Pennsylvania Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Choosing the best lawful document web template might be a have a problem. Naturally, there are plenty of templates accessible on the Internet, but how will you find the lawful form you want? Utilize the US Legal Forms web site. The services gives 1000s of templates, including the Pennsylvania Retirement Benefits Plan, that can be used for business and personal requirements. All the types are examined by experts and meet federal and state specifications.

If you are presently signed up, log in for your profile and click on the Acquire option to obtain the Pennsylvania Retirement Benefits Plan. Make use of profile to appear from the lawful types you possess acquired previously. Visit the My Forms tab of the profile and obtain yet another version of the document you want.

If you are a fresh user of US Legal Forms, listed here are straightforward directions that you can adhere to:

- First, ensure you have selected the proper form for your personal town/county. You can examine the shape using the Preview option and read the shape explanation to ensure it will be the best for you.

- In the event the form fails to meet your requirements, utilize the Seach discipline to discover the right form.

- Once you are certain that the shape is proper, go through the Get now option to obtain the form.

- Choose the pricing prepare you would like and enter in the needed information and facts. Build your profile and pay for the order with your PayPal profile or credit card.

- Opt for the document formatting and down load the lawful document web template for your product.

- Full, edit and print and indicator the obtained Pennsylvania Retirement Benefits Plan.

US Legal Forms is definitely the largest catalogue of lawful types in which you can see different document templates. Utilize the company to down load expertly-produced documents that adhere to condition specifications.

Form popularity

FAQ

The minimum retirement age for service retirement for most members is 50 years with five years of service credit. The more service credit you have, the higher your retirement benefits will be. There are three basic types of retirement: service, disability, and industrial disability.

The law mandates that all service and benefits payable to a PSERS member be forfeited if the member is found guilty of, or enters a plea of guilty or nolo contendere to, any crime identified in the Forfeiture Act, when the crime is committed through the member's position as a public employee or official or when the ...

Pennsylvania fully exempts all income from Social Security, as well as payments from retirement accounts, like 401(k)s and IRAs. It also exempts pension income for seniors age 60 or older. While its property tax rates are higher than average, the average total sales tax rate is among the 20 lowest in the country.

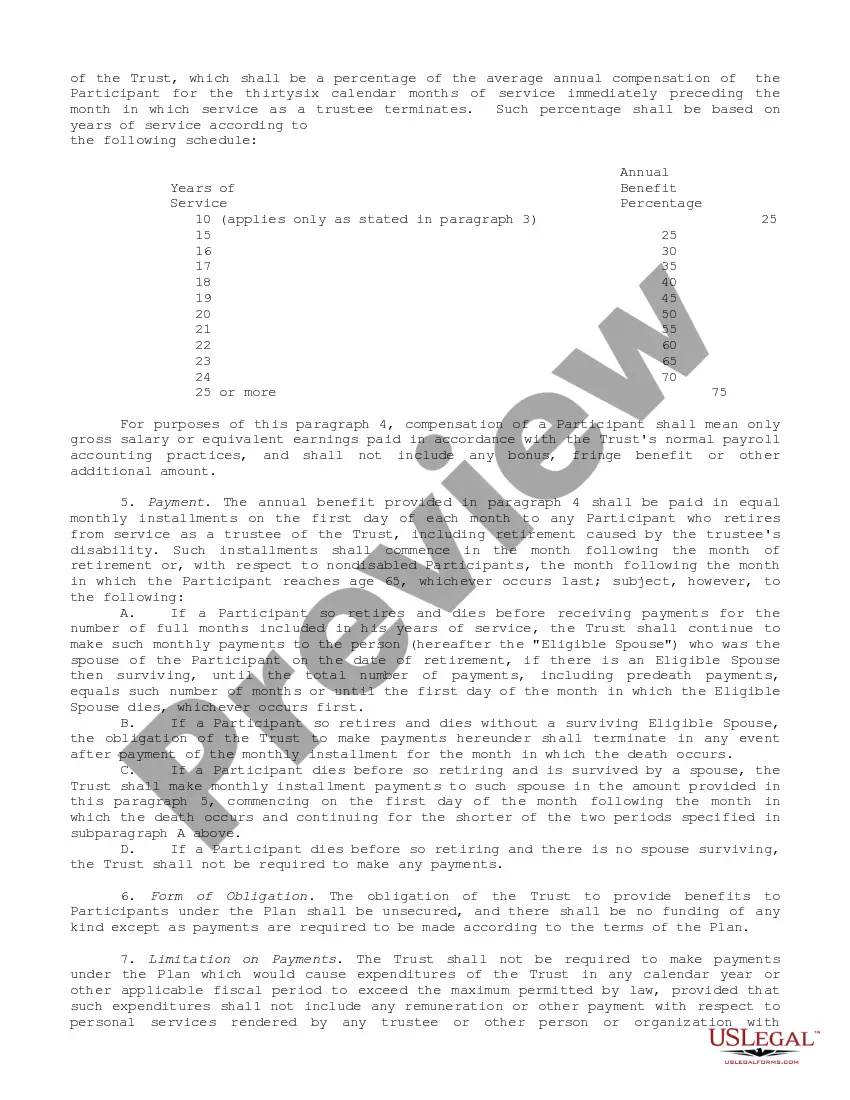

Employees may begin collecting full benefits at age 65 if they have completed 10 years of service. Those with 35 years of completed service may retire as soon as the sum of their age and years of service total 92. Employees are required to contribute 6.25 percent of their salaries each year to the plan.

Age 65 with at least three (3) years of credited service, or any age/service combination that totals 92 (?Rule of 92?) with a minimum of 35 years of service.

On December 16, 2022 the PSERS Board of Trustees certified an employer contribution rate of 34.00% for fiscal year (FY) 2023/2024, which begins July 1, 2023. The 34.00% rate is composed of a 0.64% rate for health insurance premium assistance, 0.27% for Act 5 Defined Contribution, and a pension rate of 33.09%.

Basic Formula For most SERS members, that's 2.5% of their final average salary for each year of credited service, but this can change depending on your class of service.

In most cases, yes. The PSERS pension monthly income provides you with consistent lifetime income. This is a great benefit, but it will lose value over time due to inflation.