The Pennsylvania Issuance of Common Stock in Connection with Acquisition refers to the process of a company in Pennsylvania issuing common stock as part of an acquisition deal. This means that the acquiring company uses its own stock as a form of payment to acquire another company. In this type of transaction, the acquiring company offers shares of its common stock to the shareholders of the target company. The shareholders of the target company then become shareholders of the acquiring company, and their ownership interests are determined by the number of shares they receive. This method of payment in an acquisition deal can offer several advantages for both the acquiring company and the target company. It allows the acquiring company to conserve cash and use its stock as a currency to finance the acquisition. Additionally, it can provide the target company's shareholders with the opportunity to participate in the growth and success of the acquiring company. There are different types of Pennsylvania Issuance of Common Stock in Connection with Acquisition that can occur, depending on the specifics of the deal. Some notable types include: 1. Stock-for-stock acquisition: In this type of acquisition, the acquiring company exchanges its common stock for the common stock of the target company. The ratio at which the exchange occurs is determined based on the valuation of the companies involved and the negotiated terms of the deal. 2. Reverse stock split acquisition: This type of acquisition involves the acquiring company consolidating its shares in a reverse stock split before issuing them as part of the acquisition. This means that a certain number of shares in the acquiring company are combined to create a smaller number of higher-valued shares, which are then offered to the target company's shareholders. 3. Asset acquisition with stock consideration: Instead of acquiring the entire company, the acquiring company may choose to acquire only specific assets of the target company. In this scenario, the acquiring company issues common stock as part of the consideration for the acquired assets. This allows the target company's shareholders to have an ownership interest in the remaining assets and operations of the acquiring company. 4. Stock-based merger: In some cases, an acquisition may take the form of a merger between the acquiring company and the target company. In this scenario, both companies' common stock is combined, and the shareholders of both companies become shareholders of the newly merged entity. It is important to consult legal and financial professionals when considering any Pennsylvania Issuance of Common Stock in Connection with Acquisition, as the specifics of each deal can vary greatly and require careful consideration to ensure compliance with relevant laws and regulations.

Pennsylvania Issuance of Common Stock in Connection with Acquisition

Description

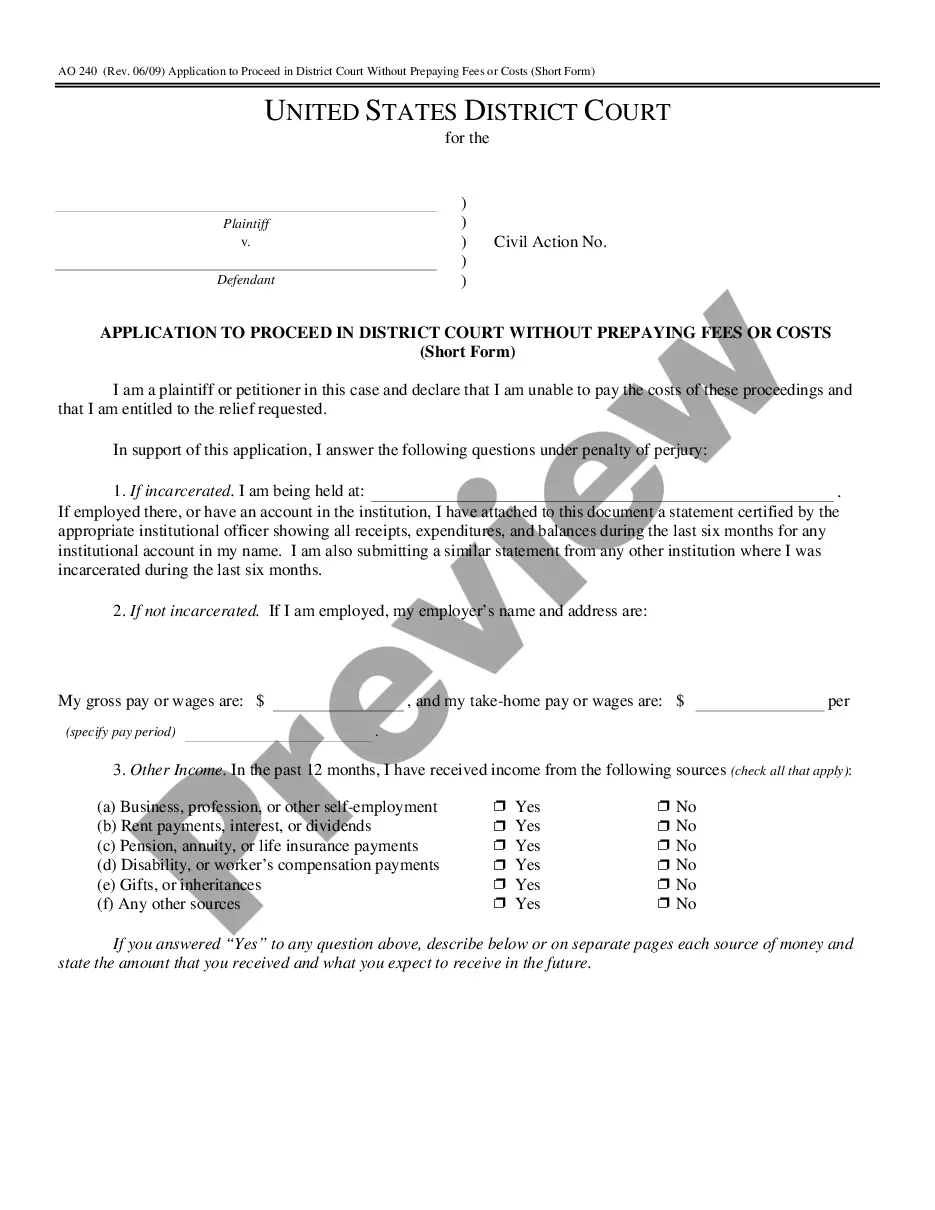

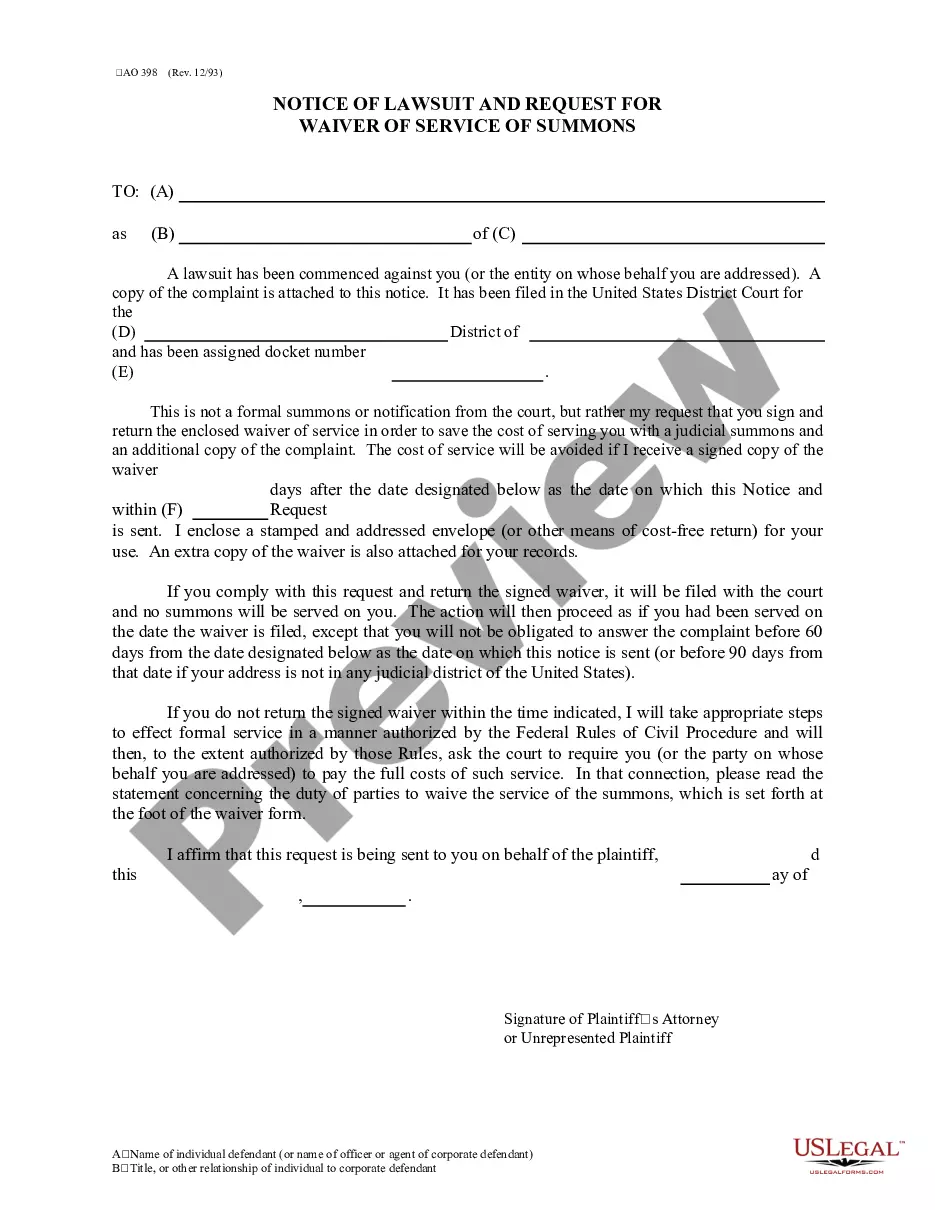

How to fill out Pennsylvania Issuance Of Common Stock In Connection With Acquisition?

Choosing the right authorized document web template can be quite a battle. Of course, there are a lot of layouts available on the net, but how can you discover the authorized form you need? Make use of the US Legal Forms website. The service offers thousands of layouts, including the Pennsylvania Issuance of Common Stock in Connection with Acquisition, which can be used for business and private requires. All the forms are examined by pros and fulfill federal and state demands.

In case you are previously listed, log in for your accounts and then click the Acquire key to find the Pennsylvania Issuance of Common Stock in Connection with Acquisition. Use your accounts to look through the authorized forms you have ordered formerly. Go to the My Forms tab of your accounts and have an additional duplicate of your document you need.

In case you are a fresh customer of US Legal Forms, here are straightforward directions so that you can comply with:

- First, make sure you have selected the correct form for the metropolis/state. You can check out the shape while using Preview key and read the shape outline to guarantee it will be the right one for you.

- If the form will not fulfill your requirements, utilize the Seach discipline to find the correct form.

- When you are positive that the shape is proper, click on the Purchase now key to find the form.

- Select the rates plan you need and enter in the required info. Make your accounts and buy the order using your PayPal accounts or credit card.

- Opt for the data file file format and down load the authorized document web template for your system.

- Comprehensive, change and print out and indicator the received Pennsylvania Issuance of Common Stock in Connection with Acquisition.

US Legal Forms may be the most significant catalogue of authorized forms where you can discover numerous document layouts. Make use of the company to down load appropriately-made documents that comply with condition demands.