Pennsylvania Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

If you wish to full, acquire, or printing lawful papers templates, use US Legal Forms, the biggest collection of lawful forms, that can be found on the Internet. Make use of the site`s basic and convenient look for to obtain the paperwork you want. Different templates for organization and personal uses are sorted by groups and suggests, or key phrases. Use US Legal Forms to obtain the Pennsylvania Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company in just a couple of clicks.

In case you are currently a US Legal Forms customer, log in to your profile and click on the Download button to obtain the Pennsylvania Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company. You can also entry forms you previously acquired inside the My Forms tab of your respective profile.

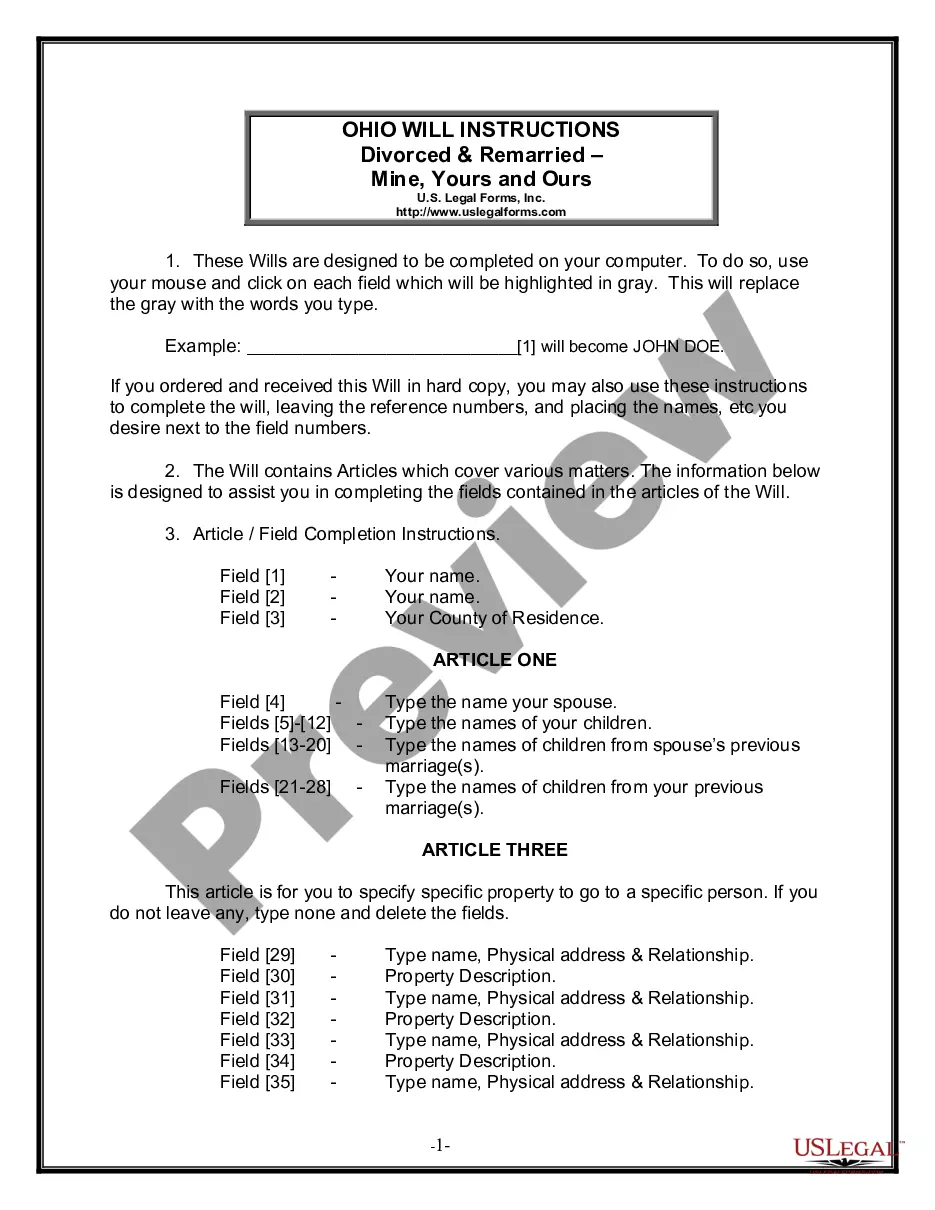

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the form for your right area/nation.

- Step 2. Utilize the Review solution to look over the form`s information. Do not forget about to see the outline.

- Step 3. In case you are not satisfied with the kind, take advantage of the Research discipline near the top of the display to get other models from the lawful kind design.

- Step 4. Upon having located the form you want, click the Buy now button. Select the rates strategy you like and put your references to register for an profile.

- Step 5. Method the deal. You may use your credit card or PayPal profile to perform the deal.

- Step 6. Choose the format from the lawful kind and acquire it on your own system.

- Step 7. Complete, edit and printing or indicator the Pennsylvania Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company.

Every lawful papers design you buy is yours eternally. You might have acces to every kind you acquired in your acccount. Go through the My Forms portion and pick a kind to printing or acquire yet again.

Be competitive and acquire, and printing the Pennsylvania Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company with US Legal Forms. There are thousands of professional and state-distinct forms you may use for your personal organization or personal requires.