Pennsylvania Authorization to purchase corporation's outstanding common stock

Description

How to fill out Authorization To Purchase Corporation's Outstanding Common Stock?

Choosing the best lawful record template might be a struggle. Of course, there are plenty of web templates available on the net, but how will you get the lawful kind you need? Take advantage of the US Legal Forms site. The assistance gives thousands of web templates, including the Pennsylvania Authorization to purchase corporation's outstanding common stock, that can be used for enterprise and private needs. Every one of the types are checked out by specialists and satisfy federal and state requirements.

Should you be presently listed, log in in your bank account and then click the Download key to have the Pennsylvania Authorization to purchase corporation's outstanding common stock. Make use of bank account to search through the lawful types you possess bought earlier. Go to the My Forms tab of your respective bank account and obtain one more duplicate of the record you need.

Should you be a whole new end user of US Legal Forms, listed below are straightforward guidelines that you can comply with:

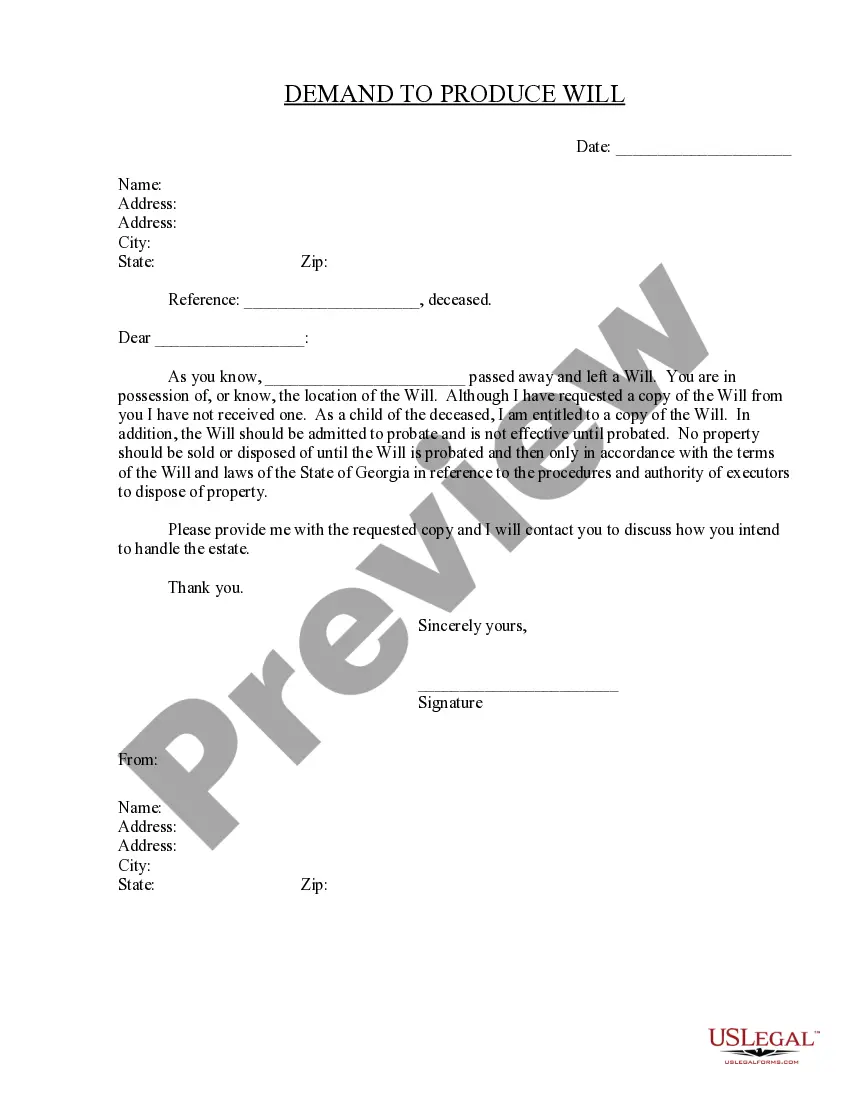

- Initially, make sure you have selected the appropriate kind for your personal area/county. It is possible to check out the form using the Review key and read the form explanation to make sure it will be the right one for you.

- In case the kind will not satisfy your requirements, take advantage of the Seach area to obtain the appropriate kind.

- When you are certain that the form is acceptable, select the Get now key to have the kind.

- Choose the rates strategy you desire and enter in the required info. Build your bank account and buy an order making use of your PayPal bank account or charge card.

- Opt for the document structure and down load the lawful record template in your product.

- Full, modify and printing and indicator the acquired Pennsylvania Authorization to purchase corporation's outstanding common stock.

US Legal Forms will be the biggest catalogue of lawful types where you will find numerous record web templates. Take advantage of the service to down load appropriately-produced paperwork that comply with state requirements.

Form popularity

FAQ

Pennsylvania Business Corporation Law of 1988 defines Corporation or Domestic Corporation as a corporation incorporated for profit under the rules of the Commonwealth of Pennsylvania. One or more corporations for profit or not-for-profit or natural persons of full age may incorporate a business corporation.

Title 15 - CORPORATIONS AND UNINCORPORATED ASSOCIATIONS.

(b) Action by consent. --Unless otherwise restricted in the bylaws, any action required or permitted to be approved at a meeting of the directors may be approved without a meeting by a consent or consents to the action in record form.

--Unless otherwise provided in the bylaws, a majority of the directors in office of a business corporation shall be necessary to constitute a quorum for the transaction of business, and the acts of a majority of the directors present and voting at a meeting at which a quorum is present shall be the acts of the board of ...

--Unless otherwise restricted in the bylaws, any action required or permitted to be taken at a meeting of the shareholders or of a class of shareholders of a business corporation may be taken without a meeting if a consent or consents to the action in record form are signed, before, on or after the effective date of ...

Pennsylvania Business Corporation Law of 1988 defines Corporation or Domestic Corporation as a corporation incorporated for profit under the rules of the Commonwealth of Pennsylvania. One or more corporations for profit or not-for-profit or natural persons of full age may incorporate a business corporation.

If a company wants to become a corporation, it must file articles of incorporation with its appropriate state agency. This formation document is required as part of the incorporation process, and the articles provide the state a variety of information about the company and its incorporators.

Title 15 - CORPORATIONS AND UNINCORPORATED ASSOCIATIONS.