Title: Understanding the Pennsylvania Amendment to Articles of Incorporation to Change the Terms of Authorized Preferred Stock Introduction: The Pennsylvania Amendment to Articles of Incorporation provides a mechanism for Pennsylvania-based corporations to modify the terms of their authorized preferred stock. This amendment allows companies to adapt to changing market conditions, investor preferences, or corporate development needs. In this article, we will delve into the details of this amendment and explore potential variations of amendments specific to changing the terms of authorized preferred stock. Overview of the Pennsylvania Amendment to Articles of Incorporation: Under Pennsylvania law, corporations can modify their Articles of Incorporation through an amendment process. This process enables companies to revise various provisions, including the terms governing preferred stock, which is a class of stock that carries specific rights or privileges compared to common stock. The preferred stock terms that can be adjusted through the amendment may include dividend rates, conversion rights, redemption provisions, voting rights, liquidation preference, and other essential attributes that impact the rights and powers of preferred stockholders. Types of Pennsylvania Amendments to Articles of Incorporation Regarding Preferred Stock: 1. Dividend Rate Amendment: This amendment facilitates changes in the dividend rate paid to preferred shareholders. Pennsylvania's corporations can adjust the dividend percentage or modify dividend payment frequency to better align with the company's financial position, industry trends, or investor expectations. 2. Conversion Rights Amendment: This amendment allows corporations to modify the conversion rights associated with the preferred stock. Companies may choose to alter conversion ratios (the number of common shares received upon conversion), conversion prices, or conversion triggers, which can impact the ability of preferred stockholders to convert their shares into common stock. 3. Redemption Provision Amendment: Pennsylvania corporations can use this type of amendment to change the redemption provisions of the authorized preferred stock. It permits modifications to dates, prices, or conditions under which preferred shares can be redeemed, providing flexibility to adapt to changing market conditions or business strategies. 4. Voting Rights and Powers Amendment: This amendment empowers corporations to revise the voting rights and powers associated with preferred stock. Adjustments may include modifying voting rights on specific matters, altering the number of votes per share, or expanding or limiting preferred stockholders' influence in corporate decisions. 5. Liquidation Preference Amendment: Corporations can amend the liquidation preference provisions of their preferred stock through this amendment. It enables adjustments to the priority and amount of distribution preferred stockholders receive in case of liquidation, acquisition, or winding up of the company. Conclusion: Pennsylvania corporations have the ability to shape the terms and conditions of their authorized preferred stock through the Amendment to Articles of Incorporation process. By utilizing specific amendments such as those mentioned above, companies can fine-tune their preferred stock terms to adapt to changing circumstances, ensure fairness among shareholders, and meet the evolving needs of their business and investors. Understanding the intricacies of these amendments is essential for businesses seeking to modify the terms of their preferred stock in compliance with Pennsylvania state law.

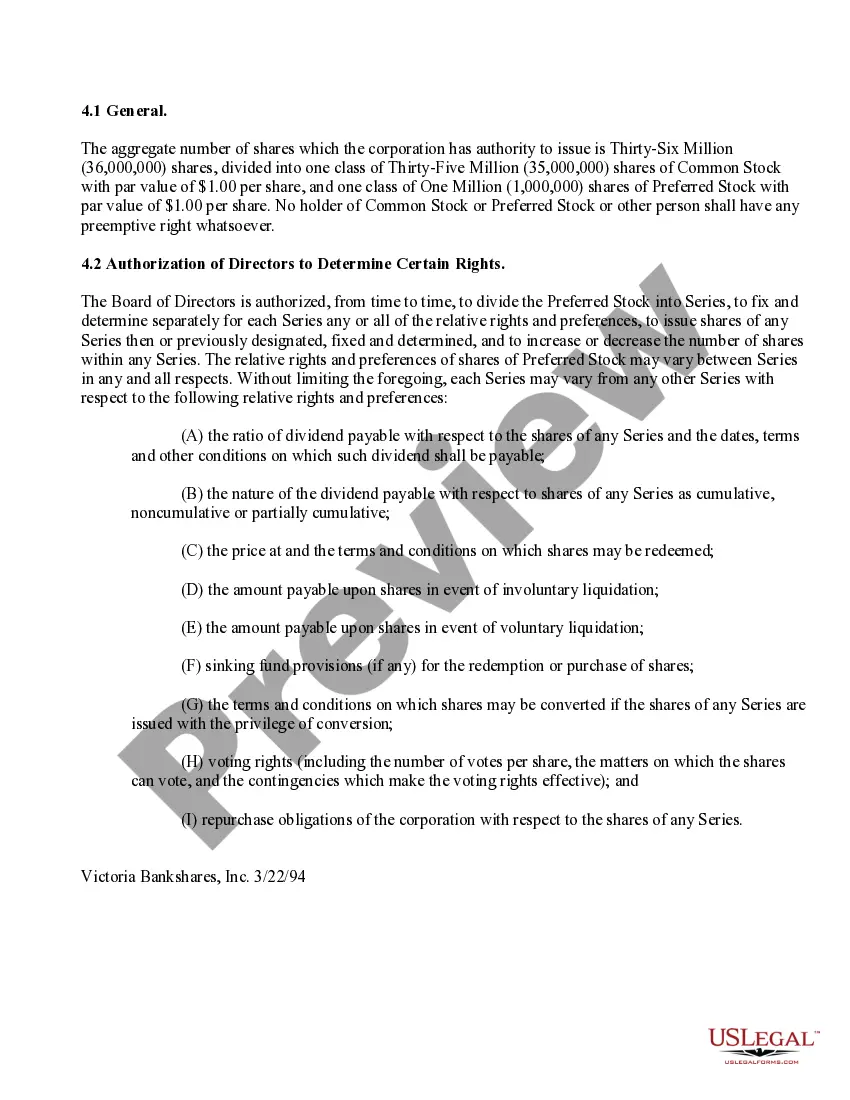

Pennsylvania Amendment to Articles of Incorporation to change the terms of the authorized preferred stock

Description

How to fill out Pennsylvania Amendment To Articles Of Incorporation To Change The Terms Of The Authorized Preferred Stock?

Finding the right legal file format can be a have difficulties. Needless to say, there are a lot of web templates accessible on the Internet, but how can you get the legal form you will need? Utilize the US Legal Forms website. The assistance gives 1000s of web templates, for example the Pennsylvania Amendment to Articles of Incorporation to change the terms of the authorized preferred stock, that you can use for business and private needs. All of the types are checked by specialists and satisfy federal and state specifications.

Should you be currently signed up, log in in your bank account and click on the Download key to get the Pennsylvania Amendment to Articles of Incorporation to change the terms of the authorized preferred stock. Use your bank account to search with the legal types you might have acquired formerly. Go to the My Forms tab of your own bank account and acquire an additional copy from the file you will need.

Should you be a new user of US Legal Forms, here are straightforward guidelines that you should stick to:

- First, make sure you have selected the right form for your personal metropolis/region. It is possible to look over the shape while using Preview key and look at the shape explanation to make certain it will be the right one for you.

- In the event the form fails to satisfy your expectations, take advantage of the Seach industry to find the correct form.

- When you are sure that the shape is proper, go through the Get now key to get the form.

- Choose the costs strategy you want and enter the required info. Create your bank account and pay for the transaction making use of your PayPal bank account or charge card.

- Select the document structure and acquire the legal file format in your device.

- Full, revise and printing and indicator the received Pennsylvania Amendment to Articles of Incorporation to change the terms of the authorized preferred stock.

US Legal Forms may be the biggest catalogue of legal types for which you can discover different file web templates. Utilize the company to acquire skillfully-made documents that stick to condition specifications.