The Pennsylvania Stock Option Agreement of Full House Resorts, Inc. is a legal document that outlines the terms and conditions of stock options granted to employees, directors, or other individuals associated with the company. This agreement is specifically regulated by Pennsylvania state laws and includes various key elements to ensure a fair and transparent stock option plan. The Full House Resorts, Inc. is a renowned gaming and hospitality company that owns and operates several casinos and resorts across the United States, including properties in Pennsylvania. The Pennsylvania Stock Option Agreement is designed to offer eligible individuals the opportunity to purchase a specific number of company stocks at a predetermined price, known as the exercise price, within a specified time frame. This arrangement aims to incentivize and reward employees for their valuable contributions to the company's growth and success. Key provisions and details within the Pennsylvania Stock Option Agreement may include: 1. Grant of Options: This section outlines the number of shares granted, the exercise price, and the date of grant. It may also specify vesting periods, which determine when the options become exercisable. 2. Exercise Period: The agreement specifies the time frame during which the stock options can be exercised. It may include specific dates or a range of years, typically following a vesting schedule. 3. Exercise Price: The exercise price is the cost at which individuals can purchase the company's stock when exercising their stock options. This is usually set at the fair market value of the stock on the date of grant. 4. Vesting Schedule: This provision outlines the period over which the stock options vest. It may be time-based (e.g., options vesting over four years with 25% vesting annually) or performance-based (e.g., options vesting upon the achievement of certain financial targets). 5. Termination of Options: The agreement addresses circumstances under which stock options may terminate before they are fully vested or exercised, such as termination of employment, retirement, or upon a change of control event. 6. Stock Option Exercise: This section explains the process by which stock options can be exercised, including any necessary procedures and timing requirements. It may also detail how taxes and transaction fees associated with exercising options are handled. 7. Non-Transferability: In most cases, stock options granted under the Pennsylvania Stock Option Agreement cannot be transferred or assigned to another party, except through a will or by the laws of inheritance. Different types of Pennsylvania Stock Option Agreements of Full House Resorts, Inc. may exist based on various factors, such as the position, seniority, or specific eligibility criteria of the individuals being granted stock options. These agreements could include: 1. Employee Stock Option Agreement: Designed for employees of Full House Resorts, Inc., this agreement grants stock options to eligible individuals as part of their compensation package, aiming to align their interests with the company's long-term success. 2. Director Stock Option Agreement: Directors serving on the Full House Resorts, Inc. board may be offered stock options through this agreement, acknowledging their contributions in guiding the company's strategic decisions and corporate governance. 3. Consultant Stock Option Agreement: In certain cases, Full House Resorts, Inc. may extend stock option grants to external consultants or advisors. This agreement ensures that these individuals are incentivized to deliver valuable insights and support to the company. In summary, the Pennsylvania Stock Option Agreement of Full House Resorts, Inc. is a legally binding document governing the terms and conditions of stock option grants within the organization. It aims to provide eligible individuals with the opportunity to purchase the company's stock, typically at a predetermined price, within a specified time frame. Different types of agreements may exist depending on the recipient's role within the company, such as employees, directors, or consultants.

Pennsylvania Stock Option Agreement of Full House Resorts, Inc.

Description

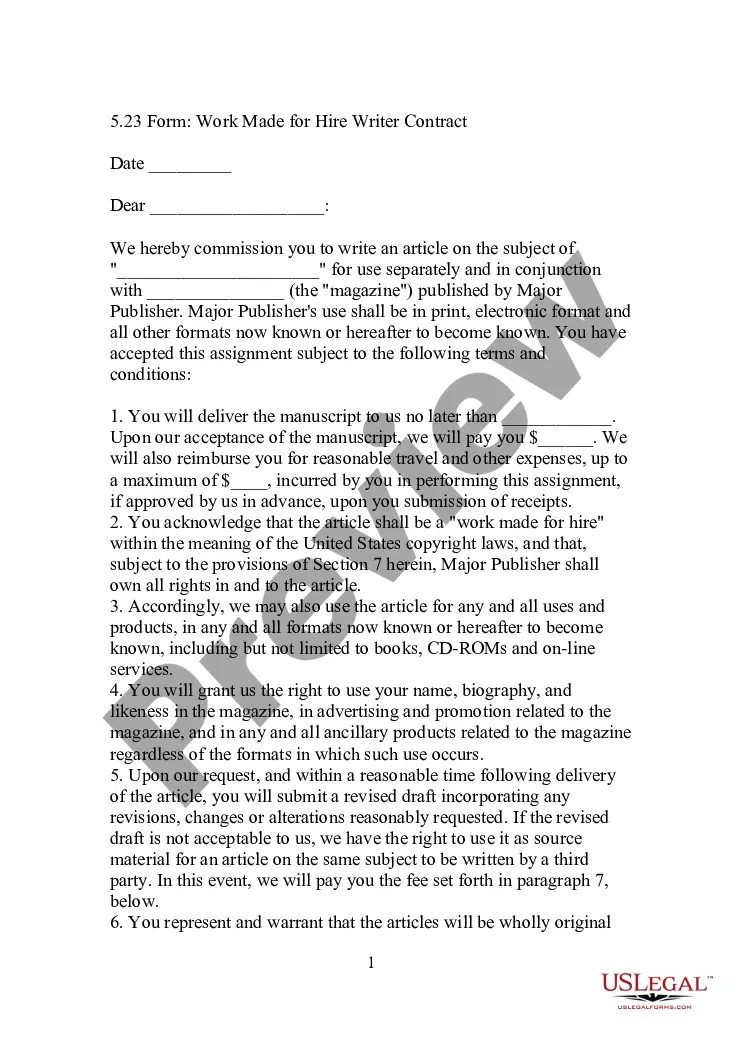

How to fill out Pennsylvania Stock Option Agreement Of Full House Resorts, Inc.?

US Legal Forms - one of several greatest libraries of lawful types in America - offers a variety of lawful record templates it is possible to acquire or printing. Utilizing the website, you can find a large number of types for company and specific purposes, sorted by groups, claims, or keywords.You will find the newest variations of types just like the Pennsylvania Stock Option Agreement of Full House Resorts, Inc. in seconds.

If you currently have a registration, log in and acquire Pennsylvania Stock Option Agreement of Full House Resorts, Inc. from your US Legal Forms catalogue. The Download option can look on each kind you look at. You have accessibility to all previously saved types from the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, listed below are simple directions to obtain started:

- Be sure to have selected the proper kind to your metropolis/region. Go through the Preview option to check the form`s articles. Read the kind information to actually have chosen the proper kind.

- In the event the kind doesn`t fit your specifications, utilize the Look for area near the top of the screen to find the one that does.

- When you are pleased with the shape, affirm your selection by simply clicking the Get now option. Then, select the pricing prepare you like and provide your accreditations to register to have an bank account.

- Procedure the purchase. Use your credit card or PayPal bank account to perform the purchase.

- Choose the file format and acquire the shape on the gadget.

- Make alterations. Complete, edit and printing and indication the saved Pennsylvania Stock Option Agreement of Full House Resorts, Inc..

Each and every template you put into your account lacks an expiration particular date and it is your own property permanently. So, in order to acquire or printing another duplicate, just proceed to the My Forms area and click in the kind you will need.

Obtain access to the Pennsylvania Stock Option Agreement of Full House Resorts, Inc. with US Legal Forms, probably the most comprehensive catalogue of lawful record templates. Use a large number of specialist and condition-particular templates that meet up with your company or specific requirements and specifications.