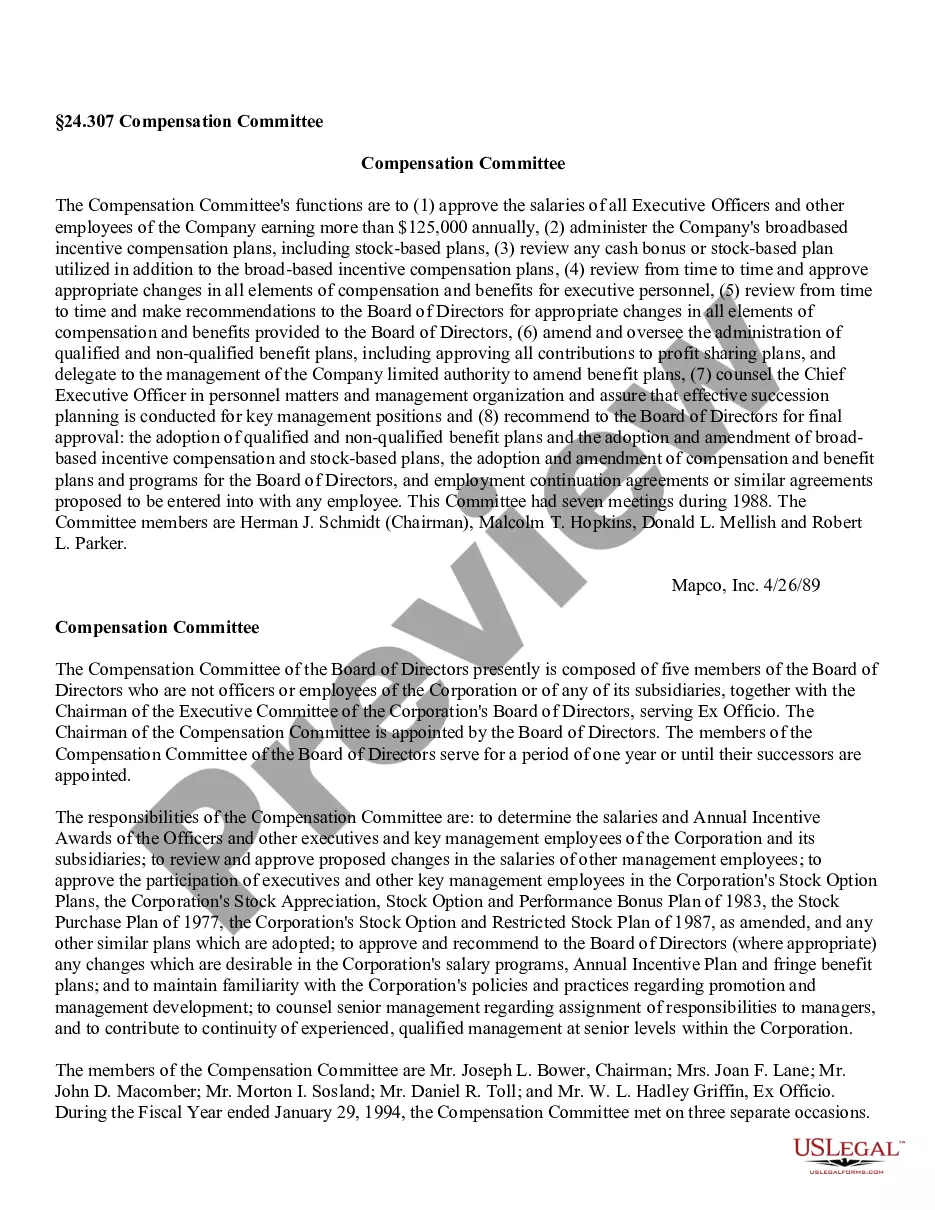

The Pennsylvania Adoption of Incentive Stock Plan refers to a specific program implemented by the state of Pennsylvania to encourage companies to offer incentive stock options to their employees. This plan aims to attract and retain top talent, stimulate economic growth, and promote long-term business expansion in the state. Here, we will delve into the details of the Pennsylvania Adoption of Incentive Stock Plan, highlighting its purpose, advantages, requirements, and potential variations. The Pennsylvania Adoption of Incentive Stock Plan is designed to provide employers with a tax advantage when granting stock options to their employees. By offering stock options as part of their compensation packages, companies can motivate and reward employees for their hard work and dedication while fostering a sense of ownership and commitment. This plan offers several benefits both to employees and employers, such as the potential for significant financial gain for employees if the company's stock value increases over time. It also offers employers a competitive edge in attracting and retaining top talent, as stock options can serve as an enticing additional incentive beyond salary and traditional benefits. To qualify for the Pennsylvania Adoption of Incentive Stock Plan, companies must adhere to specific requirements set forth by the state. These requirements may include limitations on the number of stock options that can be granted, eligibility criteria that employees must meet, and guidelines concerning vesting schedules and exercise periods. While there may not be different types of the Pennsylvania Adoption of Incentive Stock Plan per se, variations can exist in terms of how companies structure their specific programs within the guidelines provided by the state. For instance, companies may choose to offer different types of stock options, such as incentive stock options (SOS), non-qualified stock options (SOS), or restricted stock units (RSS). Each option has its own set of rules and tax implications, and the company can select the option that best aligns with its goals and the needs of its workforce. Overall, the Pennsylvania Adoption of Incentive Stock Plan serves as a valuable tool for businesses operating in Pennsylvania to attract and retain talent, foster employee loyalty, and potentially enhance their growth and success. By leveraging stock options as a form of compensation, companies can create a win-win scenario for both themselves and their employees.

Pennsylvania Adoption of Incentive Stock Plan

Description

How to fill out Pennsylvania Adoption Of Incentive Stock Plan?

Choosing the best legal document design could be a struggle. Obviously, there are a lot of themes available online, but how will you find the legal form you want? Take advantage of the US Legal Forms site. The service gives a large number of themes, for example the Pennsylvania Adoption of Incentive Stock Plan, that you can use for company and personal needs. All the types are examined by experts and fulfill federal and state needs.

Should you be presently listed, log in to your bank account and click the Acquire button to obtain the Pennsylvania Adoption of Incentive Stock Plan. Use your bank account to check through the legal types you have purchased in the past. Check out the My Forms tab of the bank account and acquire one more duplicate of the document you want.

Should you be a fresh consumer of US Legal Forms, listed below are straightforward guidelines for you to adhere to:

- Initially, make certain you have chosen the proper form for your personal city/area. It is possible to look through the shape making use of the Preview button and browse the shape information to ensure this is basically the best for you.

- In the event the form is not going to fulfill your expectations, make use of the Seach area to get the appropriate form.

- When you are certain that the shape would work, click the Acquire now button to obtain the form.

- Opt for the pricing plan you would like and enter in the needed information. Create your bank account and pay money for your order utilizing your PayPal bank account or Visa or Mastercard.

- Opt for the data file formatting and acquire the legal document design to your device.

- Comprehensive, revise and print and indication the received Pennsylvania Adoption of Incentive Stock Plan.

US Legal Forms will be the largest library of legal types that you can discover a variety of document themes. Take advantage of the service to acquire skillfully-manufactured papers that adhere to state needs.

Form popularity

FAQ

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Retirement income is not taxable: Payments from retirement accounts like 401(k)s and IRAs are tax exempt. PA also does not tax income from pensions for residents aged 60 and over. Social Security income is not taxable: Just like with a pension, in Pennsylvania, Social Security is tax exempt.

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

Once you retire and begin to receive pension benefits, you will pay federal tax on your retirement payments, but you will not pay PA tax on those benefits. Depending on your income and family size, you may qualify for a reduction in state tax liability with PA's Tax Forgiveness program.

Roth IRA or Roth 401(k) ? Roth IRAs and Roth 401(k)s have tax-free qualified withdrawals at retirement since taxes are paid on contributions. Municipal Bonds Income ? A fixed-income investment that generates interest payments that are typically exempt from federal taxes.

Tax-exempt account withdrawals are tax-free, meaning you'll pay taxes up front. Common tax-deferred retirement accounts are traditional IRAs and 401(k)s. Popular tax-exempt retirement accounts are Roth IRAs and Roth 401(k)s.

You have to exercise ISOs and purchase shares before you can sell your shares. If you choose to exercise your ISOs, you usually have two options: pay for the total in cash or do a ?same-day sale??in other words, sell a portion of your shares to cover the cost of exercise.