The Pennsylvania Supplemental Employee Stock Ownership Plan (ESOP) of SIX Corporations is a unique retirement benefit program designed to provide employees with an ownership stake in the company. This plan serves as an additional component to the existing ESOP offered by SIX Corporations, providing eligible employees in Pennsylvania with an opportunity to accumulate shares of SIX Corporations stock for their future financial security. As a leading diversified industrial company, SIX Corporations recognizes the value of empowering its employees by allowing them to have a direct interest in the success of the company. The Pennsylvania Supplemental ESOP serves as a mechanism to incentivize employees, foster a collaborative work environment, and ensure long-term loyalty towards the company's objectives. The Pennsylvania Supplemental ESOP operates in parallel with the primary ESOP, enabling eligible employees to acquire additional shares beyond those held in the primary plan. This supplementary plan allows employees to accumulate a more substantial ownership stake, enhancing the potential for capital appreciation and wealth creation. The primary goal of the Pennsylvania Supplemental ESOP is to provide employees an extra avenue for retirement savings and wealth accumulation, helping to create a sense of financial security for their future. By participating in this plan, eligible employees receive regular allocations of SIX Corporations stock, which are carefully managed and administered by the plan's trustees. Employees who participate in the Pennsylvania Supplemental ESOP benefit from the potential growth of SIX Corporations stock price over the long term. As the stock price increases, the value of their ESOP account grows accordingly, fostering a sense of shared success and rewarding their commitment to the company's growth. It is important to note that the Pennsylvania Supplemental ESOP is just one variation of ESOP offered by SIX Corporations. The company may have different ESOP plans tailored to specific regions or employee groups, each with its own unique features and eligibility criteria. These area-specific plans ensure that employees nationwide have the opportunity to participate in an ESOP and experience the benefits of employee ownership. In summary, the Pennsylvania Supplemental Employee Stock Ownership Plan of SIX Corporations is an additional retirement benefit program that allows eligible employees in Pennsylvania to accumulate shares of the company's stock, thereby providing them with an ownership stake and potential financial security. By participating in this plan, employees have the opportunity to benefit from the company's growth and success over the long term, reinforcing a sense of ownership and loyalty towards SIX Corporations.

Pennsylvania Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

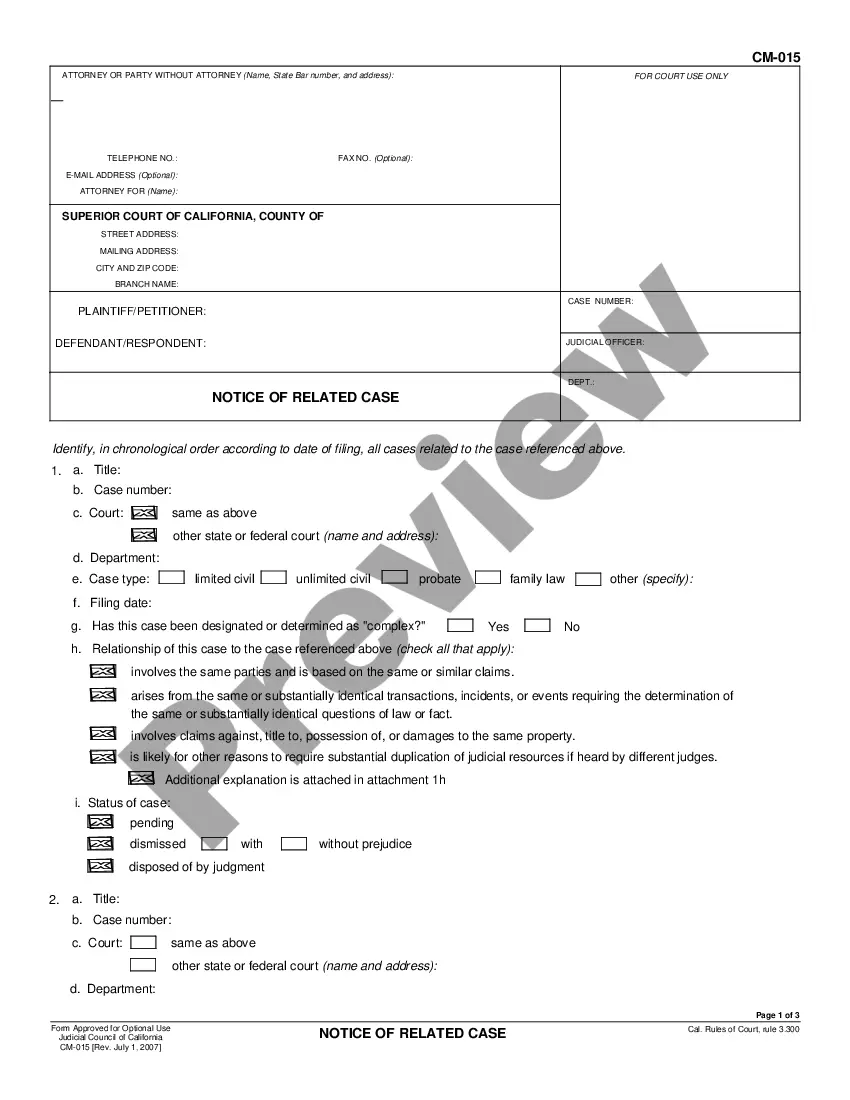

How to fill out Pennsylvania Supplemental Employee Stock Ownership Plan Of SPX Corporation?

If you wish to comprehensive, down load, or print legitimate record web templates, use US Legal Forms, the greatest variety of legitimate types, which can be found on-line. Make use of the site`s simple and easy hassle-free research to obtain the papers you want. Numerous web templates for organization and personal uses are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Pennsylvania Supplemental Employee Stock Ownership Plan of SPX Corporation in just a few click throughs.

Should you be currently a US Legal Forms consumer, log in to the profile and click on the Download switch to find the Pennsylvania Supplemental Employee Stock Ownership Plan of SPX Corporation. You may also accessibility types you earlier downloaded inside the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the proper town/region.

- Step 2. Use the Review solution to check out the form`s articles. Do not forget about to read through the information.

- Step 3. Should you be not satisfied together with the kind, utilize the Lookup discipline towards the top of the display to get other types of the legitimate kind template.

- Step 4. When you have identified the shape you want, click on the Acquire now switch. Pick the costs plan you prefer and add your accreditations to register for an profile.

- Step 5. Method the financial transaction. You can utilize your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the structure of the legitimate kind and down load it on the gadget.

- Step 7. Total, revise and print or signal the Pennsylvania Supplemental Employee Stock Ownership Plan of SPX Corporation.

Each legitimate record template you get is your own property for a long time. You might have acces to each and every kind you downloaded within your acccount. Go through the My Forms section and select a kind to print or down load once again.

Compete and down load, and print the Pennsylvania Supplemental Employee Stock Ownership Plan of SPX Corporation with US Legal Forms. There are millions of expert and condition-certain types you can use for your personal organization or personal requirements.