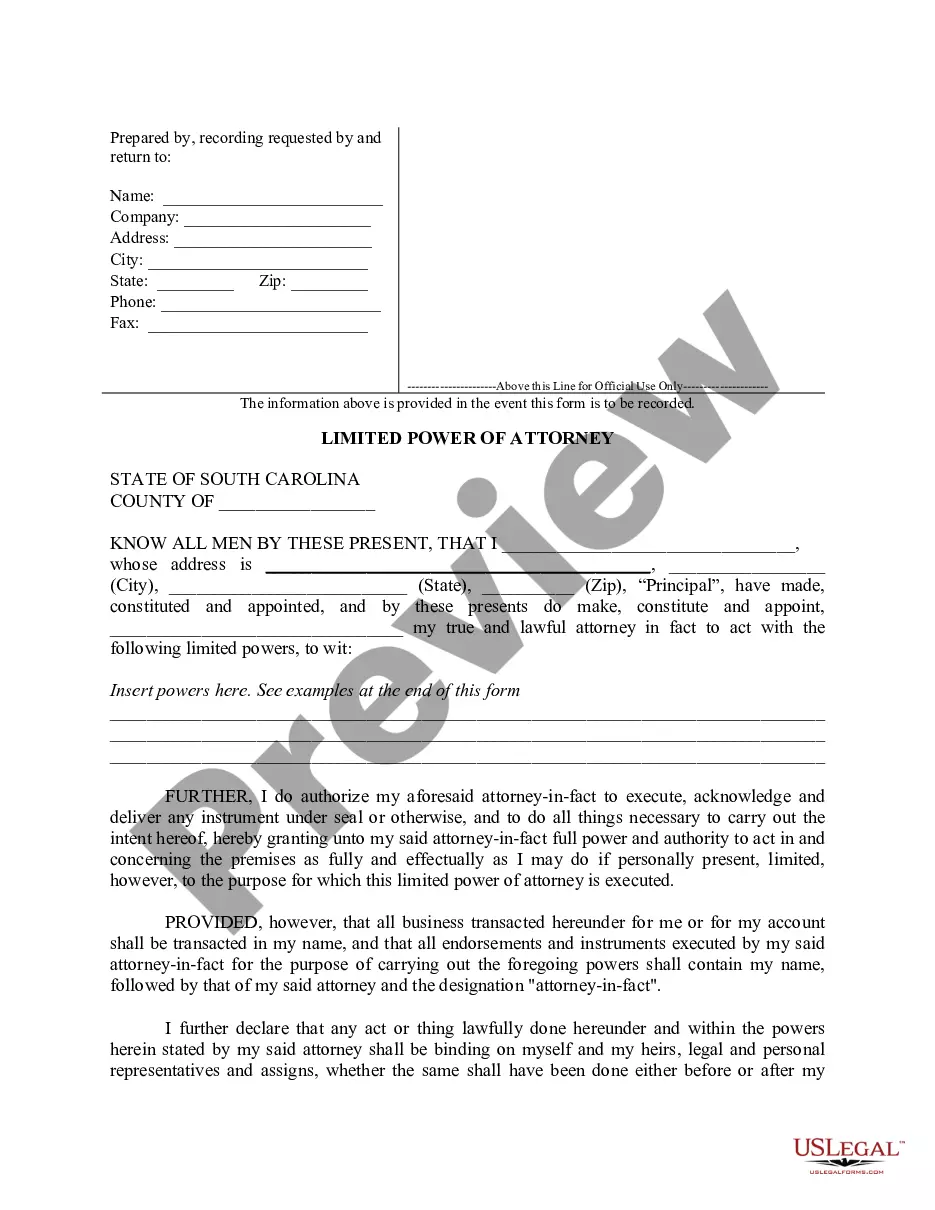

It is possible to devote hours on the Internet searching for the legal papers web template that fits the state and federal demands you need. US Legal Forms provides a huge number of legal forms that are examined by pros. It is simple to obtain or produce the Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation from the support.

If you already have a US Legal Forms accounts, you can log in and click the Down load button. Next, you can comprehensive, revise, produce, or sign the Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation. Each legal papers web template you purchase is your own property forever. To have one more copy of any obtained develop, visit the My Forms tab and click the corresponding button.

If you use the US Legal Forms internet site the first time, stick to the basic directions under:

- Initial, make certain you have selected the right papers web template to the area/metropolis of your choosing. Read the develop outline to make sure you have picked the appropriate develop. If readily available, take advantage of the Preview button to look from the papers web template also.

- If you would like discover one more variation of the develop, take advantage of the Research field to get the web template that meets your requirements and demands.

- Once you have discovered the web template you would like, click on Buy now to carry on.

- Pick the costs strategy you would like, enter your accreditations, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to fund the legal develop.

- Pick the file format of the papers and obtain it in your system.

- Make adjustments in your papers if needed. It is possible to comprehensive, revise and sign and produce Pennsylvania Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation.

Down load and produce a huge number of papers templates while using US Legal Forms web site, which provides the greatest variety of legal forms. Use expert and state-specific templates to handle your company or personal needs.