Pennsylvania Restricted Stock Plan of RPM, Inc. is a comprehensive employee benefit program offered by RPM, Inc., a leading company in the chemical industry. This plan encourages and rewards employee loyalty, dedication, and long-term commitment by providing an opportunity for employees to acquire stock ownership in the company. Under the Pennsylvania Restricted Stock Plan, eligible employees of RPM, Inc. are granted a specified number of restricted stock units (RSS) as part of their compensation package. This RSS is subject to certain restrictions and conditions, which are designed to ensure that employees are aligned with the long-term success of the company. One key aspect of the plan is that the RSS granted to employees are subject to a vesting schedule. This means that employees do not have immediate ownership rights to the stock units but rather earn them over a certain period of time or upon achieving predetermined milestones. The vesting schedule may vary depending on the employee's position, tenure, and job performance. Once the RSS are fully vested, employees have the opportunity to convert them into actual shares of RPM, Inc. stock. This allows employees to become shareholders of the company and participate in its growth and success. By having ownership in the company, employees not only benefit from potential capital appreciation but also have a vested interest in the company's overall performance. Additionally, the Pennsylvania Restricted Stock Plan may offer employees certain tax advantages. The RSS are generally taxed as ordinary income upon vesting. However, employees have the option to defer taxes on the RSS until the shares are sold, potentially allowing for a more favorable tax treatment. It is important to note that there may be different types or variations of the Pennsylvania Restricted Stock Plan within RPM, Inc. These variations may be tailored to specific groups of employees, such as executives or key contributors, and may have additional features or benefits. In summary, the Pennsylvania Restricted Stock Plan of RPM, Inc. is a valuable employee benefit program that promotes retention, aligns employee interests with company goals, and provides employees with the opportunity to share in the company's success. By offering employees ownership in the form of restricted stock units, RPM, Inc. aims to attract and retain top talent while fostering a sense of ownership and commitment throughout the organization.

Pennsylvania Restricted Stock Plan of RPM, Inc.

Description

How to fill out Pennsylvania Restricted Stock Plan Of RPM, Inc.?

Are you in a situation the place you need to have paperwork for both enterprise or individual purposes nearly every day time? There are tons of legal document web templates available on the net, but getting versions you can rely isn`t straightforward. US Legal Forms offers thousands of kind web templates, much like the Pennsylvania Restricted Stock Plan of RPM, Inc., which can be composed in order to meet federal and state needs.

If you are previously informed about US Legal Forms site and get your account, just log in. After that, you are able to download the Pennsylvania Restricted Stock Plan of RPM, Inc. web template.

If you do not offer an bank account and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is for that right metropolis/area.

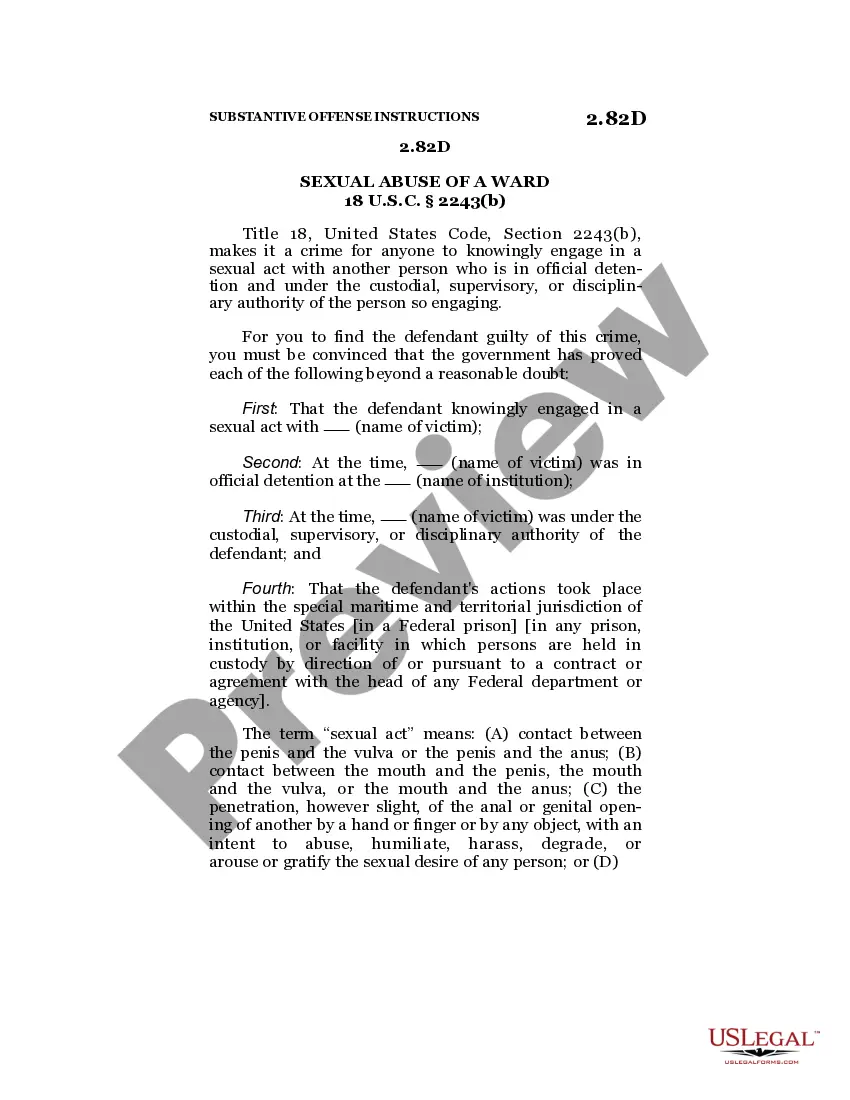

- Use the Review button to review the form.

- Browse the outline to ensure that you have selected the right kind.

- If the kind isn`t what you`re seeking, make use of the Lookup area to discover the kind that suits you and needs.

- Whenever you discover the right kind, simply click Buy now.

- Choose the costs strategy you want, fill in the desired information and facts to make your account, and pay money for the transaction using your PayPal or Visa or Mastercard.

- Decide on a hassle-free document formatting and download your copy.

Locate each of the document web templates you might have purchased in the My Forms food list. You may get a further copy of Pennsylvania Restricted Stock Plan of RPM, Inc. whenever, if required. Just click the essential kind to download or print the document web template.

Use US Legal Forms, probably the most comprehensive collection of legal types, to conserve time as well as steer clear of errors. The support offers skillfully created legal document web templates which you can use for a variety of purposes. Create your account on US Legal Forms and start generating your lifestyle a little easier.