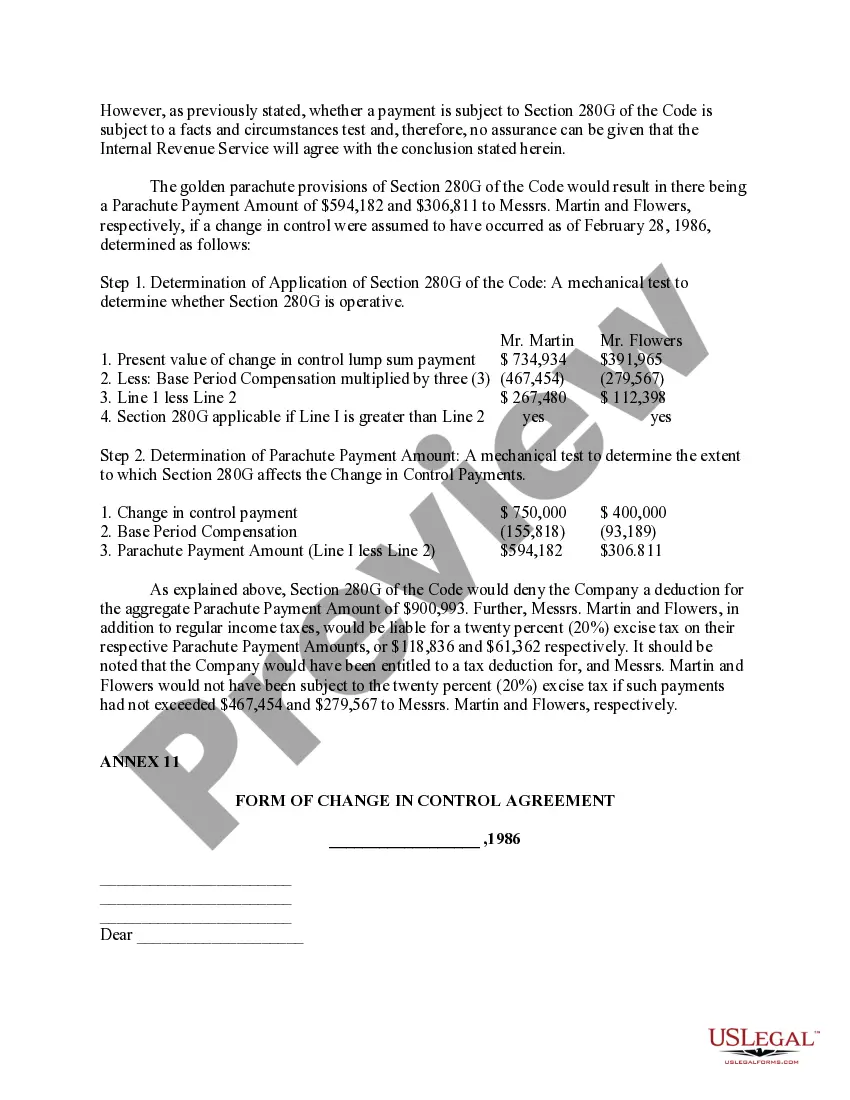

The Pennsylvania Ratification of Change in Control Agreements serves as an essential document for binding agreements between parties involved in a change in control situation. It provides legal protection and clarification on terms and conditions, ensuring a smooth transition of power and ownership within an organization. This detailed description will highlight the significance of this ratification, discuss the various types of agreements, and provide a comprehensive explanation of the contents of a typical change in control agreement form. 1. Importance of Pennsylvania Ratification of Change in Control Agreements: The Pennsylvania Ratification of Change in Control Agreements is a critical legal instrument that safeguards the rights and interests of all parties involved in a significant transfer of power or ownership. It ensures that the process is fair, transparent, and compliant with relevant laws and regulations. This ratification not only protects shareholders, but it also helps establish a framework for negotiation, corporate governance, and dispute resolution during a change in control transaction. 2. Types of Pennsylvania Ratification of Change in Control Agreements: a. Executive Change in Control Agreements: This type of agreement focuses on the rights and benefits offered to key executives or top management during a change in control scenario. It outlines compensation terms, severance packages, stock options, and other benefits, aiming to retain crucial talent and incentivize their commitment during times of transition. b. Shareholder Change in Control Agreements: These agreements ensure that shareholders' rights and interests are protected during a change in control event. It may address issues like preemptive rights, voting rights, buyback options, and stock price adjustments, ensuring fairness and equitable treatment for all shareholders involved. c. Employee Change in Control Agreements: Employee-focused agreements aim to provide reassurance to the workforce affected by a change in control. They may include provisions related to job security, severance pay, retention bonuses, and details about potential changes in employee benefits programs resulting from the ownership transfer. 3. Contents of a Change in Control Agreement Form: The Pennsylvania Ratification of Change in Control Agreement typically includes: — Identification of the involved parties: This section explicitly identifies the organization, the acquiring entity, and the individuals entering into the agreement. — Definitions: Clearly defined terms ensure mutual understanding and prevent potential conflicts or misunderstandings. — Change in Control Triggers: This section outlines the events that will qualify as a change in control, such as the sale of a specific percentage of shares, merger, or acquisition. — Terms and Conditions: The agreement specifies the terms and conditions surrounding the change in control, highlighting any benefits, compensations, or severance provisions for executives or employees. — Confidentiality: To protect sensitive business information, a confidentiality clause may be included, preventing parties from disclosing or using proprietary information for personal gain. — Governing Law and Dispute Resolution: This section clarifies which state or jurisdiction's laws govern the agreement, and provides a mechanism for resolving disputes outside of litigation, such as arbitration or mediation. In conclusion, the Pennsylvania Ratification of Change in Control Agreements plays a vital role in ensuring a smooth transition of power and ownership during corporate change. Variations of this document include executive, shareholder, and employee-focused agreements. The agreement form itself typically includes an identification of parties, definitions, change in control triggers, terms and conditions, confidentiality provisions, and dispute resolution mechanisms. By utilizing this ratification and adhering to its terms, organizations can mitigate risks and maintain stability during transformative events.

The Pennsylvania Ratification of Change in Control Agreements serves as an essential document for binding agreements between parties involved in a change in control situation. It provides legal protection and clarification on terms and conditions, ensuring a smooth transition of power and ownership within an organization. This detailed description will highlight the significance of this ratification, discuss the various types of agreements, and provide a comprehensive explanation of the contents of a typical change in control agreement form. 1. Importance of Pennsylvania Ratification of Change in Control Agreements: The Pennsylvania Ratification of Change in Control Agreements is a critical legal instrument that safeguards the rights and interests of all parties involved in a significant transfer of power or ownership. It ensures that the process is fair, transparent, and compliant with relevant laws and regulations. This ratification not only protects shareholders, but it also helps establish a framework for negotiation, corporate governance, and dispute resolution during a change in control transaction. 2. Types of Pennsylvania Ratification of Change in Control Agreements: a. Executive Change in Control Agreements: This type of agreement focuses on the rights and benefits offered to key executives or top management during a change in control scenario. It outlines compensation terms, severance packages, stock options, and other benefits, aiming to retain crucial talent and incentivize their commitment during times of transition. b. Shareholder Change in Control Agreements: These agreements ensure that shareholders' rights and interests are protected during a change in control event. It may address issues like preemptive rights, voting rights, buyback options, and stock price adjustments, ensuring fairness and equitable treatment for all shareholders involved. c. Employee Change in Control Agreements: Employee-focused agreements aim to provide reassurance to the workforce affected by a change in control. They may include provisions related to job security, severance pay, retention bonuses, and details about potential changes in employee benefits programs resulting from the ownership transfer. 3. Contents of a Change in Control Agreement Form: The Pennsylvania Ratification of Change in Control Agreement typically includes: — Identification of the involved parties: This section explicitly identifies the organization, the acquiring entity, and the individuals entering into the agreement. — Definitions: Clearly defined terms ensure mutual understanding and prevent potential conflicts or misunderstandings. — Change in Control Triggers: This section outlines the events that will qualify as a change in control, such as the sale of a specific percentage of shares, merger, or acquisition. — Terms and Conditions: The agreement specifies the terms and conditions surrounding the change in control, highlighting any benefits, compensations, or severance provisions for executives or employees. — Confidentiality: To protect sensitive business information, a confidentiality clause may be included, preventing parties from disclosing or using proprietary information for personal gain. — Governing Law and Dispute Resolution: This section clarifies which state or jurisdiction's laws govern the agreement, and provides a mechanism for resolving disputes outside of litigation, such as arbitration or mediation. In conclusion, the Pennsylvania Ratification of Change in Control Agreements plays a vital role in ensuring a smooth transition of power and ownership during corporate change. Variations of this document include executive, shareholder, and employee-focused agreements. The agreement form itself typically includes an identification of parties, definitions, change in control triggers, terms and conditions, confidentiality provisions, and dispute resolution mechanisms. By utilizing this ratification and adhering to its terms, organizations can mitigate risks and maintain stability during transformative events.