The Pennsylvania Stock Incentive Plan is a comprehensive equity compensation program offered by Abase Corp., a financial services company headquartered in Pennsylvania. This plan aims to incentivize and reward employees and key personnel by granting them ownership in the company through stock options, restricted stock units (RSS), and other equity-based instruments. Under the Pennsylvania Stock Incentive Plan, eligible employees have the opportunity to receive stock options, which grant the right to purchase company stock at a predetermined price, often referred to as the exercise price or strike price. These options typically have a specific vesting period during which employees must remain with the company to exercise their options. In addition to stock options, Abase Corp. may also grant RSS as part of the Pennsylvania Stock Incentive Plan. RSS represents a promise to deliver company stock to employees at a future date, typically once certain vesting conditions are met. RSS guarantees the recipient the value of a specified number of shares of company stock, even if the market price fluctuates. The Pennsylvania Stock Incentive Plan of Abase Corp. provides employees with the opportunity to participate in the company's long-term growth and profitability. By offering equity-based incentives, Abase Corp. aims to align the interests of its employees with those of its shareholders, motivating employees to perform at their best and contribute to the company's success. It is worth noting that the specific terms and conditions of the Pennsylvania Stock Incentive Plan, including eligibility, grant sizes, vesting schedules, and exercise periods, may vary depending on the position of the employee and the overall company performance. Abase Corp. may periodically review and adjust the plan to ensure its effectiveness and alignment with its strategic objectives. Overall, the Pennsylvania Stock Incentive Plan reflects Abase Corp.'s commitment to rewarding and retaining talented employees while promoting a culture of long-term ownership and shared success.

Pennsylvania Stock Incentive Plan of Ambase Corp.

Description

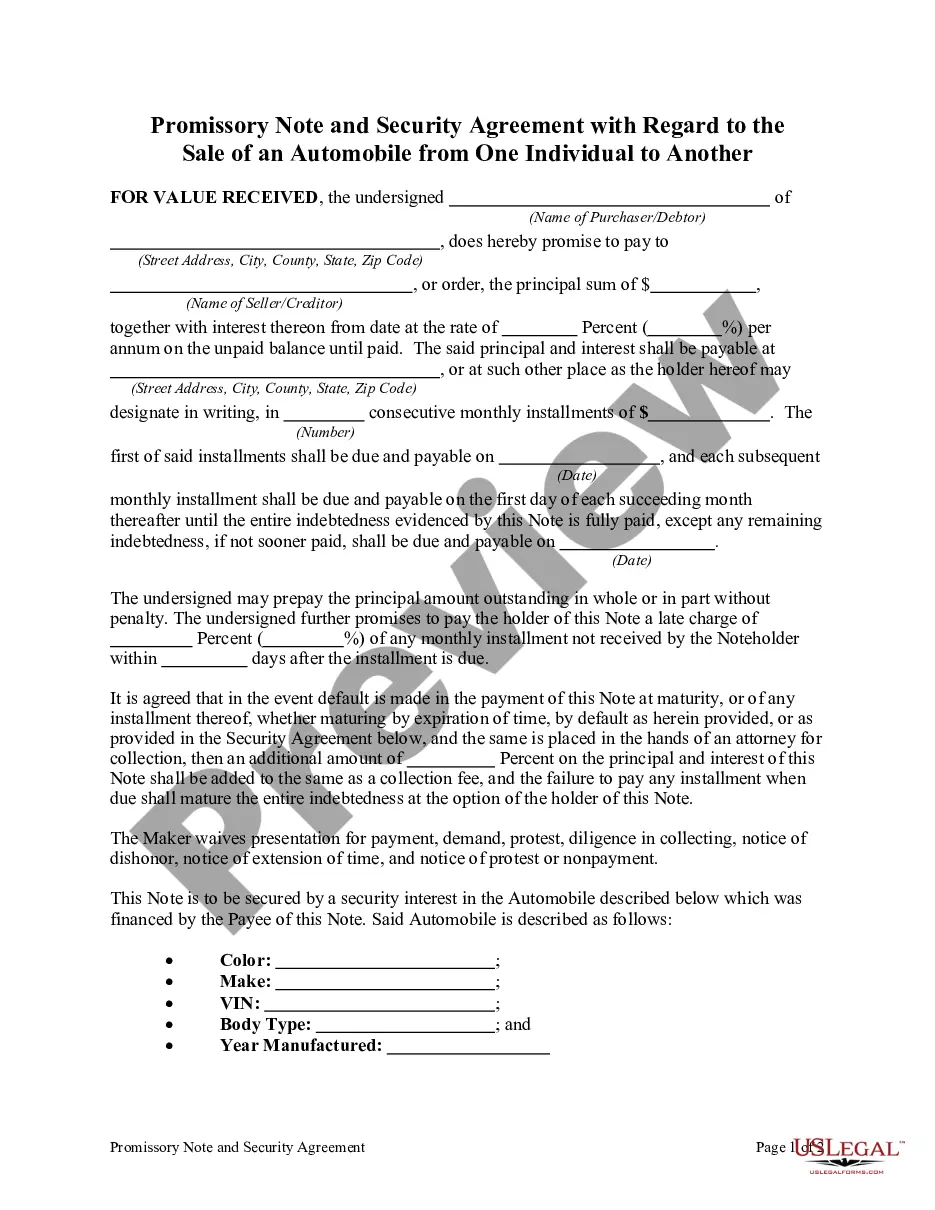

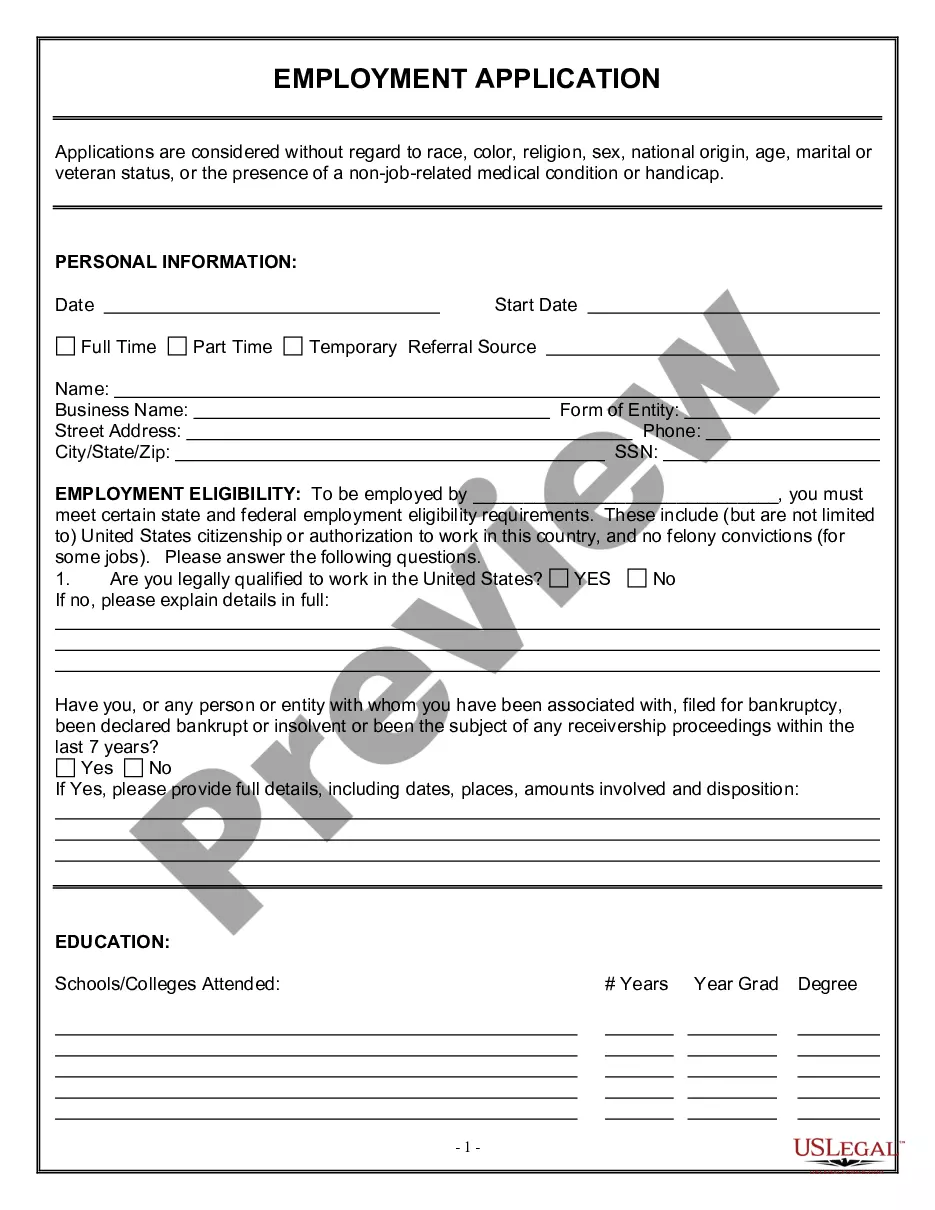

How to fill out Pennsylvania Stock Incentive Plan Of Ambase Corp.?

You are able to spend time on the web looking for the legitimate document design which fits the state and federal requirements you need. US Legal Forms gives thousands of legitimate varieties that happen to be evaluated by pros. It is possible to acquire or printing the Pennsylvania Stock Incentive Plan of Ambase Corp. from your assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Acquire switch. Afterward, it is possible to comprehensive, revise, printing, or sign the Pennsylvania Stock Incentive Plan of Ambase Corp.. Each and every legitimate document design you purchase is your own property forever. To acquire one more backup of any purchased type, go to the My Forms tab and click the related switch.

If you are using the US Legal Forms web site the very first time, adhere to the easy instructions under:

- First, ensure that you have chosen the proper document design for that region/town of your choosing. Browse the type explanation to ensure you have picked the right type. If offered, utilize the Review switch to appear through the document design too.

- If you wish to find one more model from the type, utilize the Search industry to obtain the design that meets your requirements and requirements.

- When you have discovered the design you would like, click on Buy now to carry on.

- Select the rates plan you would like, enter your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the legitimate type.

- Select the format from the document and acquire it to your device.

- Make alterations to your document if required. You are able to comprehensive, revise and sign and printing Pennsylvania Stock Incentive Plan of Ambase Corp..

Acquire and printing thousands of document layouts while using US Legal Forms Internet site, which provides the largest variety of legitimate varieties. Use expert and express-distinct layouts to handle your company or person demands.