The Pennsylvania Finance Master Lease Agreement is a legal contract that allows a business or government entity in Pennsylvania to lease equipment or property from a lessor on a long-term basis. It is a widely-used financial tool that provides flexibility and numerous benefits for both lessees and lessors. This agreement serves as a comprehensive framework that outlines the terms and conditions of the lease, including payment schedules, duration, renewal options, maintenance responsibilities, and insurance requirements. The contract is typically tailored to meet the specific needs of the lessee and lessor, ensuring all parties' interests are protected. There are various types of Pennsylvania Finance Master Lease Agreements available, designed to suit different industries, equipment types, and financing arrangements. Some common types include: 1. Equipment Lease Agreement: This type of master lease agreement focuses on leasing specific types of equipment, such as machinery, vehicles, or technology, to a lessee for a fixed period. It allows businesses to gain access to expensive equipment without making a large upfront investment. 2. Real Estate Lease Agreement: This agreement pertains to leasing properties, such as office spaces, warehouses, or retail spaces, on a long-term basis. It provides businesses with the flexibility to operate without the need for large capital expenditures or commitments associated with owning property. 3. Municipal Lease Agreement: Governments and municipalities often utilize this type of master lease agreement to finance essential equipment or infrastructure development projects. It allows them to acquire equipment or improve facilities while spreading the cost over time. 4. Sale and Leaseback Agreement: In certain cases, a business that owns equipment or property may choose to sell it to a lessor and simultaneously lease it back. This arrangement provides immediate capital through the sale while allowing the business to continue using the equipment or property through the lease. Pennsylvania Finance Master Lease Agreements offer several benefits, including improved cash flow management, tax advantages, preservation of credit lines, and flexibility in equipment or property management. They provide businesses and government entities with cost-effective and efficient ways to access essential assets needed for their operations and growth, enabling them to thrive in a competitive environment.

Pennsylvania Finance Master Lease Agreement

Description

How to fill out Pennsylvania Finance Master Lease Agreement?

If you need to complete, acquire, or print out legitimate record templates, use US Legal Forms, the greatest selection of legitimate forms, which can be found online. Use the site`s simple and easy convenient look for to get the papers you require. Numerous templates for organization and person functions are categorized by types and suggests, or keywords. Use US Legal Forms to get the Pennsylvania Finance Master Lease Agreement with a handful of click throughs.

If you are previously a US Legal Forms buyer, log in for your account and click on the Down load switch to find the Pennsylvania Finance Master Lease Agreement. You can also entry forms you formerly saved from the My Forms tab of your respective account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for the correct city/nation.

- Step 2. Take advantage of the Preview method to look over the form`s information. Don`t forget to read through the explanation.

- Step 3. If you are not satisfied with the kind, make use of the Look for industry at the top of the display to get other models from the legitimate kind template.

- Step 4. Upon having discovered the form you require, go through the Purchase now switch. Pick the pricing program you like and add your credentials to sign up for an account.

- Step 5. Approach the purchase. You can utilize your charge card or PayPal account to perform the purchase.

- Step 6. Choose the structure from the legitimate kind and acquire it in your device.

- Step 7. Complete, revise and print out or indicator the Pennsylvania Finance Master Lease Agreement.

Every legitimate record template you acquire is your own eternally. You possess acces to every kind you saved in your acccount. Go through the My Forms portion and select a kind to print out or acquire once more.

Compete and acquire, and print out the Pennsylvania Finance Master Lease Agreement with US Legal Forms. There are millions of professional and state-certain forms you may use for the organization or person requirements.

Form popularity

FAQ

The Tenant shall be permitted to occupy the Premises on a month-to-month basis starting on (mm/dd/yyyy) and ending upon a notice of _ (#) days from either party, in ance with State law (the ?Lease Term?).

?Per annum? is Latin for ?by the year? or ?each year.? In contracts, per annum refers to obligations that occur annually over the life of an agreement.

A Pennsylvania month-to-month lease agreement is a residential rental contract whereby a tenant is granted occupancy of a landlord's property for (1) month at a time. In this type of arrangement, the tenant renews the lease by paying rent to the landlord each month.

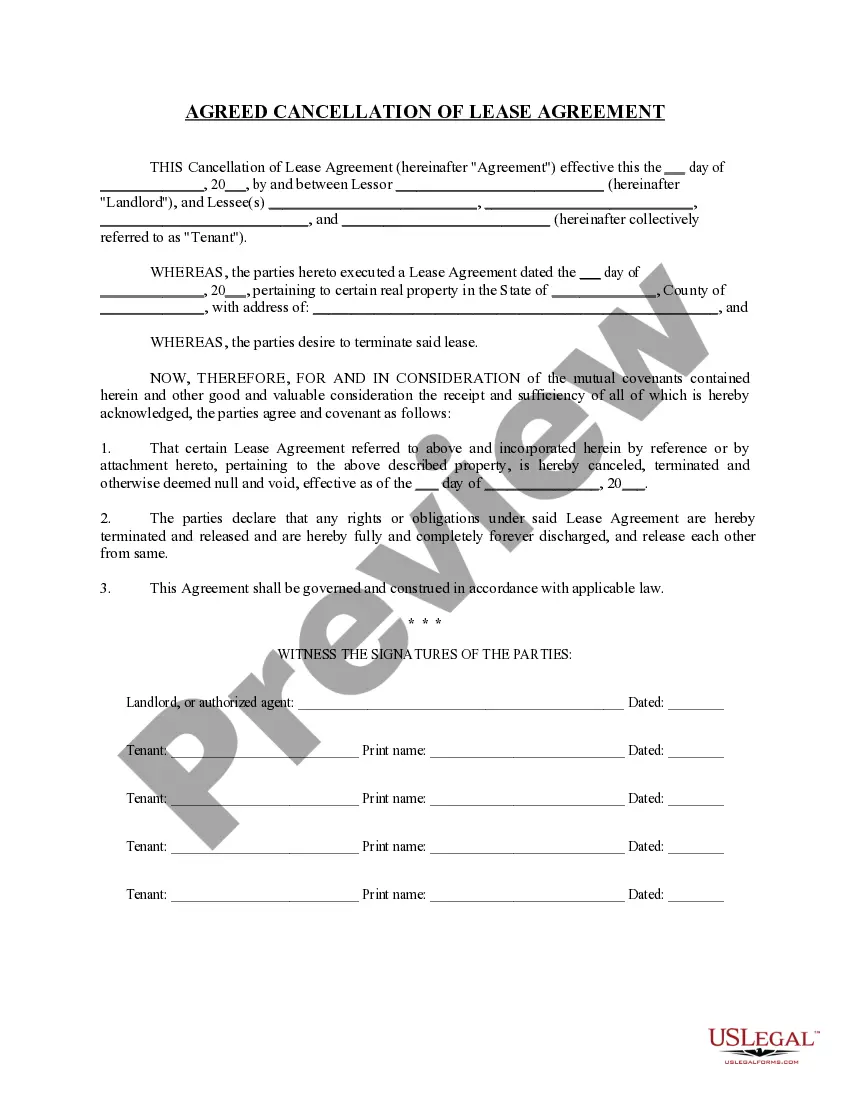

A master lease is a continuing lease arrangement, preferred by customers who anticipate multiple installations over a sustained period of time. This arrangement allows the customer to sign a single agreement and make one agreed payment, instead of several agreements, with several separate payments.

A Pennsylvania month-to-month rental agreement is a lease that can only be canceled upon written, thirty (30) days from a landlord or tenant. If notice is never sent, the agreement will continue under its original terms in perpetuity.

If you do not have a written lease, in most circumstances the law considers you to have an oral month-to-month lease. Either you or your landlord can end the lease at the end of any month, for any reason or for no reason. Are there some reasons for eviction that are illegal? Yes.

A master lease agreement is legal document where you lease an income-producing property as a single tenant-landlord and sublease to two or more tenants to produce income. One common example are shopping malls, which have many stores renting space from one landlord.