Pennsylvania Approval of Option Grant: A Comprehensive Overview In Pennsylvania, the approval of option grant refers to the legal process through which an employer awards options to its employees or other individuals as a part of their compensation package. These options grant recipients the right to purchase company stock at a predetermined price, known as the exercise price or strike price, within a specified timeframe. Pennsylvania recognizes various types of option grants, each with its own unique characteristics and implications. Some key types of option grants include: 1. Incentive Stock Options (SOS): These are typically offered to key employees and provide certain tax advantages. SOS must meet specific statutory requirements outlined by the Internal Revenue Service (IRS) and are subject to certain holding periods before the gains qualify for favorable tax treatment. 2. Non-Qualified Stock Options (Nests): Nests are more flexible than SOS and can be granted to both employees and non-employee service providers. Unlike SOS, Nests do not qualify for favorable tax treatment and are subject to ordinary income tax rates upon exercise. 3. Restricted Stock Units (RSS): While not technically options, RSS are often considered as an alternative form of equity compensation. RSS represents a promise to deliver company shares at a future date after the vesting conditions are met. These grants may be subject to different rules and regulations compared to traditional options. 4. Performance-based Stock Options: These options grants are contingent upon achieving specific performance goals or milestones, whether at the individual, team, or company level. They serve as an effective means of aligning employee incentives with the company's objectives, enhancing motivation and productivity. In Pennsylvania, the approval of option grants typically involves following certain legal requirements and obtaining the necessary authorizations. Employers must comply with state and federal securities laws, including ensuring proper disclosure, registration exemptions, and filings. Furthermore, companies need to have established stock option plans or agreements in place that detail the terms and conditions of the grants. It is essential for employers to engage legal counsel or experienced professionals to navigate the complexities associated with option grants. They can guide employers through the approval process, communicate the potential tax implications to employees, and ensure compliance with Pennsylvania state law, federal securities regulations, and IRS guidelines. In conclusion, the approval of option grants in Pennsylvania involves the granting of stock options to employees or other individuals as a form of compensation. Different types of option grants, such as SOS, Nests, RSS, and performance-based stock options, provide varying benefits and have distinct requirements. Employers must adhere to legal guidelines, seek proper counsel, and establish clear documentation to successfully execute option grants while complying with relevant laws and regulations.

Pennsylvania Approval of option grant

Description

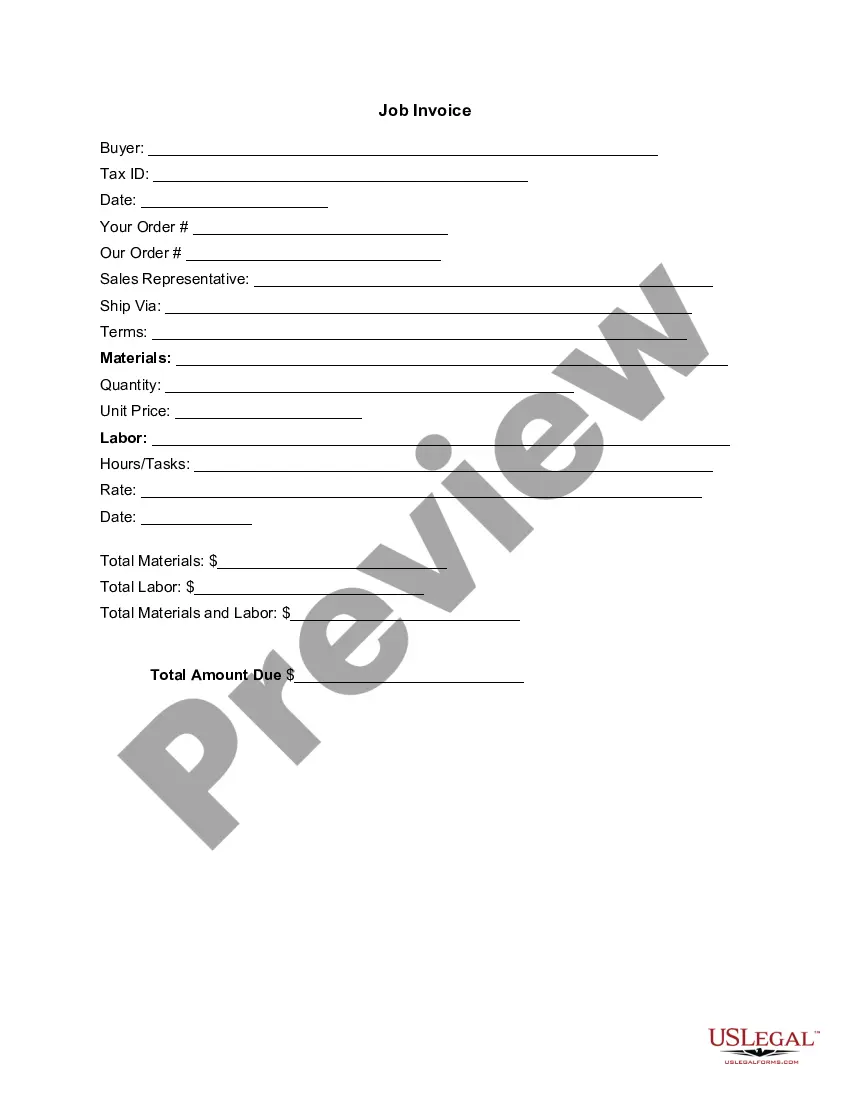

How to fill out Pennsylvania Approval Of Option Grant?

If you need to full, acquire, or produce legal record layouts, use US Legal Forms, the most important variety of legal kinds, that can be found on the Internet. Utilize the site`s basic and handy search to get the files you will need. Different layouts for enterprise and specific reasons are sorted by types and suggests, or keywords. Use US Legal Forms to get the Pennsylvania Approval of option grant within a number of click throughs.

Should you be currently a US Legal Forms customer, log in for your bank account and then click the Acquire button to have the Pennsylvania Approval of option grant. Also you can accessibility kinds you earlier acquired in the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for the proper city/land.

- Step 2. Take advantage of the Review method to check out the form`s content. Don`t forget to read through the information.

- Step 3. Should you be not satisfied together with the type, take advantage of the Research field on top of the display screen to get other variations of your legal type web template.

- Step 4. After you have located the shape you will need, select the Get now button. Select the rates program you choose and add your references to sign up on an bank account.

- Step 5. Procedure the transaction. You can use your credit card or PayPal bank account to complete the transaction.

- Step 6. Pick the file format of your legal type and acquire it in your system.

- Step 7. Total, change and produce or signal the Pennsylvania Approval of option grant.

Each legal record web template you purchase is your own forever. You might have acces to every single type you acquired in your acccount. Click the My Forms segment and pick a type to produce or acquire yet again.

Remain competitive and acquire, and produce the Pennsylvania Approval of option grant with US Legal Forms. There are millions of professional and express-specific kinds you may use for your personal enterprise or specific needs.

Form popularity

FAQ

The shared-ride program allows senior citizens (65 years of age and older) to use shared-ride services.

We offer help at home, meals, support for caregivers, health and wellness activities, protective services, prescription services, legal assistance and more to support keeping older adults independent, safe and healthy.

The OPTIONS Care Management Program Home Delivered Meals. Adult Day Services, also known as Social Day Care. Personal Care Services or Home support. Personal Emergency Response Systems. Medical Equipment, Supplies, Assistive/ Adaptive Devices (not paid for through your health insurance)

Stock options are taxable as compensation on the date they are exercised or when any substantial restrictions lapse. The difference between the fair market value of the stock on the date the option... Should people pay PA personal income tax on their gambling and lottery winnings?

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

The OPTIONS Program provides care management and in-home services to seniors who are experiencing some degree of frailty in their physical or mental health status. Potential consumers for this program may be considering nursing facility care or other placement options, but would prefer to remain at home.

The OPTIONS Program provides care management and in-home services to seniors who are experiencing some degree of frailty in their physical or mental health status. Potential consumers for this program may be considering nursing facility care or other placement options, but would prefer to remain at home.