Pennsylvania Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

You can spend hrs on the Internet looking for the lawful papers web template that meets the state and federal specifications you will need. US Legal Forms provides a huge number of lawful forms which can be analyzed by professionals. You can easily obtain or produce the Pennsylvania Profit Sharing Plan from our assistance.

If you currently have a US Legal Forms bank account, you can log in and click the Acquire key. Next, you can total, modify, produce, or indicator the Pennsylvania Profit Sharing Plan. Every single lawful papers web template you purchase is your own eternally. To get one more version of the obtained kind, check out the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site initially, adhere to the basic guidelines beneath:

- Very first, be sure that you have chosen the right papers web template for your region/area of your liking. Browse the kind outline to make sure you have selected the right kind. If readily available, use the Review key to look throughout the papers web template at the same time.

- If you wish to locate one more edition of your kind, use the Research area to obtain the web template that suits you and specifications.

- Once you have found the web template you want, just click Get now to move forward.

- Find the rates plan you want, enter your references, and register for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal bank account to purchase the lawful kind.

- Find the format of your papers and obtain it to the product.

- Make alterations to the papers if possible. You can total, modify and indicator and produce Pennsylvania Profit Sharing Plan.

Acquire and produce a huge number of papers templates making use of the US Legal Forms web site, that offers the biggest collection of lawful forms. Use professional and express-particular templates to tackle your small business or specific requires.

Form popularity

FAQ

Employee benefits in a profit-sharing plan are subject to IRS rules designed to discourage early withdrawal. As with a 401(k), employees who take distributions from their profit-sharing plan's retirement account before age 59.5 will face a 10% penalty. Withdrawals will be taxed as income.

The minimum retirement age for service retirement for most members is 50 years with five years of service credit. The more service credit you have, the higher your retirement benefits will be. There are three basic types of retirement: service, disability, and industrial disability.

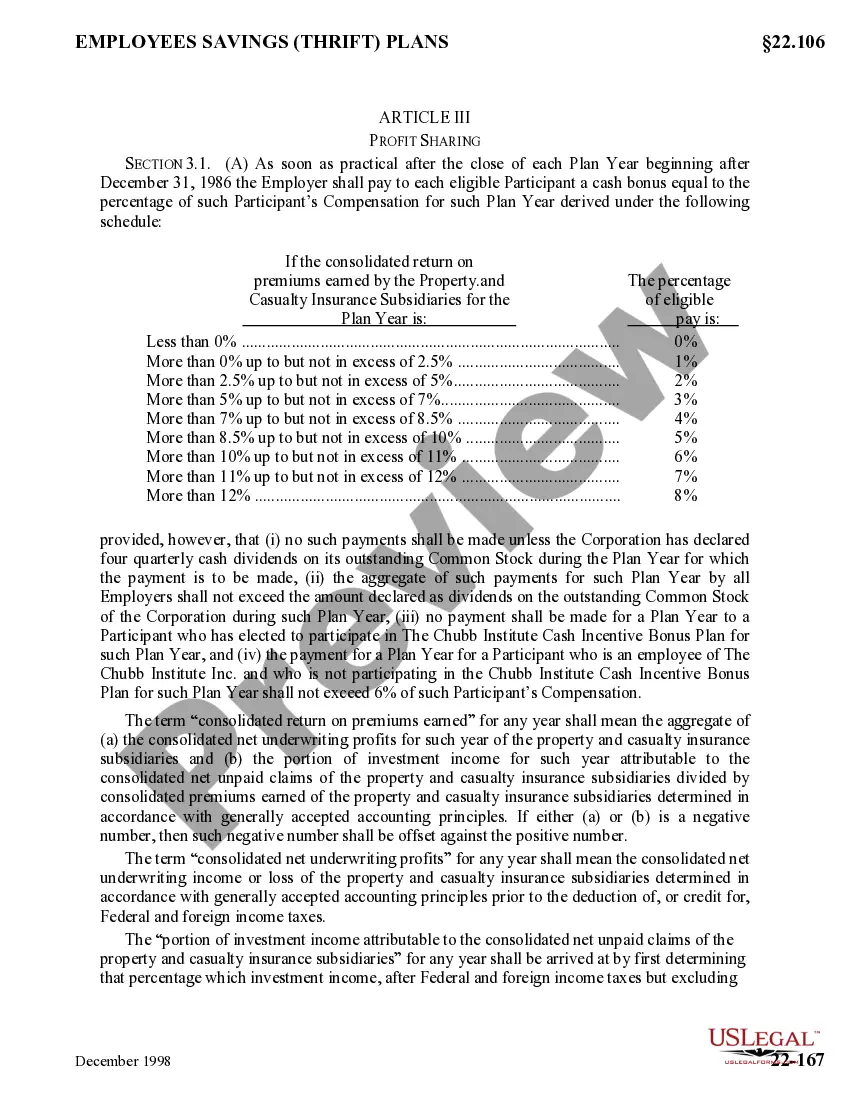

What is profit-sharing? A profit-sharing plan is a retirement plan that allows an employer or company owner to share the profits in the business, up to 25 percent of the company's payroll, with the firm's employees.

In most cases, yes. The PSERS pension monthly income provides you with consistent lifetime income. This is a great benefit, but it will lose value over time due to inflation.

If you are a state employee not in education, the SERS manages your pension. If you work in public education, PSERS manages your retirement savings.

The law mandates that all service and benefits payable to a PSERS member be forfeited if the member is found guilty of, or enters a plea of guilty or nolo contendere to, any crime identified in the Forfeiture Act, when the crime is committed through the member's position as a public employee or official or when the ...

On December 16, 2022 the PSERS Board of Trustees certified an employer contribution rate of 34.00% for fiscal year (FY) 2023/2024, which begins July 1, 2023. The 34.00% rate is composed of a 0.64% rate for health insurance premium assistance, 0.27% for Act 5 Defined Contribution, and a pension rate of 33.09%.

Age 65 with at least three (3) years of credited service, or any age/service combination that totals 92 (?Rule of 92?) with a minimum of 35 years of service.