Pennsylvania Stock Option Plan of National Penn Bancshares, Inc.

Description

How to fill out Stock Option Plan Of National Penn Bancshares, Inc.?

Discovering the right legitimate papers format could be a battle. Naturally, there are tons of themes accessible on the Internet, but how would you discover the legitimate develop you will need? Make use of the US Legal Forms internet site. The service offers thousands of themes, like the Pennsylvania Stock Option Plan of National Penn Bancshares, Inc., that can be used for business and personal demands. All of the forms are checked out by professionals and fulfill state and federal needs.

Should you be presently listed, log in to the bank account and click the Acquire key to get the Pennsylvania Stock Option Plan of National Penn Bancshares, Inc.. Use your bank account to look throughout the legitimate forms you may have purchased in the past. Proceed to the My Forms tab of your respective bank account and get one more version in the papers you will need.

Should you be a brand new end user of US Legal Forms, allow me to share basic directions so that you can stick to:

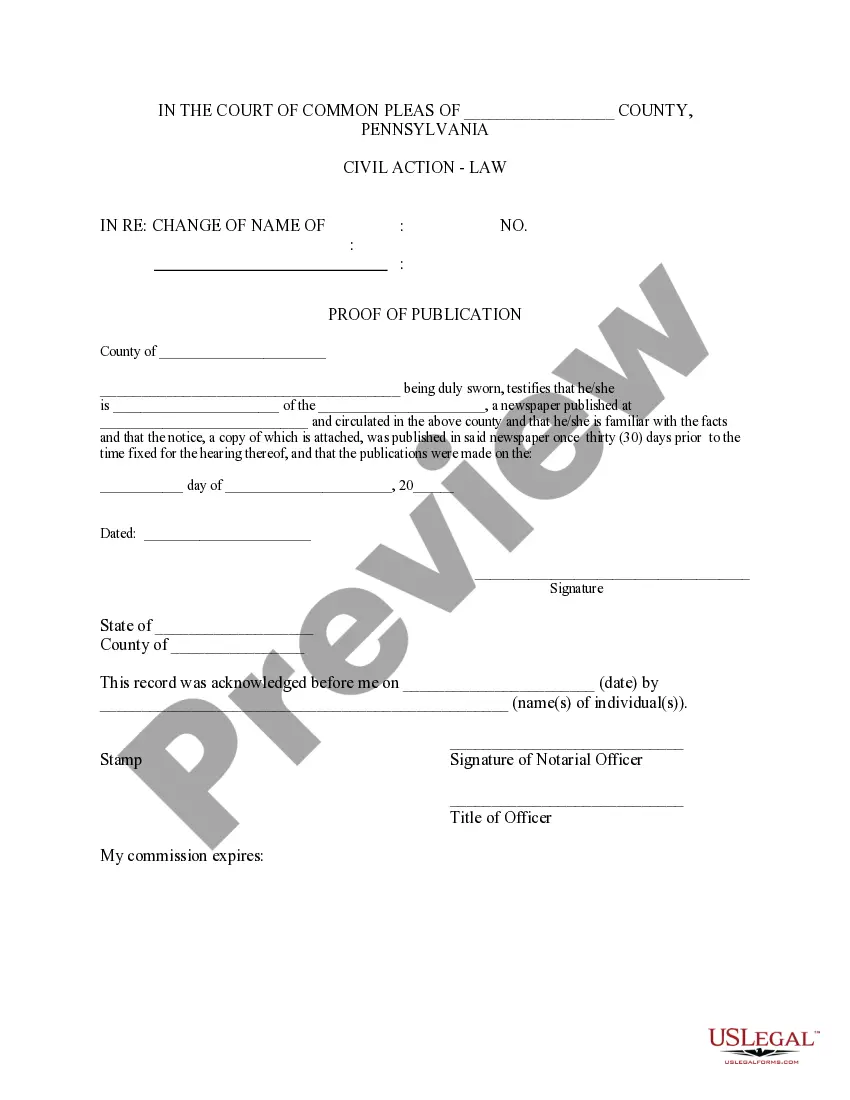

- Initial, make certain you have chosen the appropriate develop for the town/region. You can look through the shape making use of the Preview key and study the shape information to make certain this is basically the right one for you.

- When the develop fails to fulfill your expectations, take advantage of the Seach field to get the proper develop.

- When you are certain that the shape is suitable, click the Get now key to get the develop.

- Pick the prices strategy you need and enter the required info. Build your bank account and purchase an order with your PayPal bank account or charge card.

- Pick the data file structure and obtain the legitimate papers format to the device.

- Total, revise and print and signal the obtained Pennsylvania Stock Option Plan of National Penn Bancshares, Inc..

US Legal Forms may be the largest catalogue of legitimate forms for which you can find a variety of papers themes. Make use of the company to obtain appropriately-produced paperwork that stick to status needs.

Form popularity

FAQ

In August 2015, it was announced National Penn had been acquired by BB&T, which was expanding its presence in the mid-Atlantic states. National Penn CEO Scott Fainor said the deal was practical because BB&T could offer customers a wider range of products and services, such as deposit, loan and insurance offerings.

National Penn Bancshares Inc., which in 2007 bought Lehigh Valley bank KNBT and in 2014 opened a headquarters in center city Allentown, was itself purchased on Monday, ing to a news release. BB&T Corp., of Winston-Salem, North Carolina, bought National Penn for $1.8 billion.

WINSTON-SALEM, N.C., April 4, 2016 /PRNewswire/ -- BB&T Corporation (NYSE: BBT) today announced it has completed its acquisition of National Penn Bancshares, Inc., (NASDAQ: NPBC) effective April 1, 2016.