The Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. is a comprehensive program designed to incentivize and reward employees of the company through stock options. This plan is tailored specifically for L. Luria and Son, Inc., a Pennsylvania-based company. Under this stock option plan, eligible employees are granted the right to purchase a specific number of company stocks at a predetermined price within a defined time period. These options serve as a form of compensation and encourage employees to share in the company's success, aligning their interests with those of the shareholders. The Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. outlines various types of stock options available to employees based on different criteria. These may include: 1. Incentive Stock Options (SOS): These stock options carry certain tax benefits and are typically granted to key employees. SOS are subject to specific regulations outlined in Section 422 of the Internal Revenue Code. 2. Non-Qualified Stock Options (Nests): Nests are stock options that do not meet the criteria set forth by Section 422 of the Internal Revenue Code. These options offer more flexibility in terms of eligibility and grant requirements. 3. Performance-Based Stock Options: This type of stock option is granted based on predefined performance goals or specific milestones achieved by employees. Performance-based stock options serve as an additional motivator for employees to contribute towards the company's growth. 4. Restricted Stock Units (RSS): RSS are another form of stock-based compensation, where eligible employees receive not the underlying stock itself, but units that convert into company stock upon the fulfillment of certain conditions, such as continued employment or achieving performance targets. The Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. ensures that the granting and exercising of stock options comply with applicable laws and regulations. It outlines the vesting schedules, exercise procedures, and any restrictions or conditions associated with the stock options. Overall, the Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. is a strategic tool that provides L. Luria and Son, Inc. with a means to attract, retain, and motivate its employees by offering them an opportunity to participate in the company's financial success.

Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc.

Description

How to fill out Pennsylvania Amended And Restated Stock Option Plan Of L. Luria And Son, Inc.?

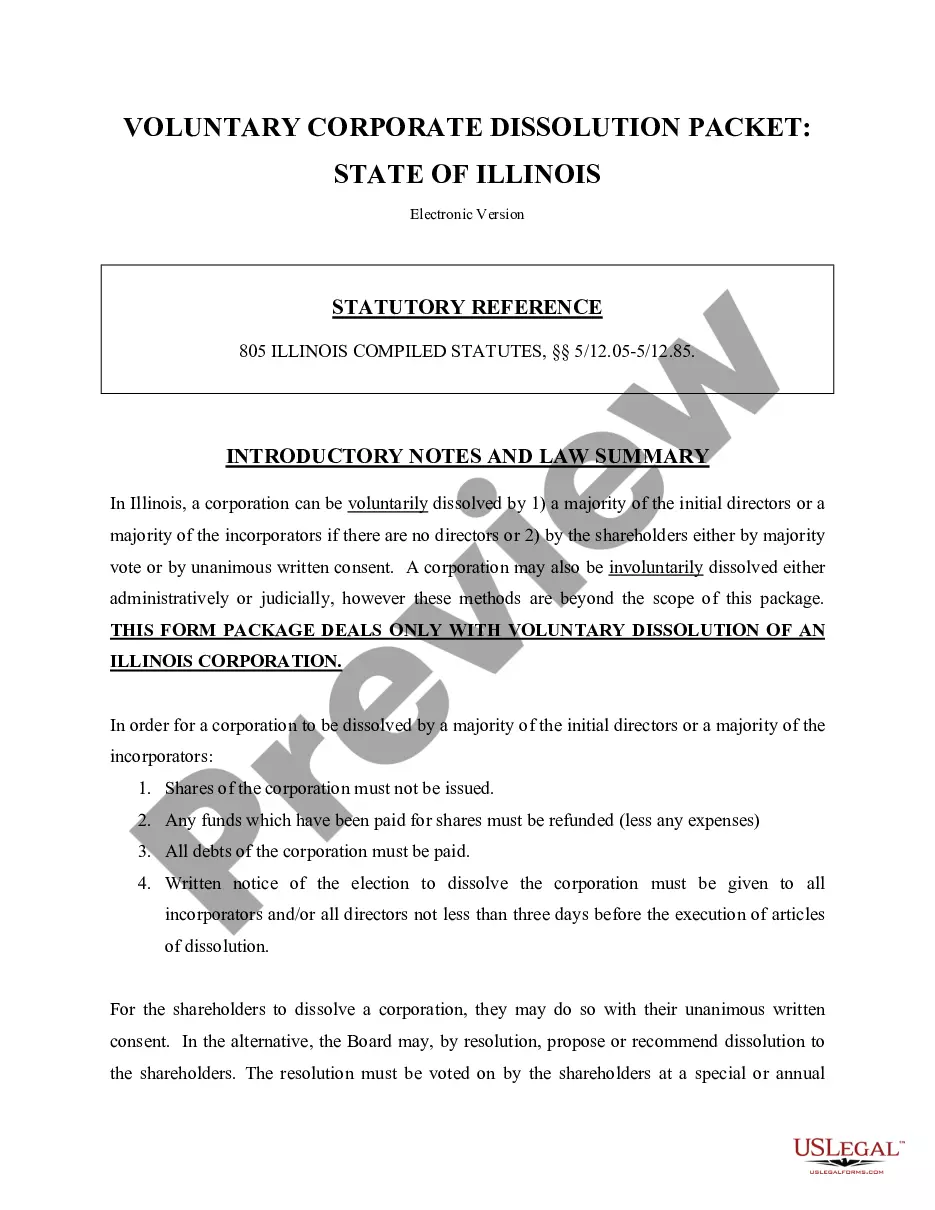

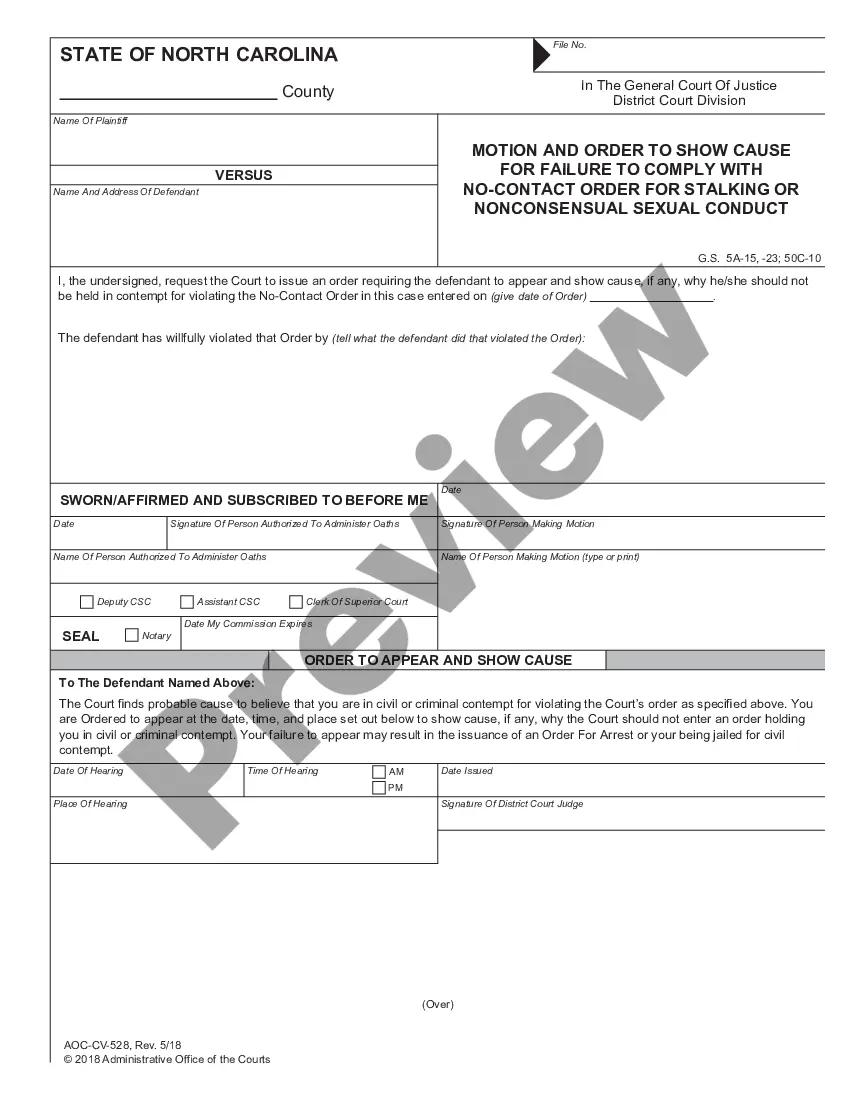

US Legal Forms - one of the most significant libraries of legitimate kinds in the USA - delivers a wide array of legitimate file layouts you may download or print. Using the site, you may get 1000s of kinds for business and personal functions, categorized by classes, claims, or keywords.You will discover the most up-to-date versions of kinds much like the Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. within minutes.

If you currently have a membership, log in and download Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. in the US Legal Forms collection. The Acquire button can look on each and every type you view. You gain access to all previously acquired kinds inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, here are basic recommendations to obtain started off:

- Be sure to have selected the correct type for your personal area/county. Go through the Preview button to examine the form`s content. Read the type information to actually have selected the proper type.

- If the type does not satisfy your demands, make use of the Lookup area near the top of the display to obtain the one that does.

- In case you are pleased with the shape, verify your choice by clicking the Get now button. Then, pick the costs plan you like and give your references to register on an accounts.

- Procedure the transaction. Make use of charge card or PayPal accounts to perform the transaction.

- Pick the file format and download the shape on your device.

- Make adjustments. Fill out, edit and print and sign the acquired Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc..

Every template you included with your money does not have an expiry date and is also the one you have forever. So, in order to download or print an additional copy, just proceed to the My Forms portion and click in the type you want.

Gain access to the Pennsylvania Amended and Restated Stock Option Plan of L. Luria and Son, Inc. with US Legal Forms, one of the most considerable collection of legitimate file layouts. Use 1000s of professional and status-distinct layouts that meet your organization or personal demands and demands.