The Pennsylvania Approval of Executive Director Loan Plan is a program designed to provide financial assistance to executive directors for various purposes. This plan aims to support and empower executive directors in Pennsylvania by offering loans with favorable terms and conditions. Under this program, executive directors can obtain loans to meet their personal or professional needs, such as home renovation, debt consolidation, educational expenses, or business development. The loans are structured to provide flexible repayment options, competitive interest rates, and reasonable borrowing limits. Executive directors who qualify for the Pennsylvania Approval of Executive Director Loan Plan can benefit from a streamlined application process and quick approval. The loan terms and conditions are carefully reviewed and approved by the relevant authorities to ensure they are in line with the borrower's financial capabilities and the program's objectives. There are different types of loan plans available under the Pennsylvania Approval of Executive Director Loan Program. These include: 1. Personal Development Loan Plan: This type of loan is tailored to help executive directors pursue personal endeavors, such as further education, certifications, or acquiring new skills. It provides funding for tuition fees, course materials, and other related expenses. 2. Business Growth Loan Plan: This loan plan is designed to facilitate the growth and expansion of executive directors' businesses. It offers financial support for various business-related activities, such as purchasing equipment, expanding facilities, or launching new products/services. 3. Housing Enhancement Loan Plan: Under this type of loan plan, executive directors can access funds to renovate or improve their residential properties. The loan can be used for repairs, remodeling, energy-efficient upgrades, or other home improvement projects. 4. Debt Consolidation Loan Plan: This loan option helps executive directors manage their existing debts by merging them into a single loan. It offers lower interest rates and simplified repayment terms, enabling borrowers to regain control of their finances. The Pennsylvania Approval of Executive Director Loan Plan aims to foster economic development, support professional advancement, and enhance the overall well-being of executive directors in Pennsylvania. By offering affordable and accessible financing, the program helps executive directors achieve their personal and professional goals, thereby contributing to the growth and success of both individuals and the community as a whole.

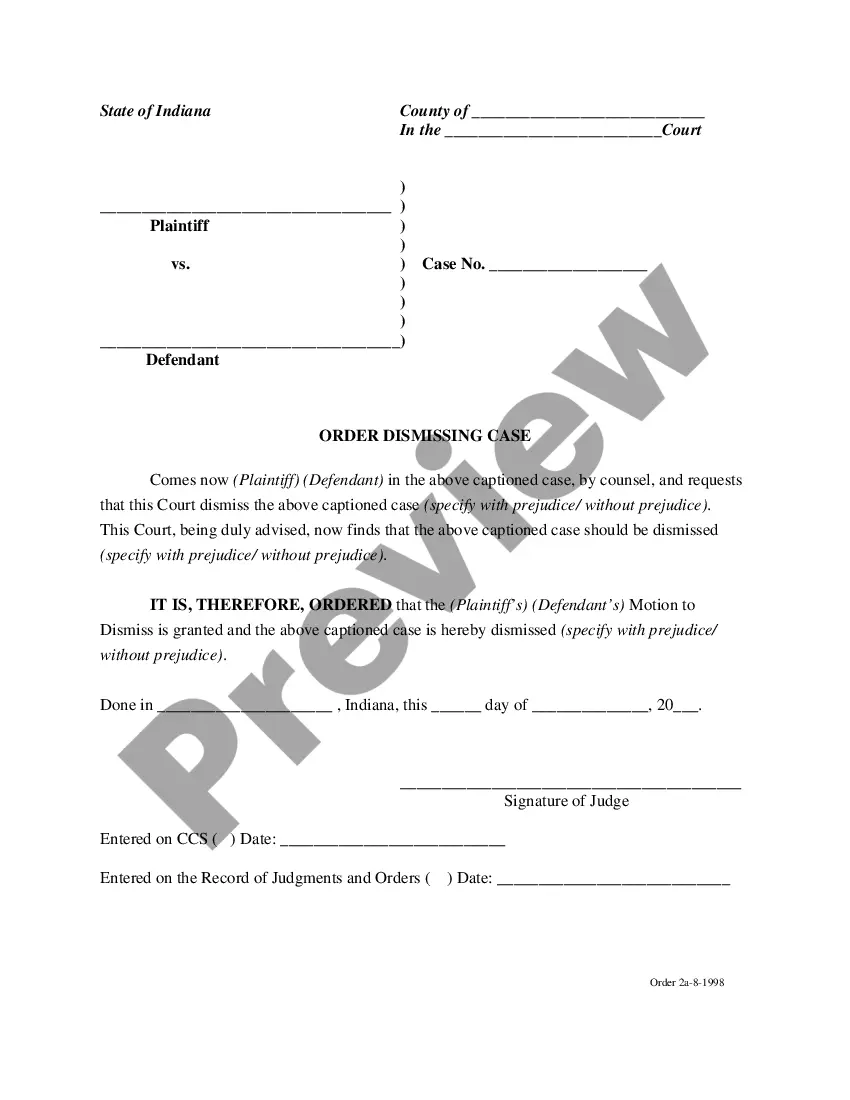

Pennsylvania Approval of executive director loan plan

Description

How to fill out Pennsylvania Approval Of Executive Director Loan Plan?

Finding the right legitimate record web template can be quite a battle. Naturally, there are a lot of templates accessible on the Internet, but how can you find the legitimate develop you require? Use the US Legal Forms internet site. The assistance gives a huge number of templates, such as the Pennsylvania Approval of executive director loan plan, that can be used for business and private requires. All of the types are checked out by professionals and fulfill state and federal requirements.

In case you are already signed up, log in to the profile and then click the Down load button to obtain the Pennsylvania Approval of executive director loan plan. Make use of your profile to appear with the legitimate types you possess bought earlier. Visit the My Forms tab of your profile and acquire one more duplicate in the record you require.

In case you are a brand new end user of US Legal Forms, listed here are straightforward directions that you should follow:

- First, be sure you have chosen the appropriate develop for the town/region. You can check out the shape while using Review button and browse the shape information to guarantee this is basically the best for you.

- If the develop fails to fulfill your needs, take advantage of the Seach discipline to discover the proper develop.

- Once you are positive that the shape is proper, click the Get now button to obtain the develop.

- Select the rates strategy you need and type in the required information and facts. Create your profile and purchase an order with your PayPal profile or charge card.

- Select the submit file format and download the legitimate record web template to the device.

- Full, revise and print and indicator the acquired Pennsylvania Approval of executive director loan plan.

US Legal Forms is the most significant catalogue of legitimate types for which you can find different record templates. Use the company to download skillfully-manufactured files that follow status requirements.

Form popularity

FAQ

The Public Service Loan Forgiveness (PSLF) program, which is available to PAs who work for state-run or not-for-profit clinics is probably the most well-known. It offers complete student loan forgiveness of a borrower's remaining balance in as little as 10 years (120 qualifying payments).

Public Service Loan Forgiveness Program Physician assistants working for non-profit or government organizations providing emergency management services, care for individuals with disabilities and/or the elderly, or public health services may be eligible for the program.