The Pennsylvania Stock Option Plan for Federal Savings Association is a program designed to provide employees of Federal Savings Associations with the opportunity to purchase company stock at a discounted price. This plan is a valuable employee benefit that not only helps attract and retain talent but also aligns the interests of employees with those of the company. Under the Pennsylvania Stock Option Plan, employees are given the right to purchase a specific number of company shares at a predetermined price, known as the exercise price. These stock options often have a vesting period, during which employees must work for the company for a certain period of time before they can exercise their options. One of the key advantages of the Pennsylvania Stock Option Plan is that it allows employees to potentially benefit from the growth of the company's stock value. If the stock price rises above the exercise price, employees can purchase the shares at the lower exercise price and sell them at the market price, thereby making a profit. Additionally, the Pennsylvania Stock Option Plan encourages employees to stay with the Federal Savings Association in the long term. As employees become vested in their stock options, they are more likely to remain committed to the success of the company, helping to foster a culture of loyalty and dedication. It is important to note that there may be different types of Pennsylvania Stock Option Plans available for Federal Savings Associations. Some common variations include: 1. Incentive Stock Options (SOS): These stock options are typically reserved for top-level executives and carry certain tax advantages. SOS must comply with specific Internal Revenue Service (IRS) requirements to qualify for preferential tax treatment. 2. Non-Qualified Stock Options (SOS): SOS are a more common type of stock option, available to employees at all levels within the Federal Savings Association. While they do not receive the same tax benefits as SOS, SOS offer more flexibility in terms of eligibility and exercise terms. 3. Employee Stock Purchase Plan (ESPN): In addition to traditional stock options, some Federal Savings Associations may offer an ESPN. This plan allows employees to contribute a certain percentage of their salary to purchase company stock at a discounted price. ESPN often have a specific enrollment period and are an attractive way for employees to invest in their company over time. In summary, the Pennsylvania Stock Option Plan for Federal Savings Association is a program designed to provide employees with the opportunity to purchase company stock at a discounted price. It serves as a valuable employee benefit, aligning the interests of employees with those of the company and fostering loyalty. Different types of stock options, such as SOS, SOS, and ESPN, may be available to cater to the needs of various employees within the Federal Savings Association.

Pennsylvania Stock Option Plan For Federal Savings Association

Description

How to fill out Pennsylvania Stock Option Plan For Federal Savings Association?

It is possible to commit hours on the web trying to find the legal document design that meets the state and federal needs you want. US Legal Forms provides 1000s of legal forms which are evaluated by professionals. It is possible to download or printing the Pennsylvania Stock Option Plan For Federal Savings Association from your assistance.

If you already have a US Legal Forms accounts, it is possible to log in and click on the Acquire option. After that, it is possible to complete, modify, printing, or sign the Pennsylvania Stock Option Plan For Federal Savings Association. Each and every legal document design you get is the one you have for a long time. To have yet another copy associated with a obtained type, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms web site the very first time, adhere to the simple instructions below:

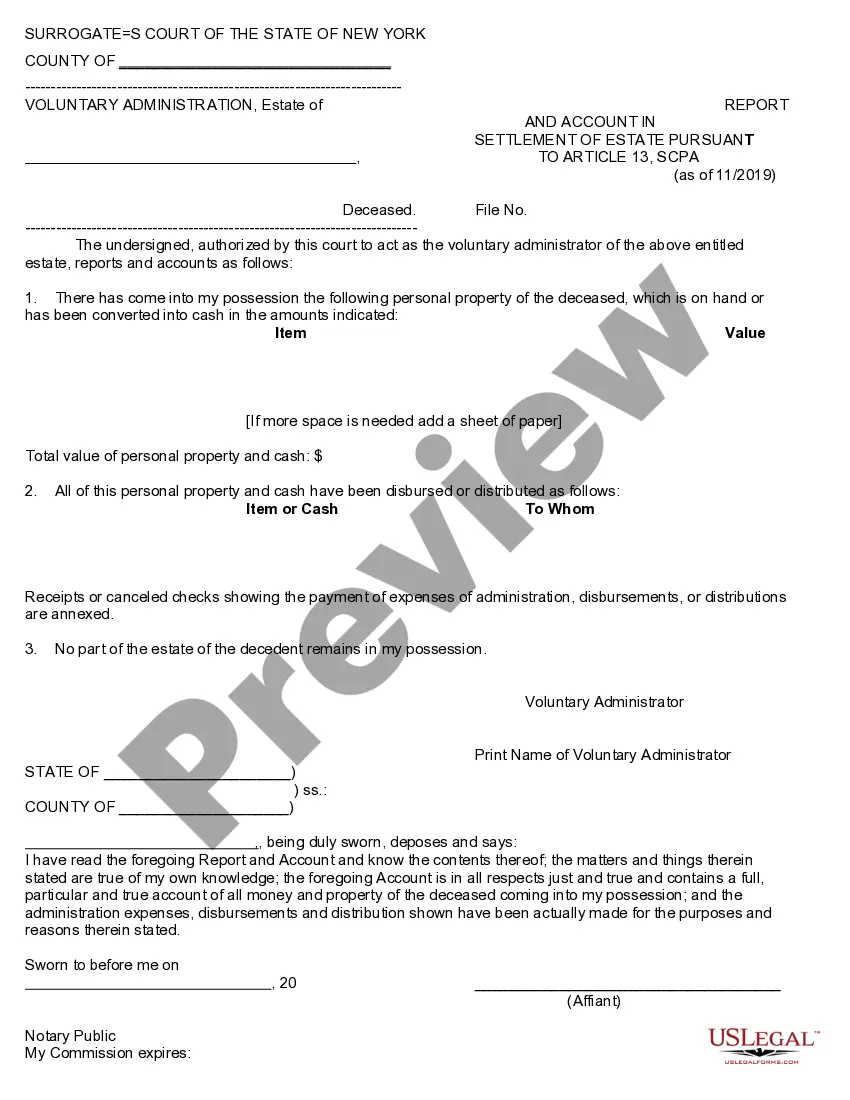

- Very first, ensure that you have selected the correct document design for your state/metropolis of your liking. Browse the type explanation to ensure you have chosen the proper type. If readily available, make use of the Review option to search from the document design at the same time.

- In order to discover yet another version from the type, make use of the Lookup discipline to obtain the design that suits you and needs.

- When you have found the design you desire, just click Purchase now to proceed.

- Choose the pricing prepare you desire, type your qualifications, and register for a free account on US Legal Forms.

- Total the deal. You should use your Visa or Mastercard or PayPal accounts to fund the legal type.

- Choose the formatting from the document and download it to the device.

- Make modifications to the document if possible. It is possible to complete, modify and sign and printing Pennsylvania Stock Option Plan For Federal Savings Association.

Acquire and printing 1000s of document themes utilizing the US Legal Forms site, that provides the biggest collection of legal forms. Use expert and express-particular themes to deal with your small business or individual needs.