Pennsylvania Reorganization of corporation as a Massachusetts business trust with plan of reorganization

Description

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

Finding the right legitimate record web template can be a struggle. Naturally, there are a variety of themes available on the Internet, but how can you find the legitimate develop you will need? Use the US Legal Forms site. The services provides a huge number of themes, like the Pennsylvania Reorganization of corporation as a Massachusetts business trust with plan of reorganization, that you can use for organization and private needs. All of the varieties are checked out by professionals and satisfy state and federal requirements.

When you are presently listed, log in in your profile and click the Download key to get the Pennsylvania Reorganization of corporation as a Massachusetts business trust with plan of reorganization. Utilize your profile to appear throughout the legitimate varieties you may have purchased earlier. Go to the My Forms tab of the profile and acquire yet another backup in the record you will need.

When you are a brand new customer of US Legal Forms, allow me to share straightforward directions that you can stick to:

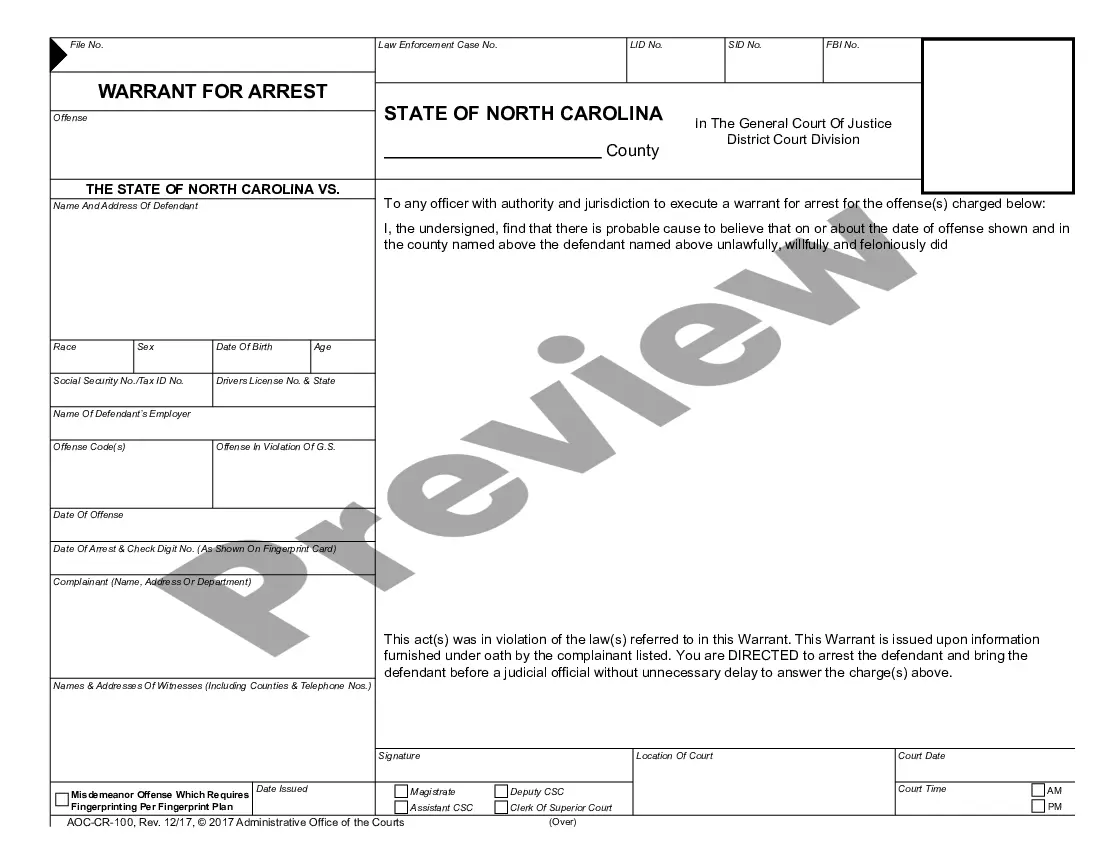

- First, ensure you have selected the appropriate develop for the town/county. It is possible to look through the form while using Review key and browse the form description to guarantee it is the right one for you.

- If the develop is not going to satisfy your requirements, take advantage of the Seach discipline to obtain the correct develop.

- Once you are positive that the form would work, click on the Get now key to get the develop.

- Select the rates plan you would like and enter in the essential info. Make your profile and pay for the order using your PayPal profile or Visa or Mastercard.

- Choose the file structure and obtain the legitimate record web template in your gadget.

- Full, edit and produce and signal the obtained Pennsylvania Reorganization of corporation as a Massachusetts business trust with plan of reorganization.

US Legal Forms may be the largest collection of legitimate varieties in which you can discover different record themes. Use the company to obtain skillfully-created documents that stick to state requirements.

Form popularity

FAQ

Shareholders may only be individuals, certain trusts, estates, and certain exempt organizations (such as a 501(c)(3) nonprofit). Shareholders may not be partnerships or corporations. Shareholders must be US citizens or residents. The business may have no more than 100 shareholders.

The best thing to own the shares in a corporate beneficiary is actually another, separate discretionary trust. That means when we pay the dividends from the company, they fall to the asset trust, then the trustees of the asset trust can allocate the dividends to the family members who pay the least amount of tax.

Massachusetts trusts (also known as common-law trusts, business trusts, or unincorporated business organizations) are a unique type of trust used by individuals to run a business outside the normal legal entities such as a corporation or partnership.

In general, living trusts and testamentary trusts may hold S corporation stock only for two (2) years after the date of death of the grantor. After death, the trusts become ineligible shareholders and the corporation will lose its S-election due to the Grantor's death.

There are several types of financial assets that can be owned by a trust, including: Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts.

Corporations. If you own stock or shares in a corporation, you should contact the corporation and fill out any necessary documents to transfer your stock or shares to a trust. Often this document is called an ?Assignment of Stock?. Submit this document to the corporation and have them file it.