The Pennsylvania Approval of Employee Stock Ownership Plan (ESOP) of Franklin Co. is an important business arrangement that allows employees of the company to acquire ownership of stock within the company. This plan offers numerous benefits to both the company and its employees, ensuring a brighter and more prosperous future for all stakeholders involved. The ESOP is a specific type of retirement plan whereby the company contributes shares of its own stock or cash to a trust fund established for the employees. The shares are allocated to individual employee accounts based on their compensation or years of service, fostering a sense of ownership and motivation among the workforce. The funds in the trust are then used to gradually buy out the business owner's shares, effectively transitioning the ownership to the employees. One of the primary benefits of the Pennsylvania Approval of Employee Stock Ownership Plan is the potential tax advantages it offers. As the company contributes shares or cash to the trust, these contributions are usually tax-deductible for the company, reducing its overall tax liability. Additionally, employees who participate in the ESOP can enjoy tax-deferred growth on their shares until they retire or leave the company. Upon distribution, the employees may even qualify for favorable tax treatment if they hold the stock for a certain period before selling. The approval process for the Pennsylvania Approval of Employee Stock Ownership Plan is a crucial step in implementing this arrangement. The company must comply with the rules and regulations set by the Pennsylvania Department of Community and Economic Development, ensuring that all legal requirements are met. This approval typically involves the submission of necessary paperwork, such as detailed financial statements and information about the ESOP's structure and governance. It's important to note that there may not be different types of Pennsylvania Approval of Employee Stock Ownership Plan specific to Franklin Co. However, companies within Franklin Co. can customize their Sops based on their unique needs and objectives. They can decide on the allocation method, vesting schedule, and other parameters that best align with their goals and the preferences of their workforce. In summary, the Pennsylvania Approval of Employee Stock Ownership Plan offers an excellent opportunity for companies in Franklin Co. to foster employee engagement, loyalty, and motivation through shared ownership. By allowing employees to acquire company stock, this plan not only provides a retirement benefit but also aligns their interests with the long-term success of the company. The process of obtaining approval for this plan ensures compliance with legal requirements and sets the stage for a successful ESOP implementation.

Pennsylvania Approval of Employee Stock Ownership Plan of Franklin Co.

Description

How to fill out Pennsylvania Approval Of Employee Stock Ownership Plan Of Franklin Co.?

Are you currently in the place that you require documents for either business or individual uses virtually every day time? There are plenty of authorized document layouts accessible on the Internet, but discovering kinds you can depend on isn`t straightforward. US Legal Forms delivers a large number of kind layouts, much like the Pennsylvania Approval of Employee Stock Ownership Plan of Franklin Co., which can be published in order to meet federal and state demands.

Should you be currently knowledgeable about US Legal Forms web site and possess a free account, just log in. After that, you can down load the Pennsylvania Approval of Employee Stock Ownership Plan of Franklin Co. web template.

If you do not come with an account and would like to start using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is to the proper metropolis/area.

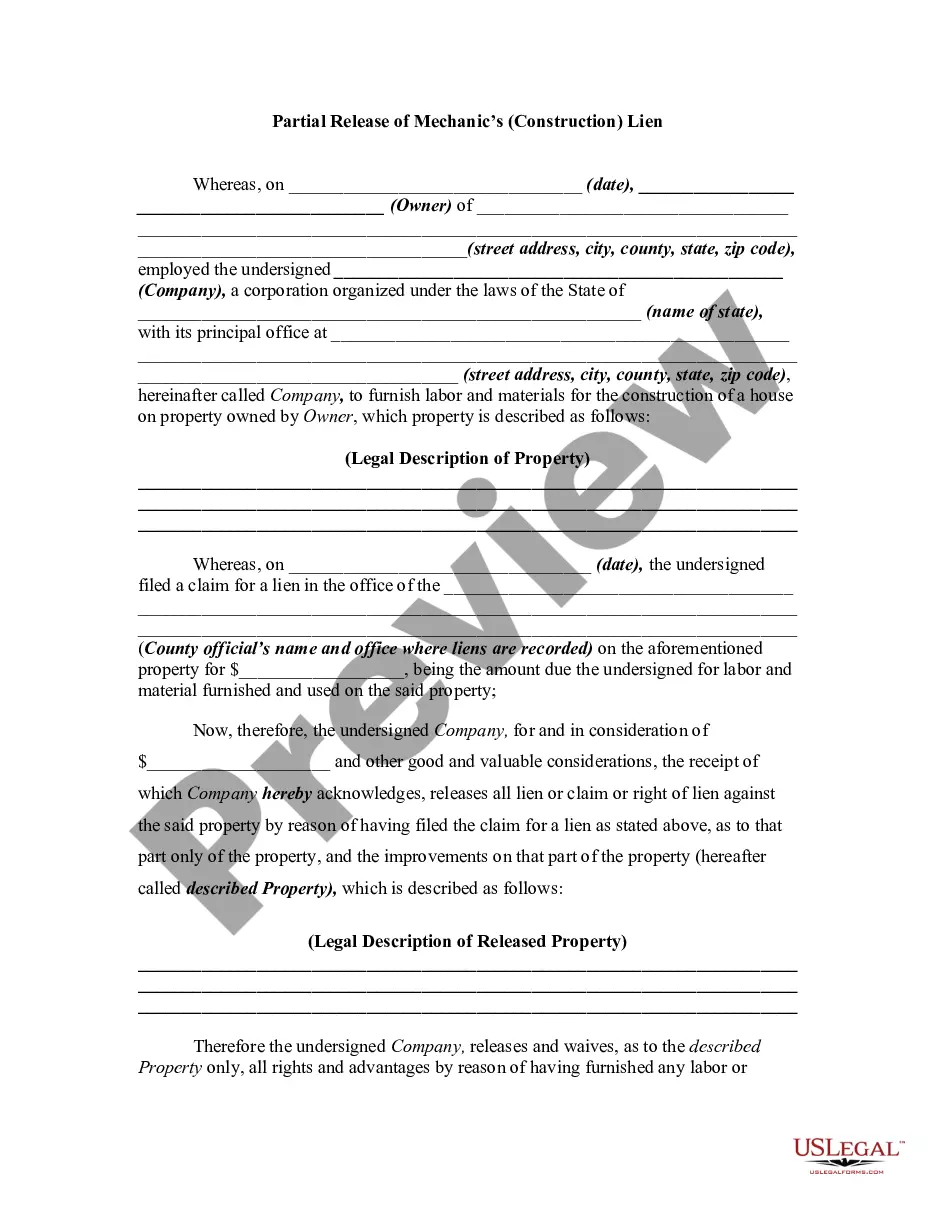

- Take advantage of the Review button to analyze the shape.

- Look at the outline to ensure that you have selected the proper kind.

- When the kind isn`t what you`re searching for, make use of the Search field to get the kind that suits you and demands.

- If you get the proper kind, simply click Purchase now.

- Opt for the rates program you want, fill in the specified info to produce your bank account, and buy the order making use of your PayPal or bank card.

- Pick a practical document format and down load your version.

Discover all of the document layouts you may have purchased in the My Forms food list. You can get a more version of Pennsylvania Approval of Employee Stock Ownership Plan of Franklin Co. anytime, if required. Just click on the required kind to down load or print the document web template.

Use US Legal Forms, by far the most extensive selection of authorized forms, to conserve time as well as steer clear of mistakes. The service delivers appropriately produced authorized document layouts that can be used for an array of uses. Create a free account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate. ESOPs are qualified defined contribution retirement plans.

To qualify, ESPPs generally have to be available to all full-time employees with a certain amount of time vested in the job. Participants may need to hold their shares for at least one year after the purchase date and two years after the grant date to take advantage of the long-term capital gains rate.

ESOPs give the sponsoring company?the selling shareholder?and participants various tax benefits, making them qualified plans, and are often used by employers as a corporate finance strategy to align the interests of their employees with those of their shareholders.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

How Do You Start an ESOP? To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for the ESOP to buy company shares, or both. The ESOP trust will own the stock and allocate shares to individual employee's accounts.

An employee stock ownership plan (ESOP) is a uniquely powerful employer-sponsored qualified benefit plan. That's because an ESOP offers business-building tax advantages while employees earn ownership stakes in the company to build their own retirement wealth.