"Capital Markets Mortgage" is a American Lawyer Media form. This is a book created by the Mortgage Bankers Association of America, The National Association of Realtors, and the National Realty Committee, for the Capital Consortium explaining everything about capital markets mortgage.

Pennsylvania Capital Markets Mortgage

Description

How to fill out Capital Markets Mortgage?

If you wish to total, acquire, or print legitimate file web templates, use US Legal Forms, the greatest selection of legitimate types, which can be found online. Utilize the site`s basic and hassle-free research to find the papers you require. Numerous web templates for business and specific reasons are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to find the Pennsylvania Capital Markets Mortgage within a number of clicks.

When you are already a US Legal Forms customer, log in for your account and then click the Acquire key to obtain the Pennsylvania Capital Markets Mortgage. Also you can gain access to types you earlier downloaded in the My Forms tab of the account.

If you use US Legal Forms the first time, follow the instructions under:

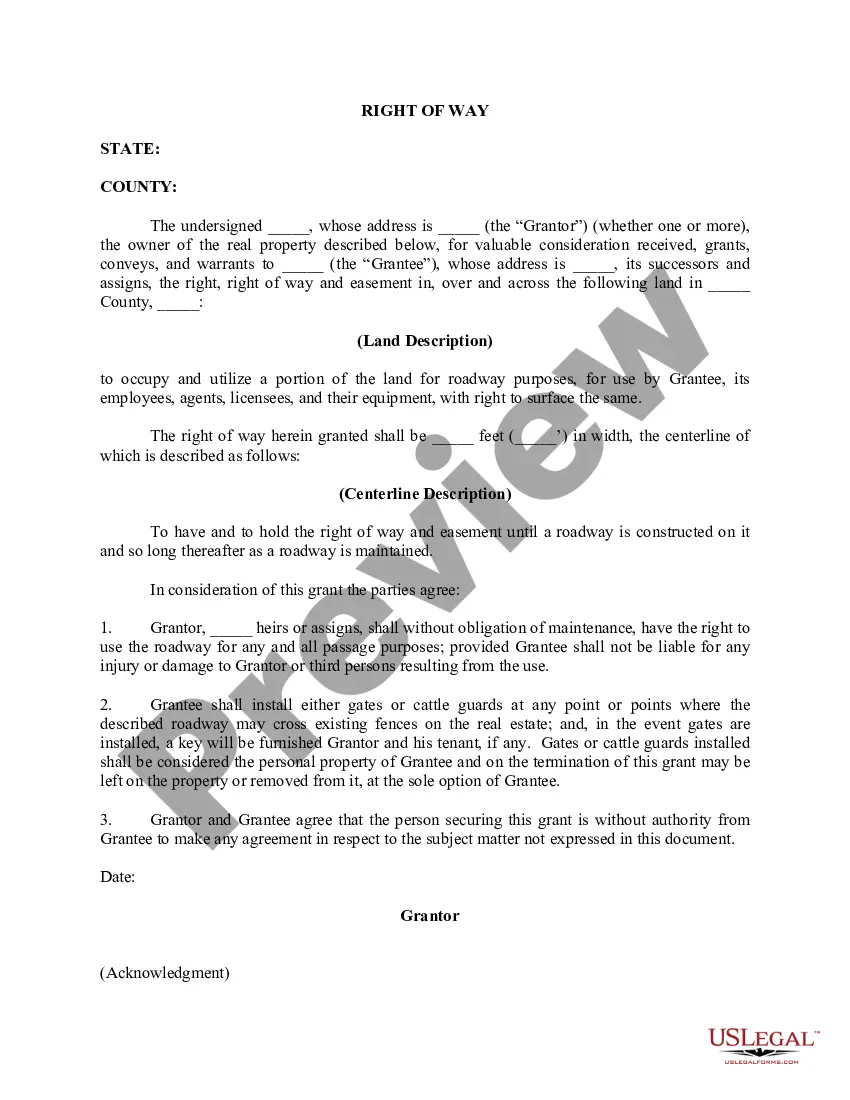

- Step 1. Make sure you have selected the shape for your appropriate city/land.

- Step 2. Use the Preview option to look through the form`s content. Do not overlook to learn the information.

- Step 3. When you are unsatisfied together with the type, take advantage of the Lookup area on top of the screen to find other models in the legitimate type web template.

- Step 4. After you have discovered the shape you require, click on the Get now key. Pick the costs prepare you like and include your qualifications to register for an account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Select the file format in the legitimate type and acquire it on the product.

- Step 7. Complete, change and print or indicator the Pennsylvania Capital Markets Mortgage.

Each and every legitimate file web template you purchase is yours permanently. You have acces to each type you downloaded in your acccount. Go through the My Forms segment and decide on a type to print or acquire once again.

Be competitive and acquire, and print the Pennsylvania Capital Markets Mortgage with US Legal Forms. There are many skilled and condition-particular types you may use for your business or specific demands.

Form popularity

FAQ

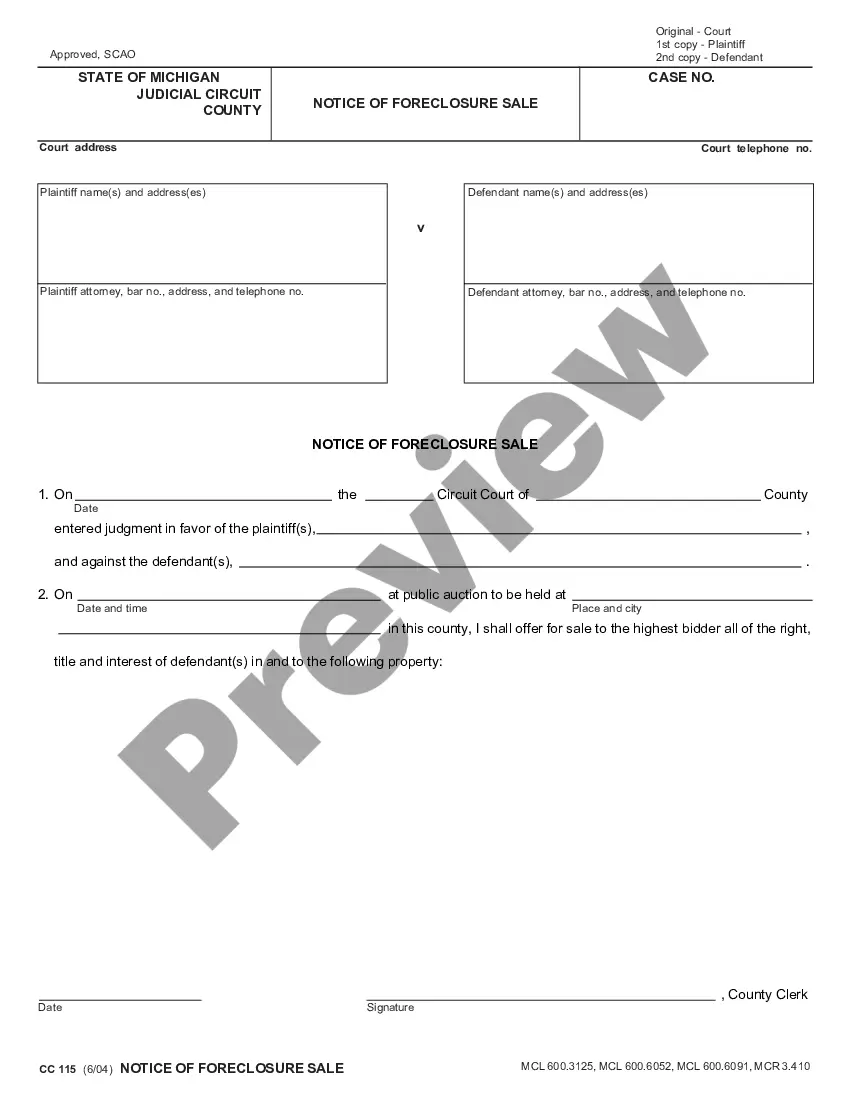

Most capital market instruments, including mortgages (loans on real estate collateralProperty pledged as security for the repayment of a loan.), corporate bonds, government bonds, and commercial and consumer loans, have fixed maturities ranging from a year to several hundred years, though most capital market ...

Capital Markets supports the liquidity of the mortgage markets and makes funding more available by purchasing mortgage-related securities guaranteed by Freddie Mac and other financial institutions in its investment portfolio. These investments are funded by issuing corporate debt securities.

Sources of Capital in Real Estate Sources of Capital in Real Estate. Sources of capital used to fund projects come in the form of debt, equity, and cashflows. ... Example: ... In the model outputs section above, we can see that this project is financed with construction debt, mezzanine debt, and equity. ... Conclusion.

Stock markets, bond markets, and currency markets (forex) are all types of capital markets. They facilitate the sale and purchase of equity shares, debentures, preference shares, zero-coupon bonds, and debt instruments.

Capital markets are financial markets that bring buyers and sellers together to trade stocks, bonds, currencies, and other financial assets. Capital markets include the stock market and the bond market. They help people with ideas become entrepreneurs and help small businesses grow into big companies.

These venues may include the stock market, the bond market, and the currency and foreign exchange (forex) markets. Most markets are concentrated in major financial centers such as New York, London, Singapore, and Hong Kong.

Real Estate Capital Markets studies debt and equity secondary markets linked to real estate assets. These markets have become a key way to funding residential and commercial real estate.

Capital markets groups help companies develop the origination and execution of equity offerings, such as IPOs, follow-ons, and convertible notes. Capital markets groups provide potential issuers with advice and education on transaction size, timing, structure, execution alternatives, and selection of underwriters.