Pennsylvania Employee Stock Option Plan of Vivigen, Inc.

Description

How to fill out Employee Stock Option Plan Of Vivigen, Inc.?

Are you in a position in which you require documents for possibly enterprise or specific reasons virtually every working day? There are tons of legal file themes available online, but discovering types you can rely is not straightforward. US Legal Forms provides thousands of form themes, much like the Pennsylvania Employee Stock Option Plan of Vivigen, Inc., that are written in order to meet state and federal needs.

In case you are currently familiar with US Legal Forms internet site and also have a merchant account, just log in. After that, you are able to obtain the Pennsylvania Employee Stock Option Plan of Vivigen, Inc. format.

Should you not offer an profile and wish to start using US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for that correct city/county.

- Make use of the Preview key to examine the shape.

- Read the description to actually have chosen the correct form.

- When the form is not what you are trying to find, use the Look for discipline to get the form that meets your requirements and needs.

- When you get the correct form, just click Purchase now.

- Pick the costs strategy you would like, complete the desired information and facts to create your bank account, and pay for the transaction utilizing your PayPal or charge card.

- Pick a practical paper formatting and obtain your version.

Get every one of the file themes you may have purchased in the My Forms food selection. You may get a further version of Pennsylvania Employee Stock Option Plan of Vivigen, Inc. at any time, if possible. Just click on the required form to obtain or printing the file format.

Use US Legal Forms, by far the most substantial collection of legal kinds, to save lots of some time and avoid faults. The services provides skillfully produced legal file themes which can be used for an array of reasons. Make a merchant account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

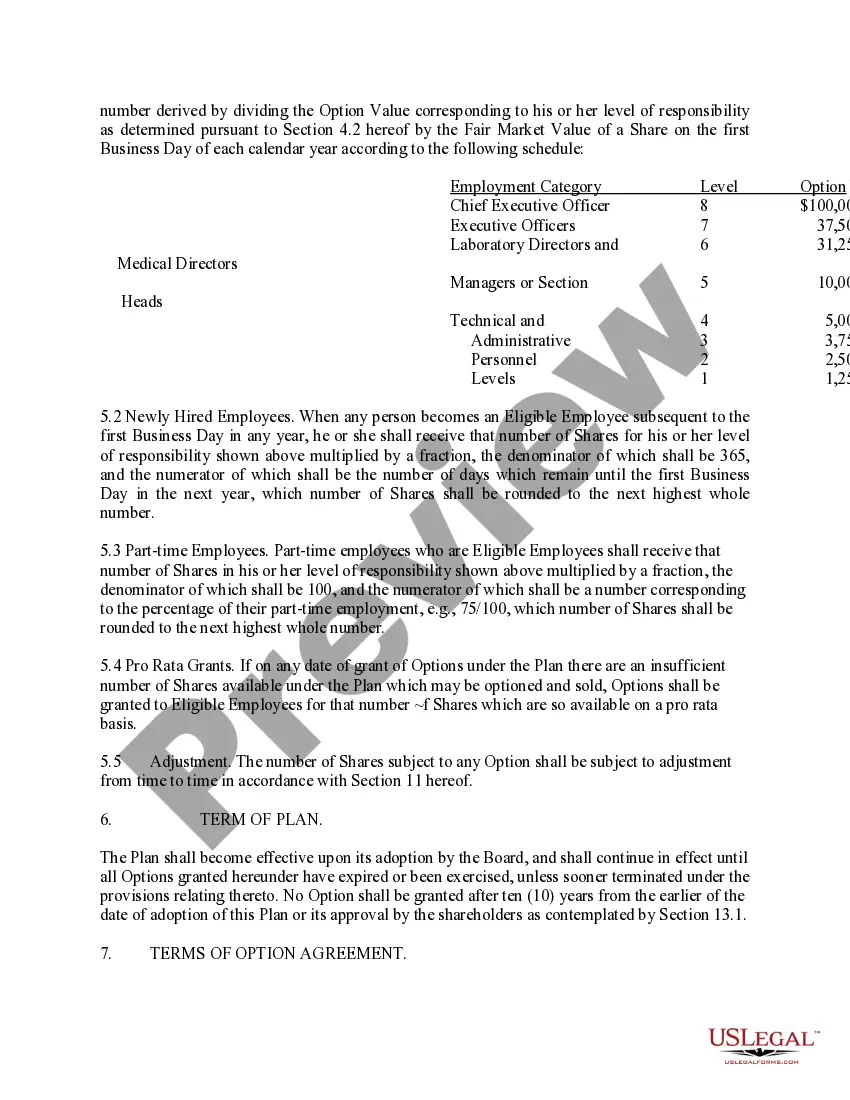

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.