Pennsylvania Dividend Equivalent Shares are a type of investment instrument that allows shareholders to receive dividends equivalent to those paid to preferred shareholders, without actually owning the preferred stock. These shares are available for purchase in the state of Pennsylvania and can be a valuable asset for income-oriented investors. Pennsylvania Dividend Equivalent Shares are designed to provide investors with a fixed income stream by replicating the dividend payments made to preferred shareholders. The dividends received by the owners of these shares are typically equivalent to a fixed percentage of the preferred stock dividends. Although the shareholders do not own the preferred stock, they still benefit from the dividend yield. These shares are commonly issued by Pennsylvania-based companies that have preferred stock as part of their capital structure. They provide an alternative investment opportunity for individuals who are seeking consistent income without actually holding preferred stock. One of the advantages of Pennsylvania Dividend Equivalent Shares is that they offer investors a relatively secure income source. Since the dividends paid to preferred shareholders are generally dependable, investors can expect to receive a steady stream of income from these shares. Furthermore, Pennsylvania Dividend Equivalent Shares are typically less volatile compared to common stocks, making them an attractive investment option for conservative investors who prioritize capital preservation and steady income. It is important to note that there may be different types of Pennsylvania Dividend Equivalent Shares available, depending on the issuing company. Some companies may offer multiple series or classes of these shares, each with different dividend rates or payment terms. Investors should carefully review the terms and conditions of each series before making a purchase decision. In summary, Pennsylvania Dividend Equivalent Shares are investment instruments that allow shareholders to receive dividends equivalent to those paid to preferred shareholders, providing a secure income stream. They are an appealing option for individuals seeking consistent income without owning preferred stock. Different types or series of these shares may exist, each with varying dividend rates or payment terms.

Pennsylvania Dividend Equivalent Shares

Description

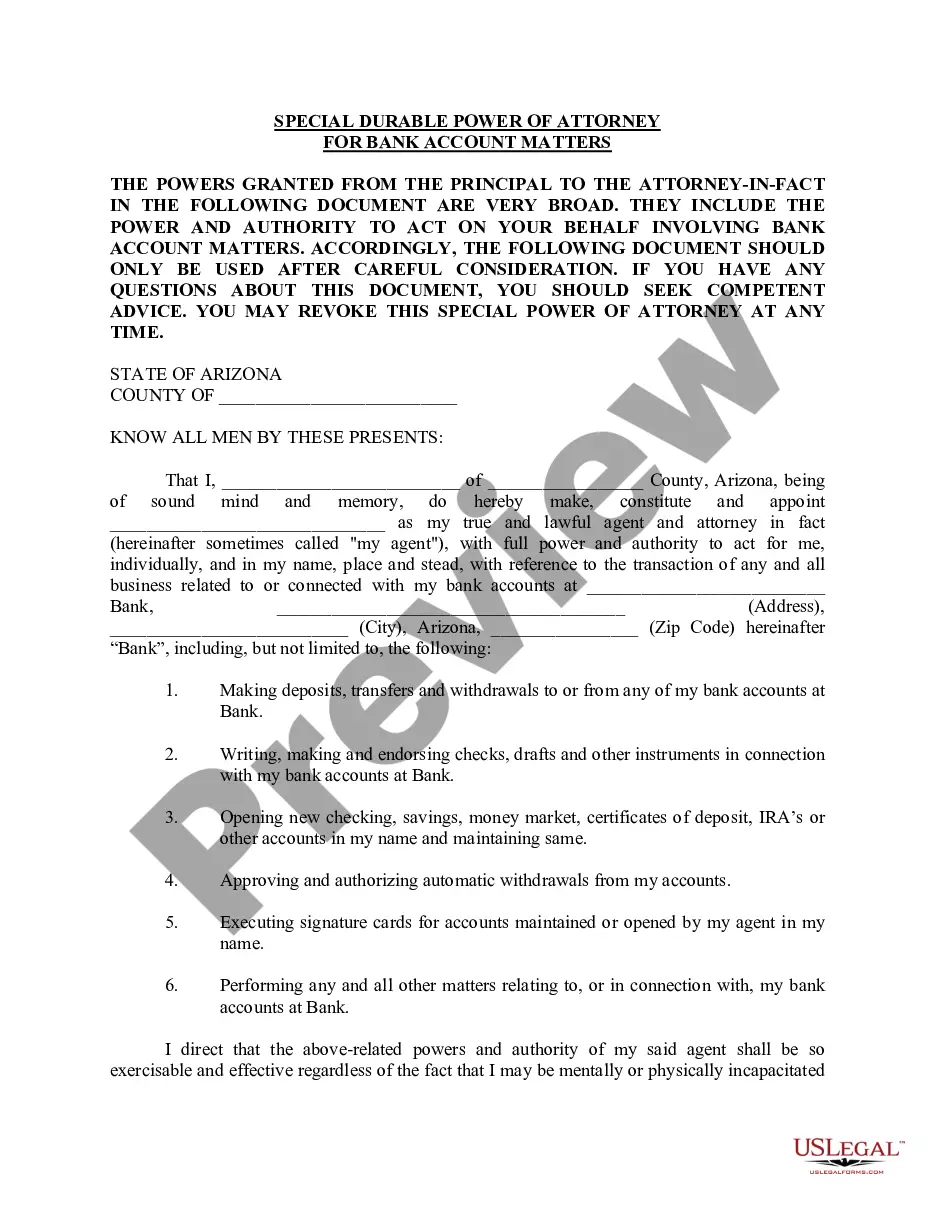

How to fill out Pennsylvania Dividend Equivalent Shares?

Choosing the right legal document format can be quite a have a problem. Of course, there are a variety of layouts available online, but how can you get the legal develop you need? Make use of the US Legal Forms site. The services delivers a large number of layouts, for example the Pennsylvania Dividend Equivalent Shares, which you can use for company and private needs. Each of the kinds are examined by experts and meet up with state and federal specifications.

If you are already registered, log in in your accounts and click the Down load key to get the Pennsylvania Dividend Equivalent Shares. Make use of your accounts to look throughout the legal kinds you may have acquired earlier. Go to the My Forms tab of your own accounts and have an additional version of your document you need.

If you are a brand new user of US Legal Forms, listed here are easy guidelines that you should stick to:

- First, make certain you have selected the appropriate develop to your town/region. You can check out the form making use of the Preview key and browse the form information to ensure it is the best for you.

- In the event the develop will not meet up with your needs, utilize the Seach field to obtain the correct develop.

- Once you are sure that the form is proper, select the Acquire now key to get the develop.

- Choose the pricing prepare you desire and enter the essential details. Design your accounts and purchase the transaction with your PayPal accounts or bank card.

- Opt for the file file format and acquire the legal document format in your system.

- Complete, change and print out and indicator the attained Pennsylvania Dividend Equivalent Shares.

US Legal Forms may be the biggest local library of legal kinds in which you can find various document layouts. Make use of the service to acquire professionally-produced documents that stick to condition specifications.