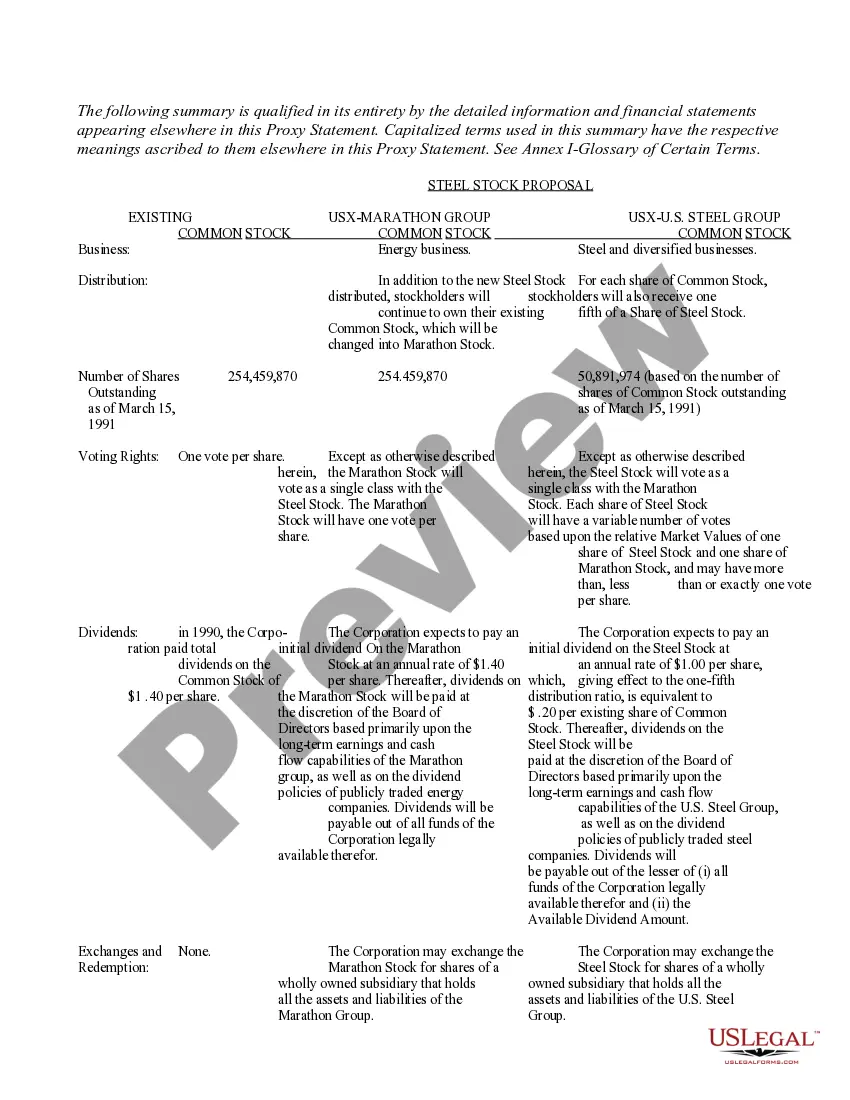

The Pennsylvania Proxy Statement and Prospectus of US Corporation serves as a comprehensive document that provides crucial information to shareholders and prospective investors about the company and its operations. The proxy statement discloses details about corporate governance matters and board elections, enabling shareholders to make informed decisions and exercise their voting rights. The prospectus, on the other hand, serves as a legal document that offers detailed insights into the company's financial health, strategy, risk factors, market position, and potential growth opportunities. It is commonly used by prospective investors to assess whether investing in US Corporation aligns with their investment objectives. Pennsylvania Proxy Statement of US Corporation is typically divided into several sections, each addressing different aspects of the company's governance and shareholder matters. These may include: 1. Board of Directors: This section provides information about the composition of the board, its committees, and the qualifications, expertise, and experience of individual directors. 2. Executive Compensation: This section details the compensation packages of top executives, including salaries, bonuses, stock options, and other benefits. 3. Shareholder Proposals: Here, shareholders can find information on any proposals submitted to the company by shareholders for inclusion in the proxy statement and exercising their voting rights. 4. Audit Committee: This section covers the functions and responsibilities of the audit committee, including oversight of the financial reporting process and internal controls. 5. Independent Auditors: It discloses the identity and scope of work undertaken by the external auditors of US Corporation. 6. Related Party Transactions: This section highlights any transactions between the company and its directors, executive officers, or affiliates, emphasizing transparency and avoiding conflicts of interest. 7. Voting Procedures: This part explains voting procedures, including how shareholders can vote on board elections and other matters and the deadlines for submitting their votes. 8. Corporate Governance: This section provides insights into the company's corporate governance practices, including codes of conduct, ethics policies, and board committee structure. US Corporation is likely to release prospectuses specific to different financial instruments such as common stocks, bonds, or derivatives. These prospectuses will provide investors with additional information tailored to the particular securities being offered. In summary, the Pennsylvania Proxy Statement and Prospectus of US Corporation are crucial documents that enhance transparency and provide essential information to shareholders and potential investors about the governance practices, financial position, and growth prospects of the company.

Pennsylvania Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Pennsylvania Proxy Statement And Prospectus Of USX Corporation?

You are able to commit several hours on the web looking for the lawful papers design that suits the state and federal demands you want. US Legal Forms provides 1000s of lawful forms that are evaluated by experts. It is possible to down load or produce the Pennsylvania Proxy Statement and Prospectus of USX Corporation from the assistance.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Obtain option. Following that, it is possible to full, revise, produce, or signal the Pennsylvania Proxy Statement and Prospectus of USX Corporation. Each lawful papers design you get is the one you have for a long time. To get yet another backup associated with a acquired kind, visit the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms web site the first time, adhere to the straightforward guidelines beneath:

- Very first, make certain you have chosen the right papers design for the county/area of your liking. See the kind information to ensure you have picked out the right kind. If offered, utilize the Preview option to look throughout the papers design at the same time.

- If you want to get yet another version of the kind, utilize the Research area to find the design that meets your requirements and demands.

- When you have found the design you desire, click Buy now to carry on.

- Find the prices strategy you desire, type your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You should use your Visa or Mastercard or PayPal bank account to fund the lawful kind.

- Find the structure of the papers and down load it in your gadget.

- Make alterations in your papers if necessary. You are able to full, revise and signal and produce Pennsylvania Proxy Statement and Prospectus of USX Corporation.

Obtain and produce 1000s of papers layouts utilizing the US Legal Forms website, which offers the greatest selection of lawful forms. Use skilled and state-particular layouts to handle your business or specific demands.

Form popularity

FAQ

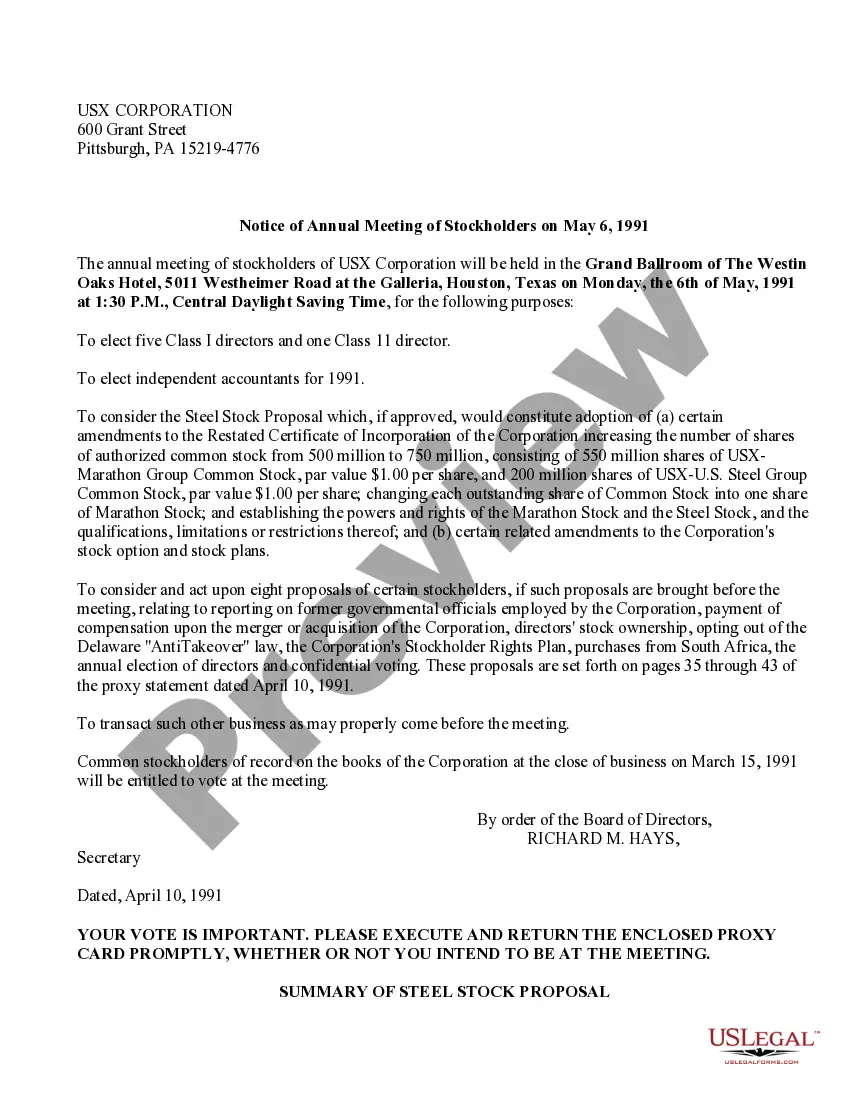

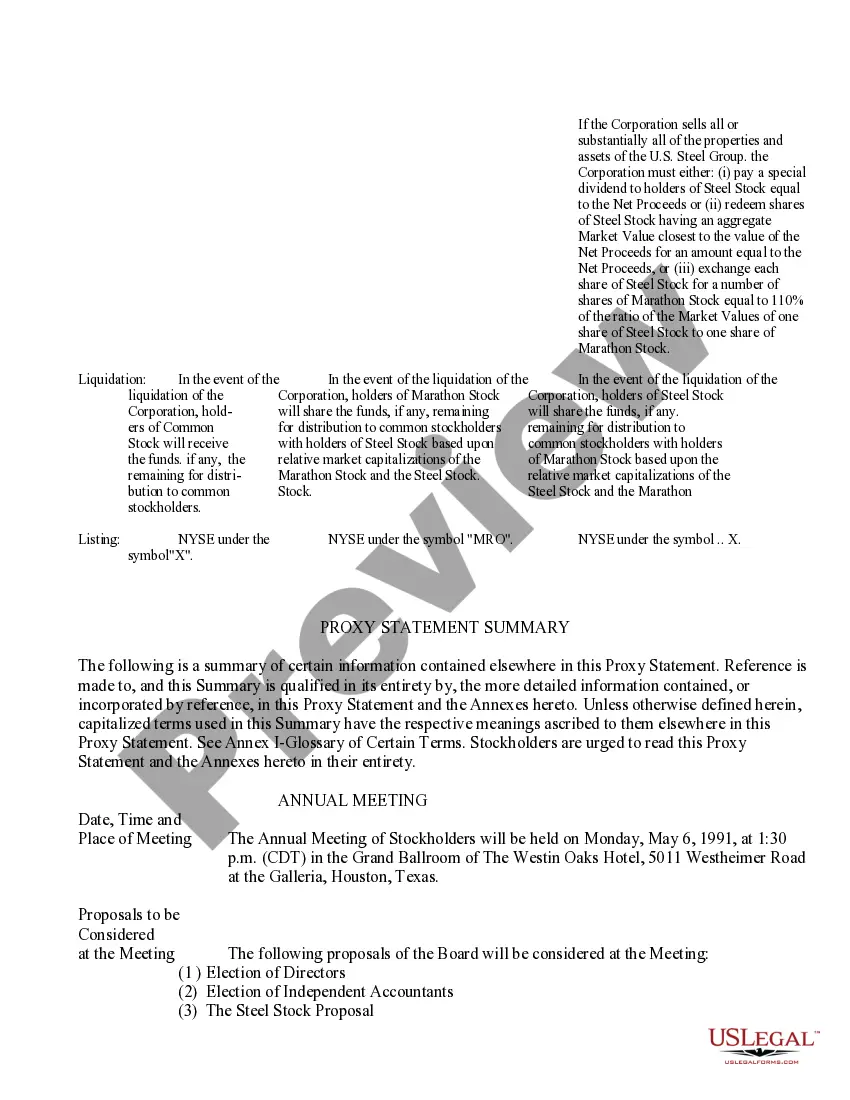

A proxy statement is a document that public companies must provide their shareholders prior to a shareholder meeting. The Securities and Exchange Commission (SEC) requires companies to file their proxy statement in compliance with Schedule 14A. Companies file proxy statements on a Form DEF 14A.

The proxy will detail business plans or issues on which the board may vote. This information, while sometimes contained in the 10-K, is often much more concise and easy to read in the proxy statement.

A proxy statement generally includes the names and short biographies of individuals on a company's board of directors, including those who are running for reelection and new candidates chosen by the board's nominating committee.

Proxy statements must disclose the company's voting procedure, nominated candidates for its board of directors, and compensation of directors and executives.

Joint Proxy Statement/Prospectus means a proxy statement to be filed with the SEC for the purpose of obtaining the Company Stockholder Approval at the Company Stockholders' Meeting and the Parent Stockholder Approval at the Parent Stockholders' Meeting, as amended or supplemented from time to time.

For example, if a member will be absent from a company meeting, they have the right to appoint another person (a non-member of the company) to attend the meeting and vote in their stead. This person is therefore called a Proxy.

Proxy statement examples may include the information about the directors' salaries, information about the bonus to the directors, additional the number of board of directors. The board forms the top layer of the hierarchy and focuses on ensuring that the company efficiently achieves its goals.

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

Proxy statements must offer insights into board and company performance, including: The salaries of the company's five highest-paid executives (including bonuses and equity) and the appropriate benchmark in chart form. Executive performance and the performance of executives of similar companies.